Traders,

It was another constructive week in the market, with a pullback and rest period toward the 50-day SPY. That was an ideal move, enabling several large-cap stocks to further build before breaking out for continuation. Names from last week’s watchlist, like HOOD and TESLA, both followed through excellently to the upside, offering fantastic R/R.

With excellent follow-through last week after a multi-day pullback and rest period, I’m coming into this week a bit more nimble. I’ll be on high alert for comments and developments from the China—US trade talks and earnings play, with many companies still reporting.

So, with that being said, let’s get into some of my top focuses for the upcoming week, including several large-cap and small-cap ideas.

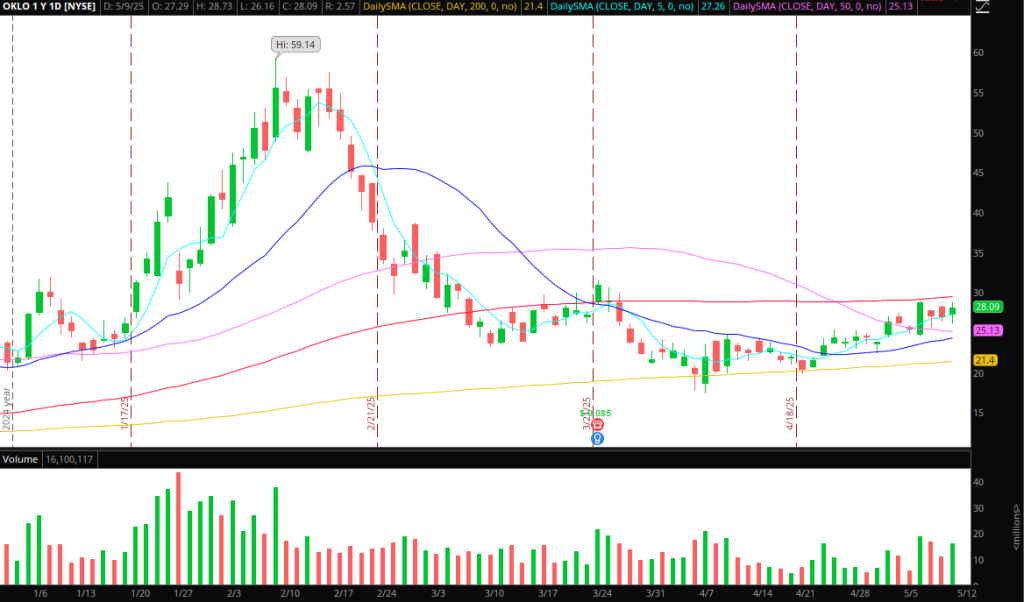

Consolidation Breakout in OKLO: Solid reclaim last week of its 50-day, and positive sector comments. Similar to the plan in HOOD from the previous week, for example, I’m looking for further build and consolidation breakout, or an opening drive entry above Friday’s high. For entry, I’d look to enter long above Friday’s high with a LOD stop. Target 1 is the recent pivot high of $31.5 and 1 ATR from the breakout point. Thereafter, I’d leave a core on trailing against either the LOD or hold below VWAP, depending on the intraday action and volume.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

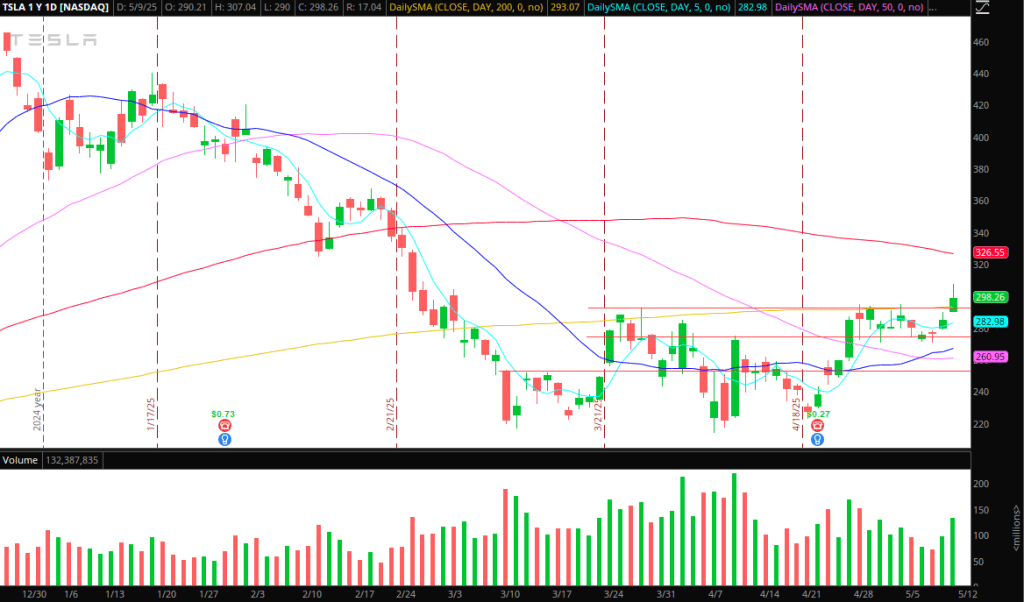

TSLA: Excellent breakout Friday and measured move into the 1 ATR target. I closed out the multi-day swing on Friday. Going forward, I’ll look for intraday momentum if the stock holds above $295 on dips and displays relative strength to the overall market. If dips get bought into $295, I’ll look for a long against the low, with targets between Friday’s key resistance areas, namely $300 – $303 and $307. I’m open to holding a swing core again if we hold above VWAP and display relative strength for continuation above Friday’s high.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

HIMS: At this point, I’m treating this as a trading vehicle. Excellent follow-through and momentum last week. With a hold above its 5-day and $50, strong momentum, and high short interest, this might experience further upward momentum this week. Above Friday’s high, I’ll be looking for intraday momentum long scalps, and remain long biased. Ideally, this extends for multiple days to the upside before setting up a potential A+ reversion opportunity. Still a long way to go for that to happen, but that’s what I would be interested in. Until that sets up, either with multiple days of extension to the upside into $60 +, I’ll be focused on momentum to the upside, until it extends or fails to hold above $50.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Failed-Follow Through Setups in Small-Scaps

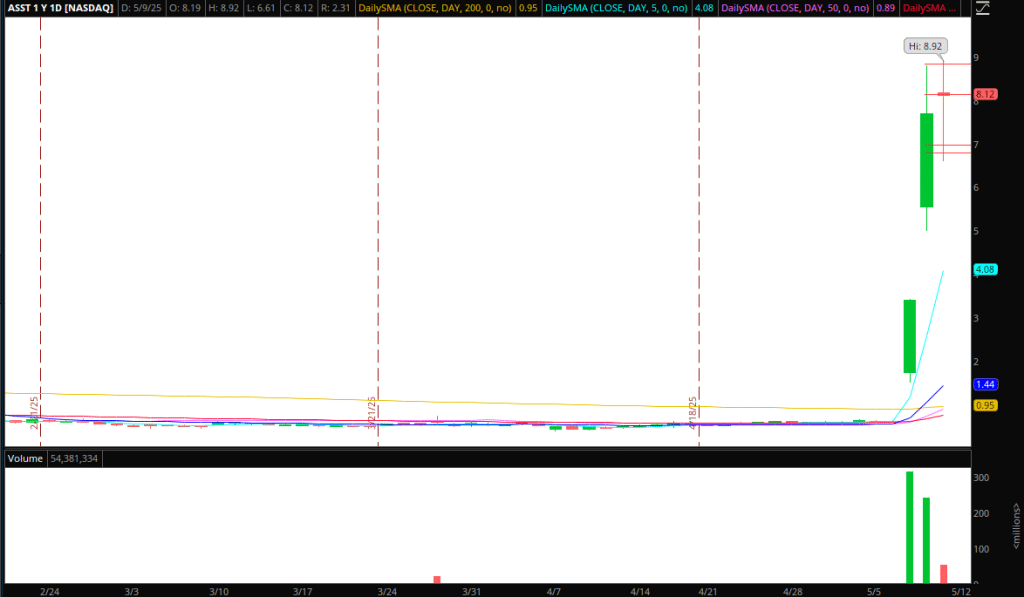

ASST: Solid uptrend break on Friday with failed follow-through into resistance ($8.8 – $9). Going forward I’ll look for momentum below $7, or failed moves and lower highs toward resistance and supply near $8.5 – $9 for intraday shorts.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

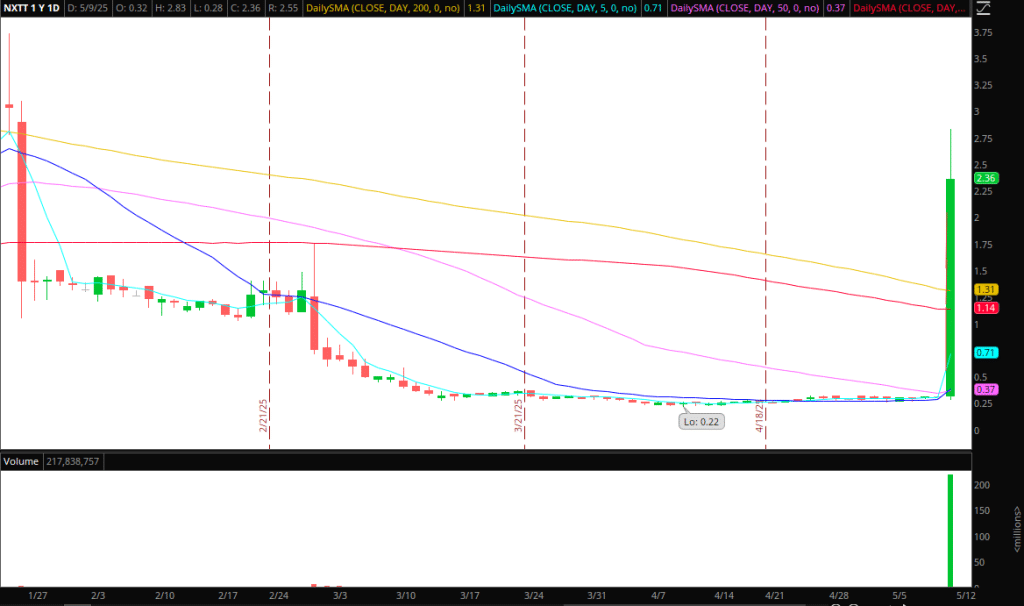

NXTT: This one caught shorts off guard Friday, and blew out in the AHs. After such an extreme move on day 1, while we are in a strong small-cap cycle, I’m more inclined to look for a short going forward. It all depends on where this opens on Monday. In general, I will now be focused on failed moves above $4, into $5, and hard stuffs for a short against the high, with either a 5-min lower high trail or short against the HOD, depending on the action. I have no interest in shorting in the hole on any significant gap down. Any $5 reclaim and push, I’ll be hands off waiting for the backside.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

SYTA: I’ll just set alerts in this name: $1.7 – $2 to monitor price action if we get back in the range. If the stock stuffs near $2, I’d look for an intraday short scalp.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

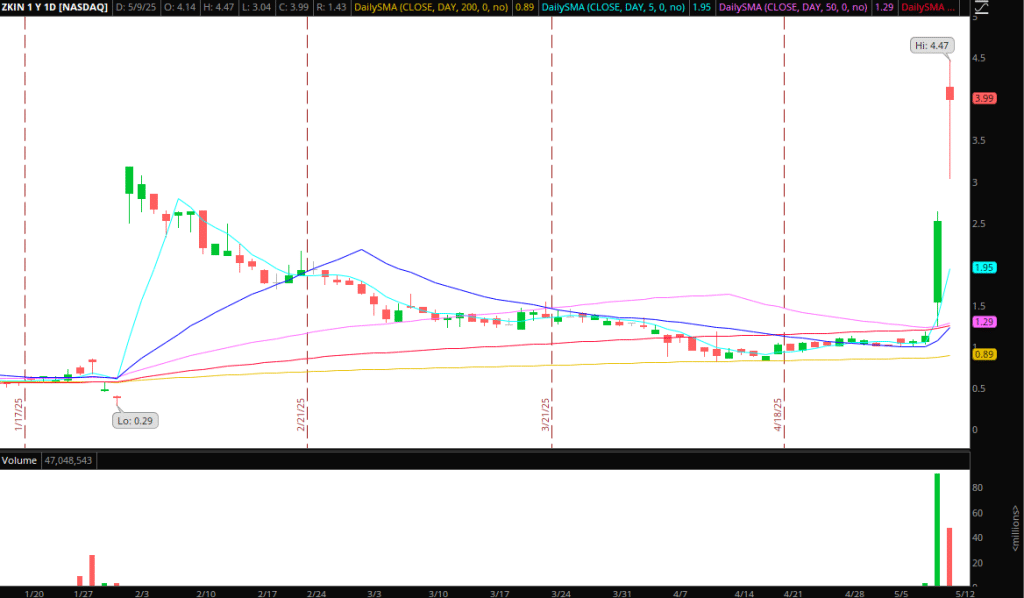

ZKIN: This is another one I will have alerts for. If there is no offering or gap down, I will monitor this for sideways action and a potential liquidity trap for a squeeze higher.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.