This week, Jay Murakami of White Rock USA will be making his debut presentation on the Options Tribe, demonstrating his signature iron condor with crash protection- a unique positive vega iron condor approach.

[Recording] 5 Ideas to Improve Your Trading This Summer

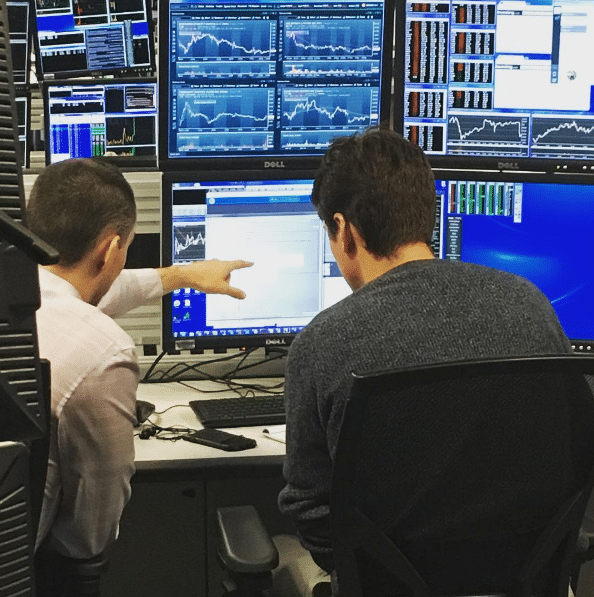

Mike Bellafiore, author of The Playbook and One Good Trade, discussed why traders at the firm are so focused on building trading models right now and how to be more selective with your ideas.

[Recording] Is it Possible to Make Money on the Open? (WEBINAR JUNE 15)

Steve Spencer explained how to to make money on the open. He discussed the following: Learn why many traders struggle to generate profits during the first 15 minutes How to formulate a plan to trade the first 15 minutes How to control risk during the open How to drill down to the exact setups and the exact prices to trade … Read More

Dumping Losing Trades

In this video, Seth Freudberg gives a recent example of just such a situation in the July and August Bearish Butterfly trades. Often times, in options trading, the conditions that will cause one trade to lose are the exact conditions that will allow another trade to win.

From Options Student to Consistent Money Maker: A Comprehensive Guide

This is Andrej Fedor (middle), SMB Options Desk trader, with Seth Freudberg and me after lunch in NYC. Andrej was a former student of Seth’s for our education arm, SMB Options. Now he sits as a profitable trader on our options desk. We love to study former students turned successful traders at SMB. And then we love sharing their path … Read More

Controlling the implications of a downside move

This video covers a technique for cutting a position’s exposure to increased options volatility under these circumstances. Options trading in a low volatility environment is not without danger. If the market sells off, options volatility will increase causing a larger than normal drawdown on positions opened in a low volatility period.

I just need to eliminate my ehh trades

Last night, I was reading the review of one of our traders, Trader A, who wrote, “I just need to stick to my plays that make me money (ETRM, TWTO, GLYC) and just faze out those ehhh ehh trades, I will become very consistent and very profitable.” To Trader A, I responded, ” When u say get rid of ehh … Read More

Traders Rave About “One Good Trade”: How It Transformed Their Options Trading

One of the great rewards from writing One Good Trade are the positive unintended consequences. One of those is how much the book has helped traders other than equities day traders. Let me offer two examples. Today at lunch, I sat with an income options trader, who shared his trading breakthrough was reading One Good Trade. This trader had … Read More