Say a billionaire approached you and asked: in a perfect world what would you need to be your best trader? Assume you worked at a prop firm so any of this would also be available for your fellow traders. He would offer an open checkbook. You would trade and focus only on growing your P&L. Here is my partial list: 1) … Read More

Morning thoughts 1/21

Good morning traders, Drawing heavily on my morning Waverly Advisors report again today. First on equities: A mixed session yesterday saw large caps struggling to recover while smaller cap stocks continued their decline. We believe the dominant technical pattern on the S&P Cash index is the small consolidation highlighted on the chart above. Taken in context, it is important to … Read More

SMB Morning Rundown – January 20, 2011

The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open.

Morning thoughts 1/20

Good morning traders, This is somewhat lengthly, but I thought it might be interesting to republish my comments on equities from my morning Waverly Advisors report. Keep in mind that most of the readers of that report are working on a significantly longer timeframe, but this does help to keep yesterday’s moves in context: Equities: Equities are in the spotlight … Read More

The Complete Trading Course (A Book Review)

After reading Corey Rosenbloom’s The Complete Trading Course, there was one basic theme that I took away from the book: these days, there’s no excuse for your average every-day investor not to at least make an attempt to manage some of his/her own money. And I also couldn’t help but hope that many traders would immediately add Corey’s book to their … Read More

SMB Morning Rundown – January 19, 2011

The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open.

Morning thoughts 1/19

Good morning traders, (this was written about 5:30 AM. Check marks to see if anything has changed by the time you read this.) Big picture on equities from my morning Waverly Advisors report: There is very little new to be said with regard to domestic equities. Volatility is compressed, volume is low, trading interest appears to be muted, but all … Read More

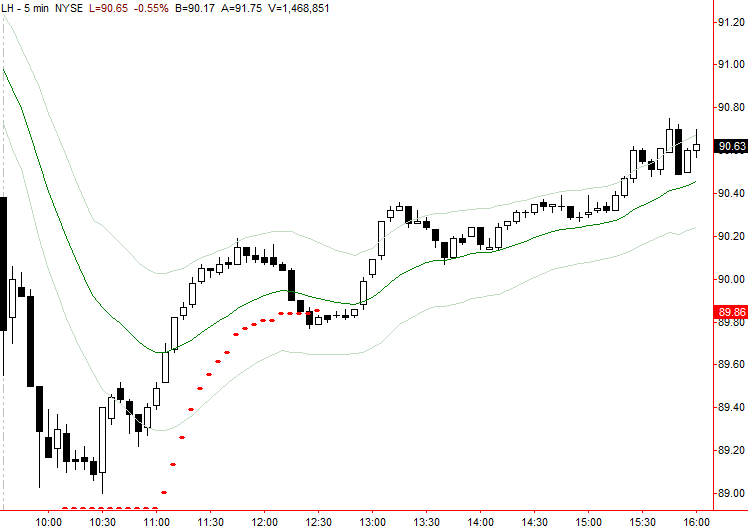

AAPL: A Case for Mechanical Trailing Stops

A look at how a mechanical trailing stop can help with exits from trending plays.