The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open.

Morning thoughts 2/1/11

A quick look at early trading and setups for today.

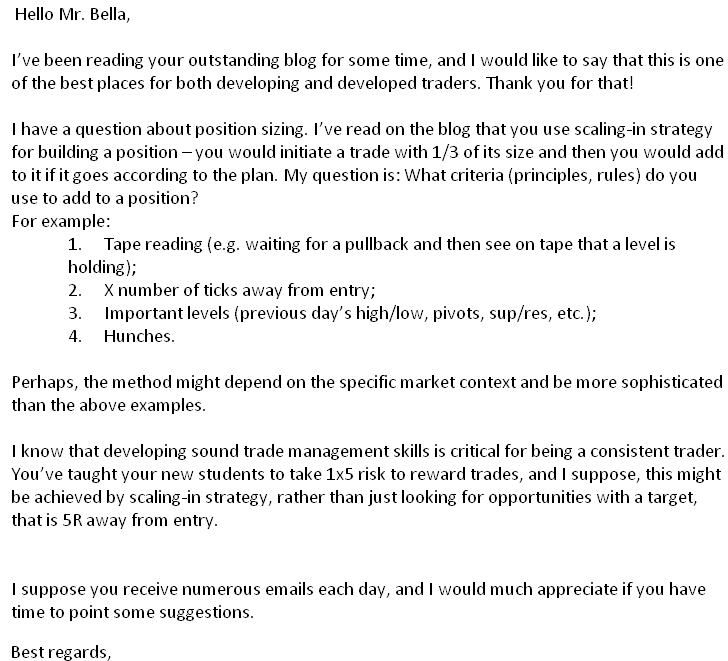

Traders Ask- Position Sizing (Part II)

Bella Responds I love the respect given with the Mr. Bella 🙂 If we start a 1/3 position then we are not as confident in the set up. We are searching for information that gives us more confidence. What factors would do so: a) the tape b) intraday charts c) long term technicals d) any important news that just hit … Read More

Evaluating your trading results (3/4)

Some ideas for doing statistical analysis of your daily trading results

My Trading Philosophy

(This blog was written on 1/25/11. But I’m lazy so didn’t post it until tonight) When a stock has fresh news and huge volume it is a great trading candidate for me. My experience tells me that there will be more trading opportunities intraday in these situations and the risk/reward will be more favorable than most other trading scenarios. In … Read More

Why Am I Getting Stopped Out More? (Part IV)

During Part I, Part II, and Part III of this series we identified a new algo on the desks of more traders that may be causing us to get stopped out more. For Part IV let’s offer some solutions. Some ideas from SMB Readers: Trade instruments wich are more liquid or trade on a higher timeframe. Cheers, Markus This is an … Read More

Traders Ask; Position Size of 1/3?

Question: I basically swing trade. I always try to put on a position in 1/3’s. How does that work daytrading? Is there time to do a position that way? I like to have another good entry point to add to a trade. How is that possible in a daytrade. Maybe I just am not used to that fast of a … Read More

SMB Morning Rundown – January 31, 2011

The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open.