@AdamG_SMB discusses setups in $SPY $ES_F $GC_F $GLD $LULU $SFLY $GMCR $COG $ACTG $ACOM $CRM $ALTR $SOLR $LNG shorts: $MTZ $PDS $MCO $VNO $FNSR $ULTA, longer term longs: $AG $FTO $MERC $HOC $PLAB $TTWO $VHC

I’d Rather Make Money Than Be Right

Those who follow SMB closely know that our AM Meeting divides trading ideas into three sections. Fresh, Second Day Plays, and Technical Plays. On Friday during we discussed YUM that recently had been trending higher and was especially strong on Thursday. With this particular scenario we highlight “prices of interest” where we would look to play YUM on the long … Read More

Gman All Cap Webinar – Free Webinar

Tuesday, May 24, 2011 Gman, head trader and partner at SMB Capital will discuss what adjustments he makes when trading small cap, mid cap, and large cap names on a daily basis. We welcome your questions both in advance and during the live webinar. Email questions to [email protected] Title: Gman All Cap Webinar Date: Tuesday, May 24, 2011 Time: 5:00 PM – … Read More

The Options Tribe – Free Webinar

Wednesday, May 25, 2011 SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by outstanding veteran options traders and experts in the world of options trading. This week we’ll be demonstrating the “Heart Friendly” butterfly trade. Title: The Options Tribe … Read More

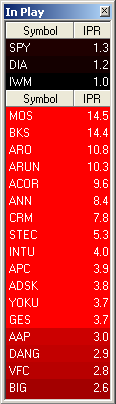

SMB Radar Update for May 20, 2011

With plenty of fresh news in the market, here are today’s top 10 stocks on the In Play column on the SMB Radar. This is the most important function of the scanner. The Radar uses a number of proprietary algorithms on a prescreened universe of stocks and processes every tick in search of finding stocks that are In Play. These … Read More

SMB Morning Rundown – May 20, 2011

The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open.

New York’s Active Trader Group Meet & Greet

If you live down in the NYC area come meet some active traders from the industry, have a few brewskis and some snacks. The event will take place in Stone Street in the financial district of NYC on May 26th at 5:30. Please RSVP and register to join our group here: http://bit.ly/jy8aN3 More details to come. Looking forward to meeting … Read More

Traders Ask: What Do I Do About An Obnoxious Bid Ask Spread on a Butterfly Trade?

An Options Tribe Member asks: Given that we’re about 55 days out from the July monthly options expiration, I was playing with a July 770-820-870 put butterfly on the RUT (when it was trading around 840). Usually the bid/ask spread for ATM and OTM puts on the RUT is narrow enough, but the spread on the 870 put ($51.80 by … Read More