Stock day traders who act in sync — no matter the stock, or whether they are buying or selling — makemore money at the end of the day than their out-of-sync peers, reports an analysis to appear in the Proceedings of the National Academy of Sciences. Making its rounds on the trading twitter circuit was an interesting article about how intraday … Read More

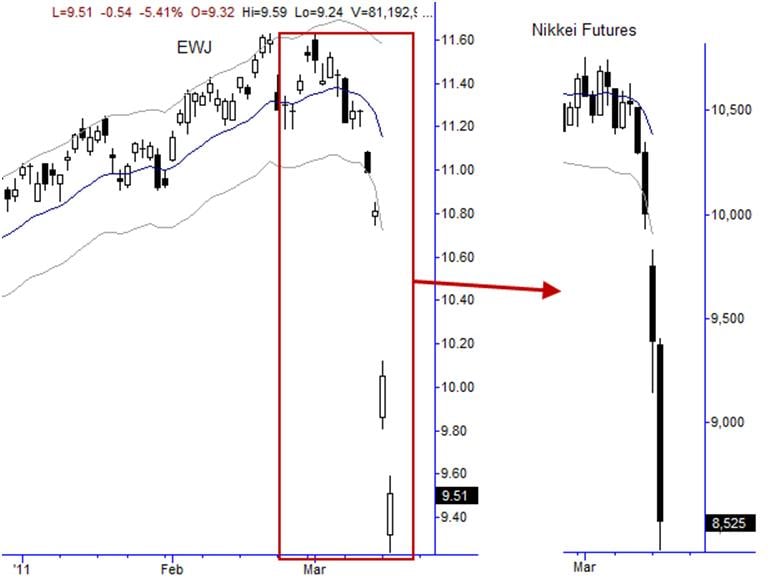

Extraordinary Situation; Ordinary Trade.

In yesterday’s post, I made a case for a bounce play in the Japanese stock market. Last night’s extreme move makes this call look kind of silly in retrospect, but I want to highlight some important points and lessons here. First of all, this really highlights the difference between “armchair quarterbacking” or “time machine trading” (as we like to call … Read More

SMB Morning Rundown – March 15, 2011

The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open.

Traders Ask: How do I “repair” my deep in the money covered call option?

A reader asked us for help in the following situation: “I have a question and wonder if you will help. I would appreciate very much any advice that you can offer. I have 100 shares of GMCR stock and I have written a covered call– June ‘ 11/ strike 43– against it . The stock gapped up from 41 to … Read More

How Many of These Trades are in your Quiver? (CCJ)

We all see the screens differently. However we all must see the screens as patterns of risk/reward opportunities that we can make our own. Below are 7 trades I might make in CCJ. Do you see your screens this way? 1) Premarket Breakdown Trade Play the downside momentum until the stocks slows. 2) The Bounce Let CCJ stop going down, … Read More

Market reactions to “Acts of God”

In my daily report for Waverly Advisors I issued a short-term buy on the Nikkei 225 futures. Obviously, this is a controversial trade fraught with difficulty, but I thought it might be interesting to think about this type of situation from a technical perspective. First of all, please read the link above. Before reducing the situation to a set of … Read More

SMB Morning Rundown – March 14, 2011

The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open.

And… we’re back….

I’ve been away from blogging and Twitter for a few weeks for a number of reasons. First of all, I have been working on a new Advanced Technical Analysis program which expands our training program at SMB with tools that are applicable to all asset classes and all timeframes. I’m excited about this project as it is the distillation of … Read More