As we continue to gravitate towards more Trades2Hold, longer holding time periods for intraday trades, we found another excellent set up today in LXK. This is a simple trade and a pattern you might spot a few times a week. We will discuss the entry and the exit. (let me state at the outset that for some reason I can’t … Read More

Stock Selection

I received an email yesterday from a reader who asked if I could discuss why we choose to avoid certain stocks. What I would first like to address is the idea of stock selection in general. At SMB we have a very specific methodology to select the best stocks for intraday trading. As most who have read our blog on … Read More

SMB Morning Rundown – February 2, 2010

The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open.

Trade2Hold Exit- AMZN

Today during our AM meeting we highlighted AMZN and the 123 level as a shorting opportunity. This turned out to be a wonderful intraday trading opportunity. As intraday traders gravitate towards a longer holding period, for us Trades2Hold, set ups like AMZN must be mastered. AMZN had earnings Thursday night, gapped up on Friday, and then sold off for … Read More

SMB Morning Rundown – February 1, 2010

The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open.

The Failure Rate of a Proprietary Trader

I remember the discussion like it was yesterday. It was in our former 8×10 makeshift training room/office/conference room/lounge with the first trader who ever failed at SMB Capital. JJ announced he was leaving to take a six-figure job at a financial services company in NYC. But let’s be honest. JJ was leaving because he was not making money as a … Read More

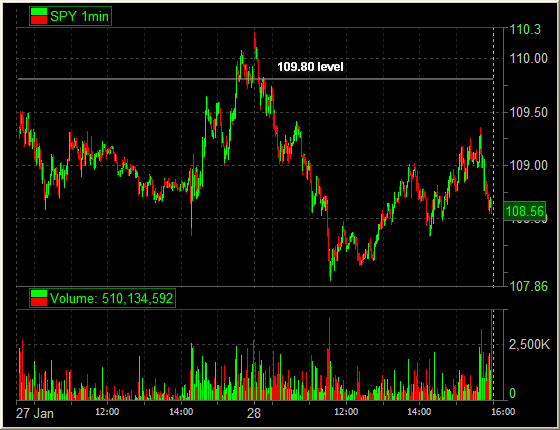

SMB Morning Rundown – January 29, 2010

The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open.

Trading Our Best AM Idea – January 29, 2010

Our “Best AM Idea” that we tweet each morning as part of our morning roundup blog is a trade idea that is based on all of the information we have prior to the market’s Open. Yesterday, I suggested that FCX be bought on a pull back to 71.50. FCX has traded down about 20% since reaching a 52 week high … Read More