A few days ago, I was trading crude oil.

It wasn’t just any old day; I had high expectations for above average moves. I had conviction in a main idea for the day. Crude had broken down below a really key level. These are the types of days we want to really crush!

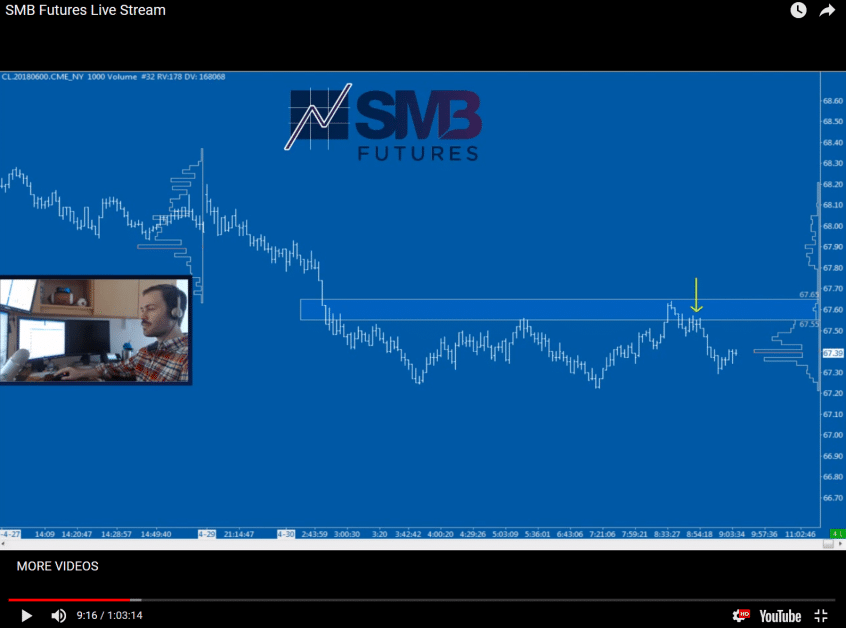

I found a nice short just before the open from overnight vwap on a retest of my key line in the sand and bearish level. Here’s a screenshot from our live morning trading stream that morning (arrow depicts entry):

That trade initially went in our favor, but couldn’t have been more wrong in terms of direction for the day in crude! How did I handle being wrong? How did I let the early morning idea (which I had high conviction in) affect my later trading?

I recognized the contextual line in the sand break, and also noticed a shift in orderflow. This allowed me to adapt and even profit from the shift. Here’s a screenshot from later on where you can see I was getting long:

That long trade ran, and ran, and ran. It was our best trade of the day.

There comes a time where your idea is wrong for every trader. You now have a choice between being two different traders:

- Trader A would continue to try and be right, to hope wish and pray, and to force their view upon the market. At the very least they allow the early losses/wrongness to affect their decision-making later in the session.

- Trader B would understand that something significant had changed, have already prepped for the potential change during their prep, stay mentally flexible, and even realize that large opportunity now exists in the opposite direction of the original trade plan.

You obviously want to be Trader B. Here’s how you can be Trader B:

Prep before the session in order to understand where contextual shifts in your market may occur. Use something like Market Profile to gain insight into the contextual read for the day and key levels.

Think through key scenarios before they ever show up. This allows you to be mentally prepared to shift and stay in the ‘now moment opportunity flow’ that Mark Douglas talked so well about. So preparation is key.

Write out your scenarios, and continue to stay aligned with them as the session unfolds. Review how good of a job you’re doing each day at both planning out quality scenarios, as well as how well you’re executing on those ideas. Often times people have trouble with one, or the other, and don’t quite realize what their problem is.

You can be Trader B.

We have a lot of Trader B’s over in our Futures Slack room chat! Join us at www.smbfutures.com

Trade well,

Merritt

*No relevant positions

Risk Disclosure