In The Stocktwits Edge I write about the fact that I have spent most of my career trading stocks that are followed by a very distinct and specific group of traders. The momentum hedge fund traders who I like to refer to as “momos”. I have observed how they move internet IPOs, secular growth stories, and other various tech startups for the past 15 years. Their fingerprints leave indelible marks on stocks such as CMG, NFLX, AMZN, LNKD, and more recently GOOG is back on their list of eligible play things.

I could probably write an entire book on the games that they play. Let’s discuss Google. Google use to be one of the momos favorites. It would move up and down 100 points after an earnings release. But in the past couple of years more and more momos began to view them as a one trick pony with no longer a great “story”. Stories are key in the momo world. If a company has a good story to tell whether it is the “new markets” that they can enter into or possibly some major “new distribution” channel they can exploit those stories can be used to move a stock.

A recent example of the “new markets” game was provided by Netflix last week. They announced they were expanding to South America. This “unexpected” news provided an opportunity to cause NFLX to gap up and run 20 points. Yesterday, NFLX raised prices and momos gapped it up above 300 further consolidating gains from the Brazilian distribution story. It looks like today they finally booked some profits from the South America gap and will be getting ready to reload on the next BS announcement.

If I am a momo and have $300 million to push around some stocks I need to understand all the possible catalysts that can attract attention to a stock and position myself accordingly. If I think good news stories are going to hit the press in the near future I will start to accumulate some stock. But I really swing into action after a story hits the wires. This gives me a chance to move a stock with a fresh news catalyst which in turn causes more news stories to be written, which all but ensures I will be able to dump my stock at a higher price. Then repeat.

You could just feel the momentum building in Google the past couple of weeks. First Google+ comes out with the rave reviews and positive buzz (no pun intended), next they launched the “Groupon Killer” at least according to @hblodget, and now the coup de grace was a phenomenal earnings release. GOOG can be added to the official momos list now and will offer between 4-8 great trades during the next twelve months.

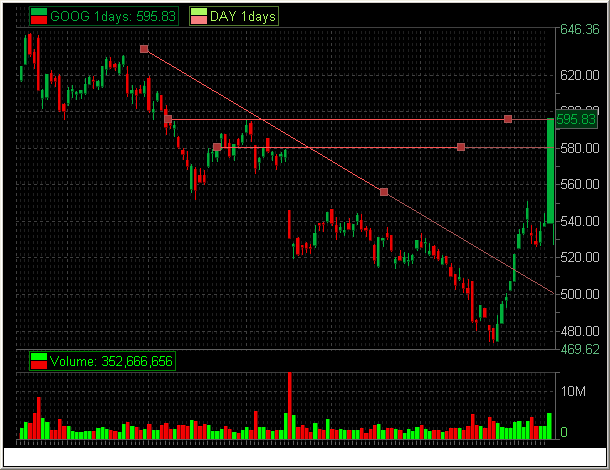

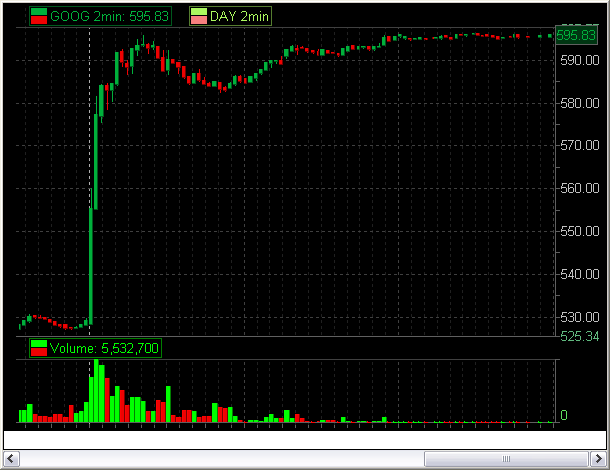

I’ve attached a couple of GOOG charts so you can see just how rationale the momos are while moving stocks in the after hours. The first move to 580 was exactly the high prior to last quarter’s earnings gap down. The next price the momos could find on the chart was a previous pivot high at 595. So it was no surprise to me when I turned to the director of SMB Systems Trading while GOOG was trading at 580 and said next stop is 595 that he glanced at the chart and nodded in agreement.

2 Comments on “The Minds of the MoMos”

How do you know what mix and type of market participants are on a equity product’s limit order book buying and selling intraday?

“So it was no surprise to me when I turned to the director of SMB Systems

Trading while GOOG was trading at 580 and said next stop is 595 that he

glanced at the chart and nodded in agreement.”

Nice. Thank you for the post.