Each morning we discuss the overall market and the top In Play stocks to trade. Today, I offered my thoughts on why the SPY was setting up for higher prices (during first 2 minutes). Enjoy! (i did record meeting at home & yes that is my basset hound moving around in the background) For a Trial of our AM Meeting … Read More

Sometimes Good News is The Best News To Short

Recently, an inexperienced trader asked me about a stock that traded lower after reporting great news. As any experienced trader will tell you, often that is a great opportunity to get short. Yesterday, Facebook reported amazing earnings with a slew of positive metrics. In the after hours it traded to a new all time high above 137. Yet, I got … Read More

Ten Trades That Have Actually Worked

You know there is a way to generate profits by trading. You know there is some setup, some strategy, some system that you can trade to get on the right side of the market and generate these profits. Unfortunately, most traders never experience that reality. We know this because we’ve surveyed thousands of traders. But… rest assured… some do make … Read More

Thoughts On Trading A Bear Market–SPY FB NFLX

In this video I offer some thoughts for how the market is setting up for the second week of February. If you are interested in our process for finding the best trading setups each day join me for a free webinar Monday February 8th at 4:30PM. Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading … Read More

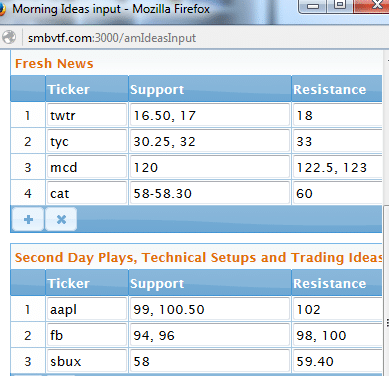

Pre-Market Trade Prep–TWTR TYC SBUX

Each morning before the market opens we outline a series of trading ideas. There is a written “game plan” to make it easier to follow along. We identify the best stocks to trade before the opening bell as this puts us in a better position to execute in the heat of the moment. Here is a screen cap of the … Read More

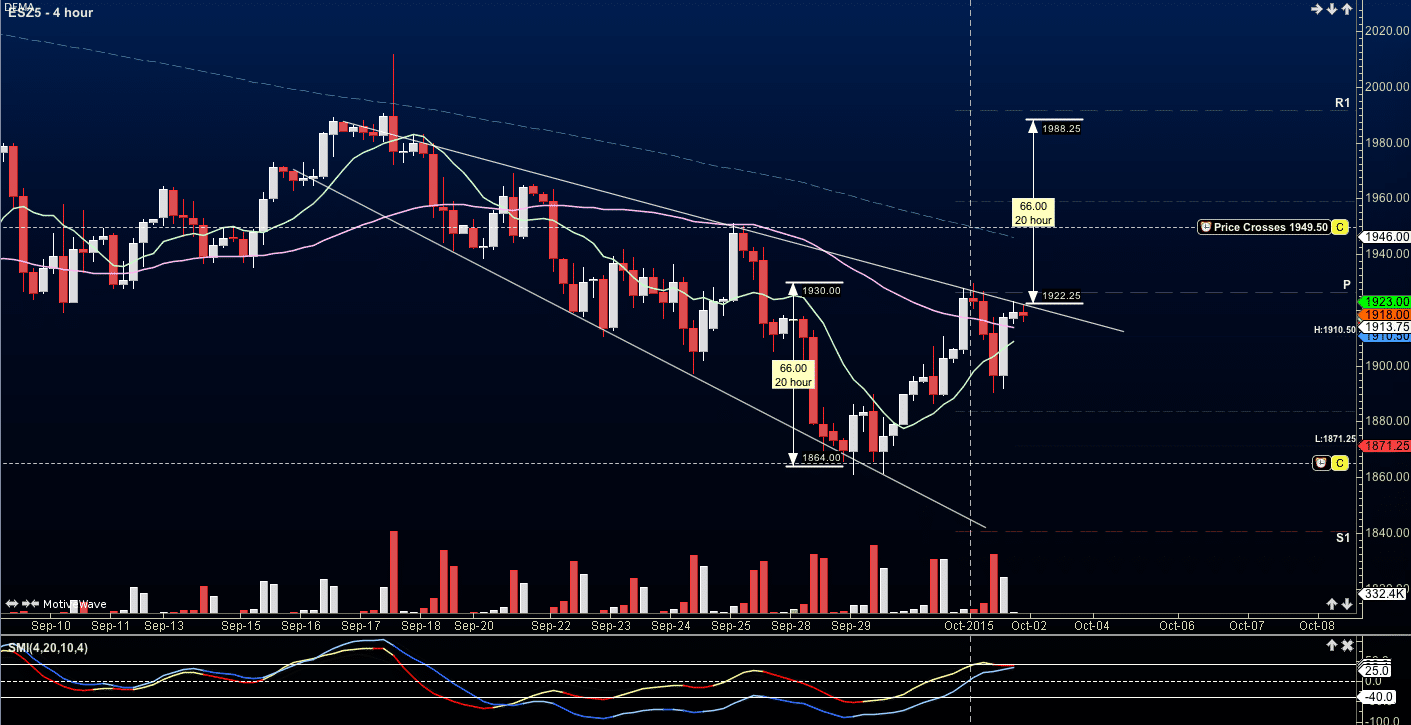

Inside The Trading Vault – Futures Market Assessment – $ES_F

SMB will be hosting a free webinar on October 6th where I will outline several trades based on techniques taught in the Vault. The formation above is that of a falling broadening wedge- this is a bullish formation. The current measured range is 66 points. We sit above the moving averages and momentum suggests at this time that pullbacks should be bought and … Read More

Netflix Revisited

Netflix traded significantly higher in the after hours following the release of its earnings report. The one item that really stood out for me was the EPS. Despite a revenue number that was basically in line they were able to report an EPS significantly higher than expected. And more importantly they guided the EPS much higher for next quarter. What … Read More

Cool Technology With Some Great Ideas

In the past few years SMB has built some remarkable trading tools. We led the pack in moving to HTML5 years before others (can use on smartphones and tablets). But beyond the cool technology in Scanner, Radar, and Real Time it is the actual idea flow that comes from very experienced traders. Traders who have spent years learning how to … Read More