A common mistake that new and developing traders make in the options market is to trade strategies that involve high commissions relative to the earning potential. We often see newer options traders applying great options strategies to the wrong instruments. Option trading strategies that involve frequent management to control risk can be commission intensive. This is especially true if you’re … Read More

Who’s Running The Ship?

When you think of a large cruise ship and the way that it’s run. Who runs the ship, the captain or the crew? If you’re like most people you would say the captain….. and you’d be wrong. As you think about all the things that need to be done on the ship, keeping the engines running, taking care of all … Read More

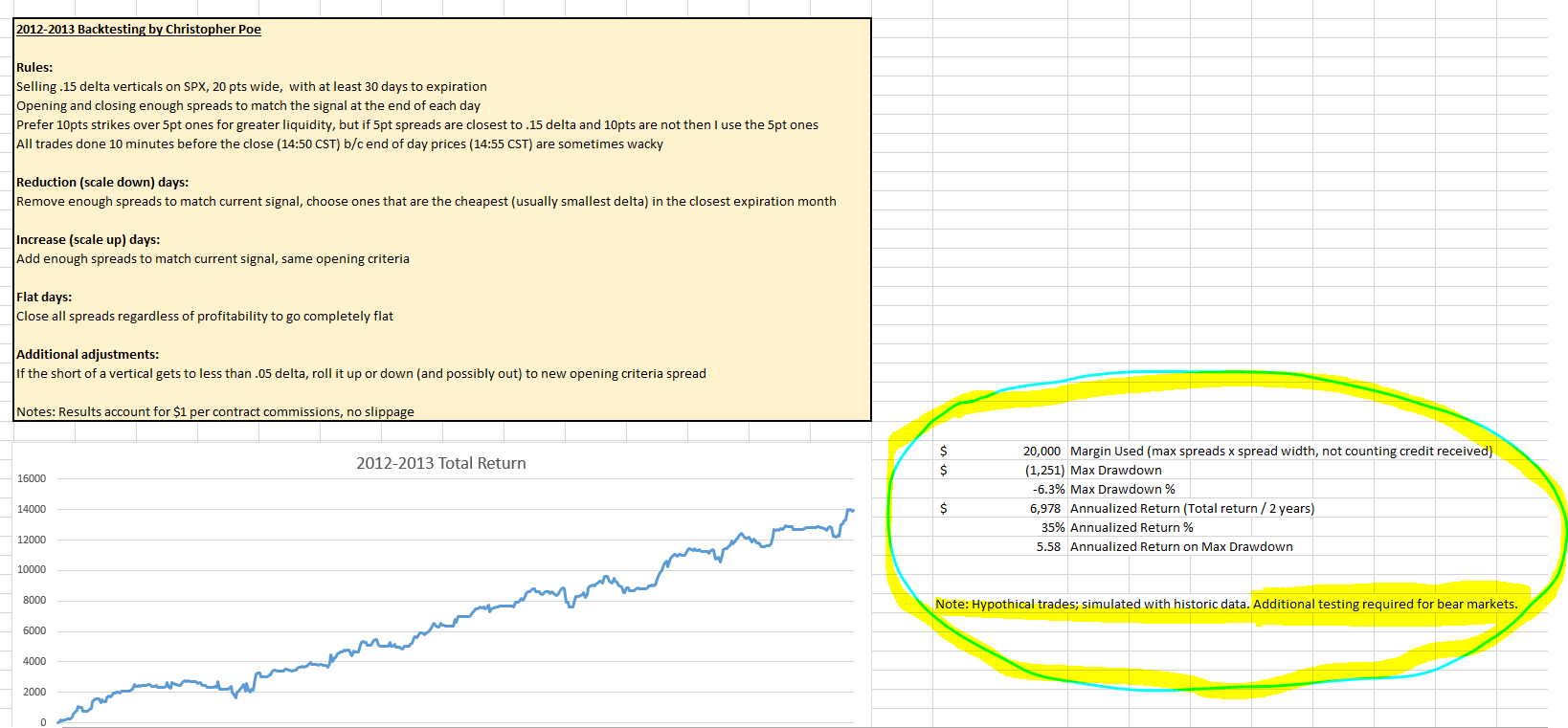

SPX Ratio Spread: 3 Year Back Test

I recently completed a third year of back testing the SPX Ratio Spread on the SPY Detector signals. Without any changes to the rules or the signals, 2012 had remarkably similar results to the previous two years which were much more volatile. Here is some documentation for this back test: PDF Overview: SPX Ratio Spread Back Testing Results – Part 2 … Read More

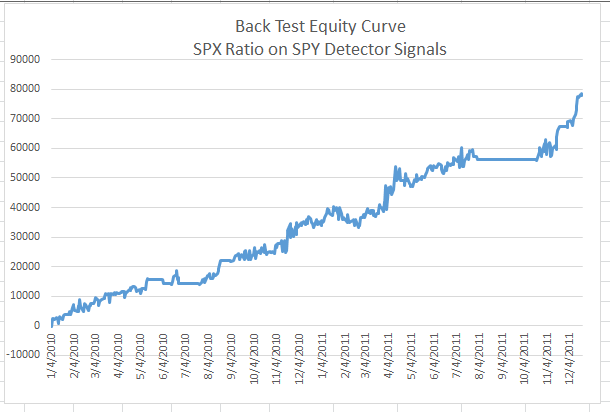

Options Back Testing Report

(Please note the following is based on hypothetical trades using historic data.) The SPY Detector signal has a 20 year history of successfully navigating the underlying price change of the S&P 500. The signal is made up of 5 sub-systems that follow trend and momentum using proprietary indicators. Each of the 5 underlying systems makes up 20% of the total … Read More

Back Testing an Options Strategy

Note: The following contains hypothetical results; simulated using historic data. As mentioned at a recent SMB Options Tribe meeting; a group of options traders are now working to back test a proprietary momentum signal using a variety of options trades. Several tests have come back with varying results… but we are seeing a common thread for options trades that show low … Read More

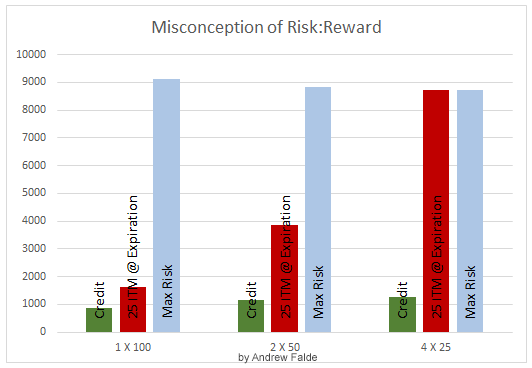

The Case for Wider Option Spreads

When analyzing a vertical based credit spread, including iron condors and butterflies, the first question that usually comes up is where to place the short strike. In a distant second usually comes the question of where to place the long strike, that is how wide the spread will be. This leaves some analysis to be done on using more contracts … Read More

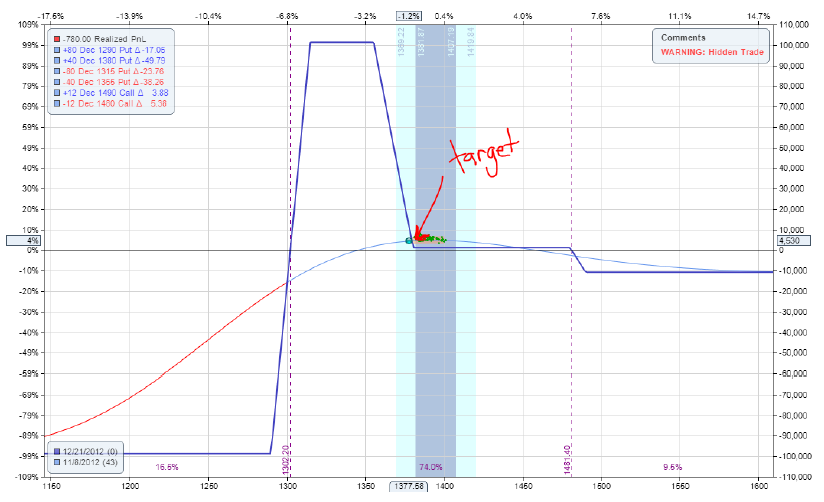

Coming in to the final hour for the SPX ‘fly

This post is another in a series that we will be publishing which track the hypothetical performance of broken wing butterfly trades selected by Greg Loehr of Optionsbuzz.com. There’s only a little more than an hour left in the trading day and the expiration of the SPX weekly options, but there’s still plenty of action left in the hypothetical broken … Read More