In this video Seth Freudberg discusses why he has a problem with the term options income trading. Find out why!

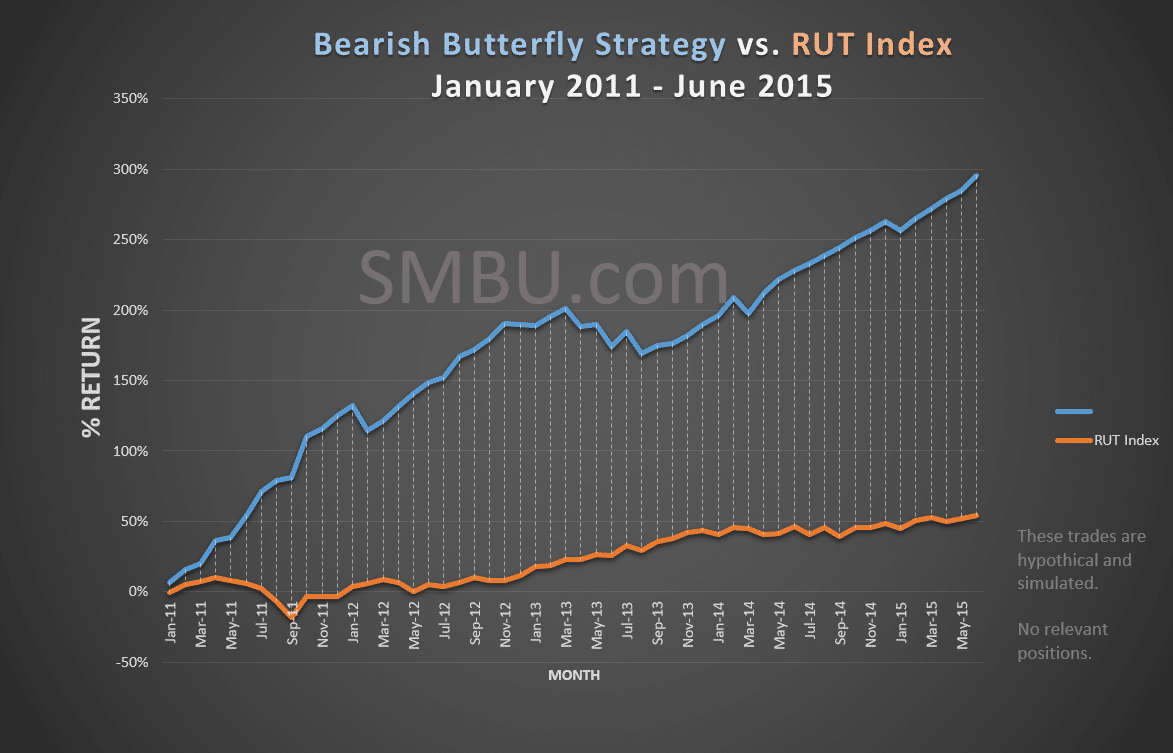

How this Bearish Strategy Beat the Index by 288%… Even in a Bull Market

Please note: Trades discussed below are hypothetical and simulated for educational purposes only. Review the options risk disclosure. The graph below compares the Bearish Butterfly vs. the S&P 500 index. If you had traded the rule-based Bearish Butterfly Strategy for the past 5 years, you could have outperformed the index by 288% — even though the market was bullish during … Read More

One Mistake Your Broker is Glad You’re Making

A common mistake that new and developing traders make in the options market is to trade strategies that involve high commissions relative to the earning potential. We often see newer options traders applying great options strategies to the wrong instruments. Option trading strategies that involve frequent management to control risk can be commission intensive. This is especially true if you’re … Read More

3 Reasons to Pairs Trade with Options

Pairs trading is a market neutral strategy that focuses on the correlation of two instruments rather than pure direction. For example, you may want to be long $GOOGL and use a short $QQQ position to offset your systemic risk. Or you may see the relative weakness of $IWM and look to trade it long against a short $QQQ position for … Read More

A Safer Way to Be Long at the “Top”

When I start getting signals to be long at the upper end of the range, it can be a psychological challenge. Traders don’t want to be “late”. It may seem like the move already happened and the risk/reward is not favorable to have a long bias. Here’s the reality. Market neutral, positive Theta options traders don’t have to make that distinction. … Read More

Turning a Bad Signal into a Winning Trade with the Right Strategy

Here is a case study in accumulating as many edges as possible to increase your risk adjusted returns. In the past, I have shared that most developing traders start by looking for the fastest way to make bigger profits. However in systems development we look for the highest risk adjusted returns. In this example trade, we are going to combine two … Read More

Options Trading for Income with John Locke for December 22, 2014

John Locke – www.lockeinyoursuccess.com A great way to improve your trading results is by keeping up to date with the latest trading techniques and current market conditions! No relevant positions Risk Disclaimer

Learn To Trade Before You NEED To

Whenever market conditions are similar for an extended period of time it’s not that difficult to come up with a trading methodology that works remarkably well. When this happens I’ll see two things. First is a bunch people selling advisories and set ups. And second are traders who think they’ve found the Holy Grail and want to retire. From early … Read More