Bubba Horwitz of Bubbatrading.com makes his debut appearance on the Options Tribe this week to discuss techniques for hedging a trader’s investment portfolio through the use options.

3 Reasons to Pairs Trade with Options

Pairs trading is a market neutral strategy that focuses on the correlation of two instruments rather than pure direction. For example, you may want to be long $GOOGL and use a short $QQQ position to offset your systemic risk. Or you may see the relative weakness of $IWM and look to trade it long against a short $QQQ position for … Read More

A Safer Way to Be Long at the “Top”

When I start getting signals to be long at the upper end of the range, it can be a psychological challenge. Traders don’t want to be “late”. It may seem like the move already happened and the risk/reward is not favorable to have a long bias. Here’s the reality. Market neutral, positive Theta options traders don’t have to make that distinction. … Read More

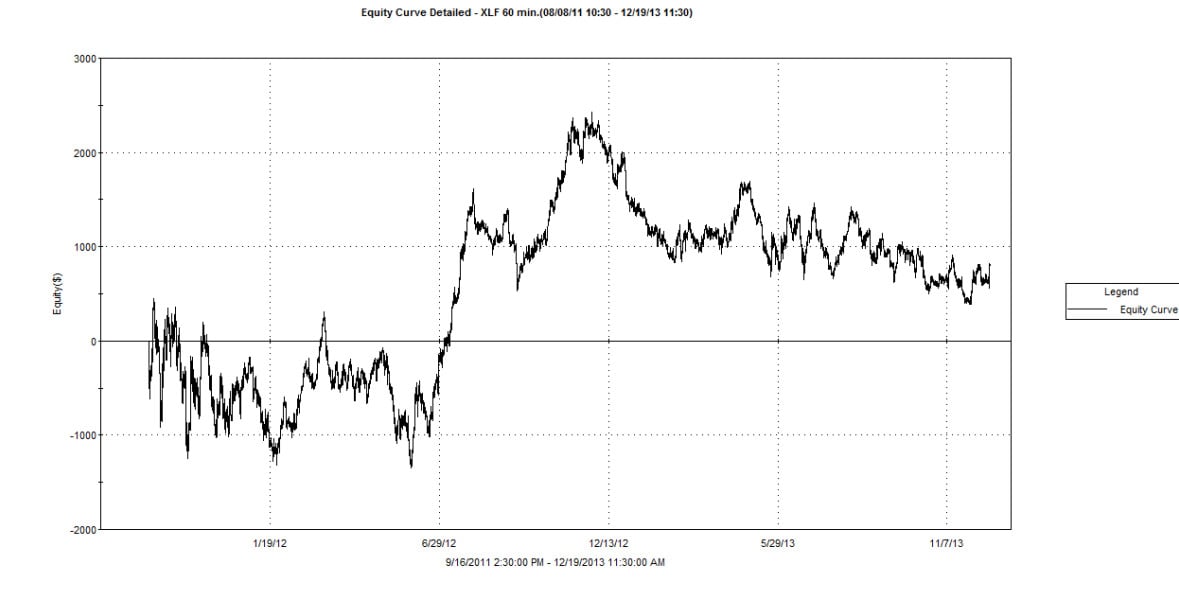

All Hedging is Not Created Equal

In this post I will show you a strategy that can be long and short financials at the same time and end profitably. The concept is based on pairing instruments that have different natures. The nature of leveraged instruments is to increase the impact of one-way movements. The nature of unlevered broad-based indexes/funds tends to have more reversion and overlapping … Read More

Forex Trading: Hedging. Is There an Advantage?

There was a time (before 2010) when you could open a forex account with any U.S. broker and have the ability to hedge your spot forex transactions in the United States. Residents outside the U.S. still have the ability to hedge their forex positions. On the surface, hedging sounds like the ideal situation: After taking your initial position, if you … Read More