If a stock has fresh news prior to the market Open it may gap up/down a large amount from the previous day’s closing price. My first instinct as a trader is to be long stocks that gap up on news and short stocks that gap down on news. My experience tells me that the majority of the time there is intraday follow through on large gaps with stocks that have significant news. But just because my first instinct is to look for follow through I don’t discount the possibility that a stock may attempt to fill the gap. Let’s take a look at MON from today.

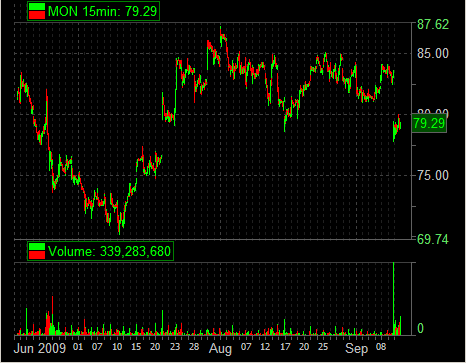

MON warned that their earnings were going to be at the low end of guidance this quarter and they lowered their guidance for 2010. The stock was gapping down about six points in the pre-market. There was an identifiable seller at 77. I got short MON even though it was already down six points in the premarket. Who am I to argue with the large seller at 77? When the seller lifted at 77 I covered and got long. This was a scalp trade. I quickly sold for a 30 cent profit. I was not yet convinced that MON would continue to trend higher.

MON then traded up to the 78 level. The market had still not opened. It spent some time consolidating around 78. My mindset at this point was to wait and see the price action when the market opened. If it held above 78 I would look to make a trade on the long side but if it held below 78 I would look for a move down to the 77 level from the premarket.

The market opened and it dropped 78. It traded down quickly to the 77.70s. But similarly to the premarket when it traded below 77 it was hard to get hit on the bid to cover. Very quickly it traded above 78 again. Then over the course of the next few minutes there was clearly buying at the 78 level. I got long and put in a stop below 77.90. I sold when MON failed to breakout above 78.50.

When it traded above 78.50 I was unable to establish a long as I was too busy ripping up some money in AIG. My mindset at this point was neutral to long for MON. After the large gap down the two strongest moves I had seen were to the upside. So I was willing to focus on getting long at opportune prices. There were probably many traders and retail investors that saw the news headlines and how much it was down and were heading for the exits. But the price action I was observing had me focusing on the best prices to get long.

After MON topped out at 79.50 I set alerts for 78.50 and 78. I was willing to establish longs at these prices as well as on a breakout above 79.50. I was not willing to risk more than 20 cents on any of these trades but I felt that 1 to 2 points of upside would be available at each of these prices.

Around 10:00AM one of our traders identified a buyer at 78 after MON had pulled back. A bunch of us got long. It traded up to 78.50 fairly quickly. As you can see from the chart it had some trouble holding a bid above this level. At around 11:00AM there was a fake break to the downside which was immediately followed by a strong move up to the morning high. Again MON failed to breach the 79.50 area so it was time to get flat and even short some for a down move to the 78.50 support.

After one more down move to 78.50 MON based for about an hour until it made another powerful up move to 79.85. At this point my mindset was to be aggressively long on a pullback to the morning highs of 79.40-79.50. If it failed to break above 80 then get flat and reevaluate.

Consider the following when you are trading a stock that gaps significantly from the prior day’s closing price:

1) Where is the stock trading relative to the pre-market high/low?

2) Where is the stock trading relative to the opening price?

3) Which moves were more powerful; up or down?

4) Did you see more accumulation or distribution while watching the tape?

5) What is the broader mindset in the market? Are we trending up or down?

Each of the above will give you clues as how to best trade these scenarios.

14 Comments on “Should I be Short or Long?”

Hi Steve:

Very insightful post.

When you mentioned accumulation and distribution what exactly are you referring to?

I suppose accumulation means the buyer is slowly buying the stock as opposed to aggressively driving the stock up.

Were there any instances of accumulation/distribution in MON?

Thanks

Hi Steve:

Very insightful post.

When you mentioned accumulation and distribution what exactly are you referring to?

I suppose accumulation means the buyer is slowly buying the stock as opposed to aggressively driving the stock up.

Were there any instances of accumulation/distribution in MON?

Thanks

Hi Steve:

Very insightful post.

When you mentioned accumulation and distribution what exactly are you referring to?

I suppose accumulation means the buyer is slowly buying the stock as opposed to aggressively driving the stock up.

Were there any instances of accumulation/distribution in MON?

Thanks

I’m a little confused: if the “identifiable seller at 77” *lifted* the offer, then was he a seller or a buyer?

I’m a little confused: if the “identifiable seller at 77” *lifted* the offer, then was he a seller or a buyer?

I’m a little confused: if the “identifiable seller at 77” *lifted* the offer, then was he a seller or a buyer?

Pretty sure this is a case of the “big fish that got away.”

Yes, most of what was written above happened, but I am quite certain that all of the above mentioned trades were profitable as states, or even occured.

I will definately give you the seller at 77 and the buyer at 78…that was obvious.

And if you got in at 77.70-77.75, then you were one of about 8 trades that occured in the first 51 seconds of the regular session. Congrats.

Pretty sure this is a case of the “big fish that got away.”

Yes, most of what was written above happened, but I am quite certain that all of the above mentioned trades were profitable as states, or even occured.

I will definately give you the seller at 77 and the buyer at 78…that was obvious.

And if you got in at 77.70-77.75, then you were one of about 8 trades that occured in the first 51 seconds of the regular session. Congrats.

young trader,

you are correct. i didn’t see a lot of accumulation in monsanto other than at the 78.50 level.

steve

young trader,

you are correct. i didn’t see a lot of accumulation in monsanto other than at the 78.50 level.

steve

jeff,

i should have said he lifted “his” offer.

steve

jeff,

i should have said he lifted “his” offer.

steve

Mark,

Don’t understand your comment. “Big fish that got away?”

My blog was about the proper mindset and factors to consider when trading a specific scenario.

Steve

Mark,

Don’t understand your comment. “Big fish that got away?”

My blog was about the proper mindset and factors to consider when trading a specific scenario.

Steve