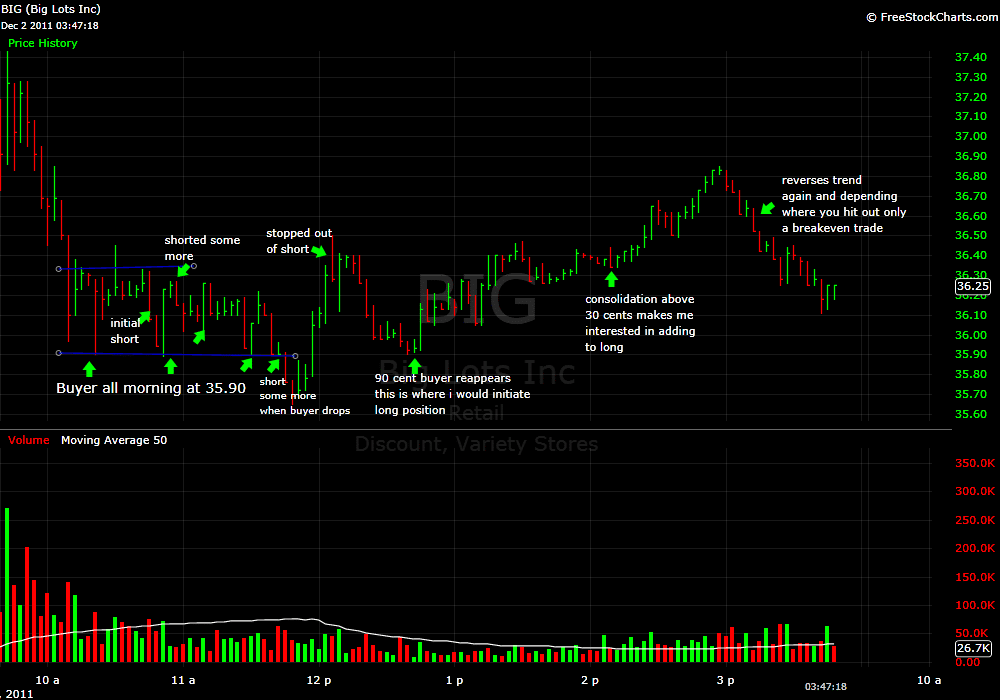

I shorted BIG in the late morning today. It gapped down on its earnings release and then proceeded to consolidate below 36.70, which in my view is an important long term support area. My initial short was when a buyer dropped at 36.20. It quickly dropped about 30 cents and then traded right back up to the 36.20s. I shorted some more and placed my stop above 36.30. Eventually it traded below the morning low of 35.90 where a buyer had previously supported it on three occasions.

When a weak stock consolidates at the low and the buyer finally drops the stock should trend lower. If it does not you need to think about the possibility that the stock may reverse its trend. I was off the desk when BIG finally reversed and I was stopped out of my short position. But if I were on the desk and saw the below pattern forming my bias would shift to being long and not short. I have marked up the chart below to explain my thought process.

Disclosure: no relevant positions

Steven Spencer is the co-founder of SMB Capital and SMB Training and has traded professionally for over 15 years. His email is [email protected]

3 Comments on “Shifting My Bias”

Steve, when you see the buyer drop off at 35.90, head lower but then stops, where is your exit to cover at that point? Do you let it come back up to your stop price? I know you want to watch the tape to see if there is a held bid or a held offer that then disappears, but what’s your game plan? Looking at a daily chart I see long-term sup around 34.50. The whole # is a key area to watch too, what’s your thoughts if it did continue its downtrend? Thanks!

i needed and used the info from this post this week – thanks

hi Steven,

thanks for the all the tips and info as a developing trader it helps allot,

i have one Q is the second short you have done (just next to the resistance at 36.3 )

is not averaging down ?

or because of the resistance you can do it or there was something else ,

many time i am next to the resistance levels and ask my self if to get more because it is very close to the same stop loss but the fact that i always hear is never average down

thanks

Eldad