Here is a timeline of my trading thought process starting on April 24th the morning after AAPL reported earnings through April 29th.

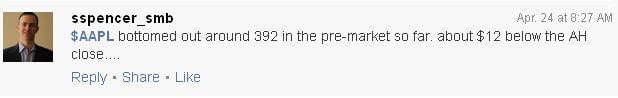

I want to put this first StockTweet in context. After AAPL released their earnings report trading was halted. AAPL announced a capital plan to return about $100 billion dollars to shareholders via dividends and stock buybacks. They reported gross margins of 37.5% which was fairly in line with expectations. When AAPL resumed trading after the halt it was at 419 up around 13 points from its 4:00PM Close. By the time the after hours session had ended AAPL had completely filled the gap, and it was setting up for a likely test of 390 the next morning, which was the closing low since 2011.

AAPL had spent the prior six months being dumped by one institution after another. The final dumping about the week prior to earnings when it cracked 419 and traded down to 386.

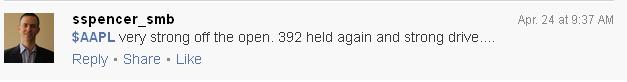

AAPL opened around 392 which was just above its closing low prior to earnings. The risk/reward at this level was awful on the short side, because of the possibility of a quick pop to 400ish the next important resistance level. When the market opened AAPL immediately began to trade higher on extremely heavy volume. In the first 30 minutes about $5 billion worth of AAPL was traded and it blew threw 400, 410 and topped out around 415. The vast majority of institutional orders on the Open were on the buy side.

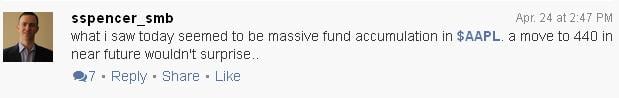

The large orders right on the Open caused a powerful 20+ move and then after a larger than expected pullback I watched a passive accumulation program buying the stock at 400.75 for about an hour. Each time AAPL dropped to the 400.75 area the program absorbed all selling. It is rare that a level is tested and holds for such a long period of time in AAPL and this caused me to establish my long position for a Trade 2 Hold. When it got above 402 a lot of other traders on the desk joined in with targets of 410.

This was really step 1 in a series of price action I would need to see in the coming days to confirm a near term move to 440.

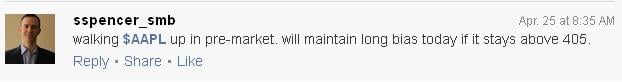

Day 2. On the second day what I wanted to see was the same accumulation program identified on Day 1 at 400.75 buying stock at much higher prices. As long as this buying occurred above 405 I would be a buyer of AAPL and try to ride the uptrend.

Day 2. Once I spotted the buy program again I started to add to my position still using my price to get flat below 405 but selling some shares below 407 if the buy program disappeared. Although I’m thinking the bottom was put in the prior day AAPL still has a lot to prove to me that buyers are willing to commit at higher prices than 400.

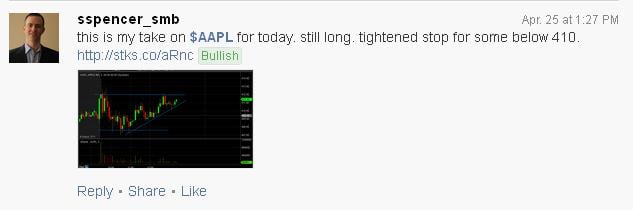

Day 2. I was pleased with the price action by midday and holding my core as long as the uptrend was intact. Trading around additional shares to keep my risk as low as possible.

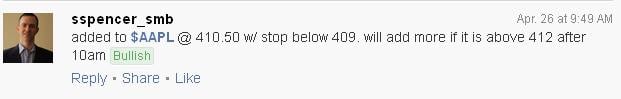

Day 3. I was looking for the prior day’s buy program from 407.25 to step up to 410 or higher to add to my overnight position.

Day 3. In the pre-market it was bid up to 410 but I took no trades waiting for the market to Open and show me commitment once the larger orders came in.

Day 3. Once I saw the commitment I was looking for with a 410 buyer I paid 410.50 but it quickly dropped out to just above 409. I placed a stop for my additional shares below the 409 level. Each time I bought shares at higher prices and was not stopped out I became more bullish on the stock as the buyers were proving to me that they would commit to buying on any pullbacks.

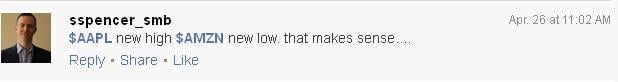

This was just a comment on the good follow through of the morning trends for both stocks…

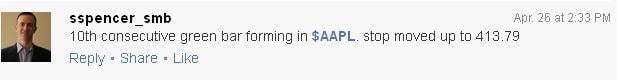

A reminder that AAPL was behaving “perfectly” and there was no reason to get out but made sense to raise stops in case this clear pattern broke.

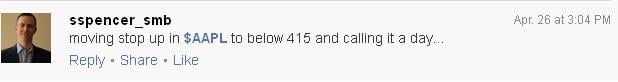

It was 3PM Friday afternoon and I was pretty exhausted from trading for the week so I just set my stop a few points lower and no longer actively managed the position.

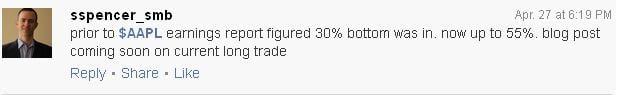

I am a numbers person. I always assign probabilities in my head of trades working. It helps me formulate the amount of risk to take on a trade and to stick with positions that have greater potential.

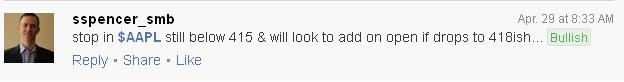

Day 4. Kept my same stop despite the gap up to around 420 on Monday. There were two possibilities to add to my position on the Open. One was a quick dropout to Friday afternoon support around 418 or a hold above 420.

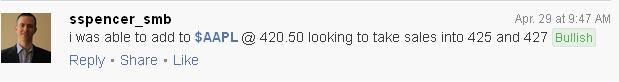

Day 4. AAPL quickly drove up to 423 on the Open so the chances of me buying into a pullback to 418 were very low so I bid in front of 420.50 comfortable that if I got filled on a quick 2.5 point dropout my risk was no more than 75 cents through the 420 level. I got filled and AAPL immediately traded higher allowing me to take some sales 424-425 to cover my risk. It then quickly traded up to my target of 427 so I got flat.

It spent some time consolidating above 427 but I chose not to get back in which technically was wrong but I had spent a lot of energy sticking with it from 400.75 to 427 and decided to take a break….

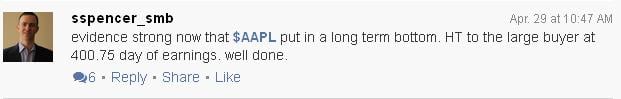

I do think the bottom is in and it will trade up to 480-520 before its next earnings report.

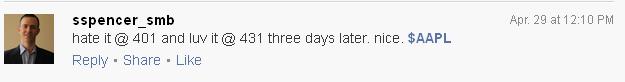

The beginning of trends are always “hard money”. Once a stock is clearly trending and there are a lot of believers in the move pullbacks become shallower and the money “easier”. We saw this as AAPL continued hire from 430 to 444 with very little in the way of pullbacks the next two trading days. If you want to be in this business for a long time try to find ways to not be the first person in doing all the heavy lifting before a trend is clearly established.

Steven Spencer is the co-founder of SMB Capital and SMB University and has traded professionally for 17 years. His email is [email protected].