This post is another in a series tracking the hypothetical performance of broken wing butterfly trades selected by Greg Loehr of Optionsbuzz.com.

Over the past several weeks I’ve been selecting and tracking hypothetical broken wing butterfly trades, in real time, using the weekly options. I was using AAPL, SPX and most recently SPXPM, and all six trades produced simulated profits ranging from 1% to 31% over those weekly time frames. Not bad at all.

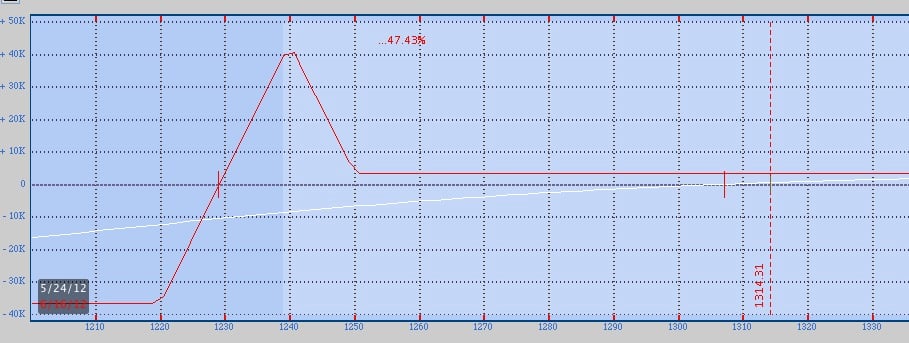

But now I’m going to track a trade on SPXPM using the regular expiration June options, which have 22 days until expiration. The trade I’m following is the 1250-1240-1220 put broken wing butterfly for a credit of $0.65. The max theoretical risk is $9.35, but that loss should never be reached if managed properly. If the market sells off, this trade can work out very nicely depending on the speed and timing of the drop. And the worst thing for this trade would be a hard sell off in a very short time frame.

If the market stays above the 1250 strike by June expiration, then the credit would represent a profit of 6.9%. Here’s a look at the stock chart:

I use basic support and resistance when looking at a chart for technical analysis. With the market having sold off recently, and with the support I see around 1,270, a bounce in the market would be a good thing for this trade. And a move down to 1,270 over a few days would also be good.

Now, what I’m going to track differently on this one, besides the fact that the time frame is longer, is that I’m going to track the hypothetical results on a trade putting 5% of a portfolio at risk, and another trade putting 1/3 of a portfolio at risk. Position sizing is a key component I discuss with my mentoring students from the Broken Wing Butterfly video series. While putting 1/3 of a portfolio into an option trade seems risky, and it certainly can be, I know money managers that do just that because they are completely comfortable understanding the real risk of the trade, how much market movement is needed before they can get hurt, and how to adjust the position if necessary.

I’ll be back later next week, or as market conditions dictate, and let you know how this trade is going.

Trade safe!

Greg Loehr

Optionsbuzz.com

Please note: Hypothetical computer simulated performance results are believed to be accurately presented. However, they are not guaranteed as to accuracy or completeness and are subject to change without any notice. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Since, also, the trades have not actually been executed; the results may have been under or over compensated for the impact, if any, of certain market factors such as liquidity, slippage and commissions. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any portfolio will, or is likely to achieve profits or losses similar to those shown. All investments and trades carry risks.

No relevant positions.