As many of you who read this blog and follow us on Twitter know, we have been very focused on FCX for the past several days. This stock has a well-earned reputation for being difficult to trade, but when it is really in play with good order flow, it actually behaves itself pretty well. I tend to focus on with-trend trades, and encourage the traders who I mentor to do the same, for many good reasons. It is very easy to get caught up fading stocks because you think they have gone too far (or if you’ve read some books on technical analysis you have a better way to say it: they are “overbought” or “oversold”), but the reality is that stocks can get overextended and stay overextended while they trend a lot further than anyone expected. Traders fading into these moves have to deal with anger, frustration and mounting losses, and save enough bullets that they can really lay into the stock when they finally catch the turn. It’s a lot to ask and a hard way to make a living, especially when there are much easier ways to sell the top or buy the bottom.

First of all, realize that we are not going to sell the exact high of the move or buy the low, except on that one trade out of a hundred when we just kind of get lucky. What we need to do is to see signs the trend has ended, watch for the very first signs that the tide has turned and is now flowing in the other direction, and then enter in the direction of the new trend. I have written before (here) about 3 pushes or 3 drives to a high, which is one of my favorite trend ending patterns on all timeframes. (If you haven’t seen this one before, I know it seems absurd. Keep an open mind and watch for it for a few months and let me know what you think then.)

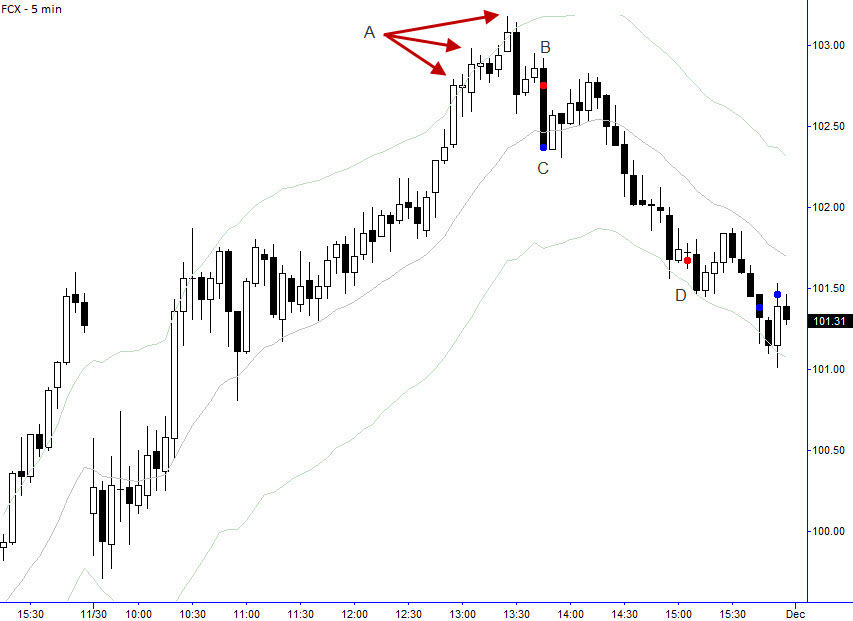

So we were watching FCX midday and Joe P (on twitter as JoeP_SMB) who sits beside me made some long trades in FCX earlier today. I was halfheartedly involved in them, but didn’t really feel the conviction, so I was very aggressive in calling out the 3 pushes top I saw (marked A) on the chart below. This pattern alone is not enough to get us short, especially a stock like this that is more than happy to run you over if you’re early on an entry, so we then waited for the first countertrend break, and shorted on the retracement marked B on the chart below. I took partial profits on the blue dot, added to the trade later in the day (for several reasons), and covered the last of my short into the close. Considering how difficult this stock can be, this was a very easy, painless trade which got us short less than half a point from the high of the move and let us ride the new downtrend all the way to the close.

There are a few subtle refinements to this trade, but this pattern occurs over and over, in all markets and all timeframes. Do some chart study, practice identifying the pattern in real time, and see if this can become a valuable addition to your playbook.

(Follow me on Twitter AdamG_SMB)

5 Comments on “FCX: One way to catch a top”

Would you say that the “three pushes” pattern can also be applied to catching tops/bottoms of retracements within a larger trend?

Indeed, ‘three thrust pattern’ – first read in the Bill McLaren technical analysis book. It works very well, see the 2009 bottom of the market – daily timeframe

Dax:

No I dont think so. It’s a climax pattern, and the little countertrend retracements shouldn’t be long enough or strong enough to end with a climax pattern. Understand?

Thanks Adam for another detailed post. I’ve had success using this pattern with index futures, especially when combined with extreme TICK readings (+1000) on the first or second push, then divergence in TICK and momentum readings on a following push higher.

There was an instance of this at the 11:03-11:05CST mark in the e-Mini today (12/1/10). Three pushes up with the second resulting in not quite +1000 TICK, but +944, and the third with a lower TICK (on the 5m chart). For me, this was a good time to exit my longs, then wait and see how the market absorbs the move.