When I began trading in 1996 the lifeblood of the trading floor was the chatter that was exchanged loudly between traders. If a trader was making money in a ticker that information was shared. If a trader found a favorable entry price that information was shared. If a large buyer or seller was identified that information was shared. I made a lot of extra money because of my trading environment.

Flash forward 10 years later when Bella started to broach the subject of starting our own trading desk. I told him I had two prerequisites to be on board. #1 We had to offer comprehensive training as opposed to the “trial by fire” that our first firm used to train us. A different market and a different time would require a new approach. #2 A desk where traders were sharing information so that we would all make more money. I didn’t want to be a part of a desk where each trader was an island unto themselves. No value in that for me.

Bella and I agreed that these two core principles would guide SMB. We ran into some trouble early on as younger traders tend to be much less vocal in their communication. They are the G-chat generation and most of their information flow is from chat and text. We did address this issue early on by giving everyone headsets and setting up Skype calls. Headsets which don’t require speaking loudly seemed to work for most newbs. But this led to cliques forming as certain traders would exclude others on the desk. Then we switched to technology where traders could jump onto whatever call they wanted. That technology got tossed by our broker dealer’s compliance so now a lot of the give and take occurs in the more common chat stream.

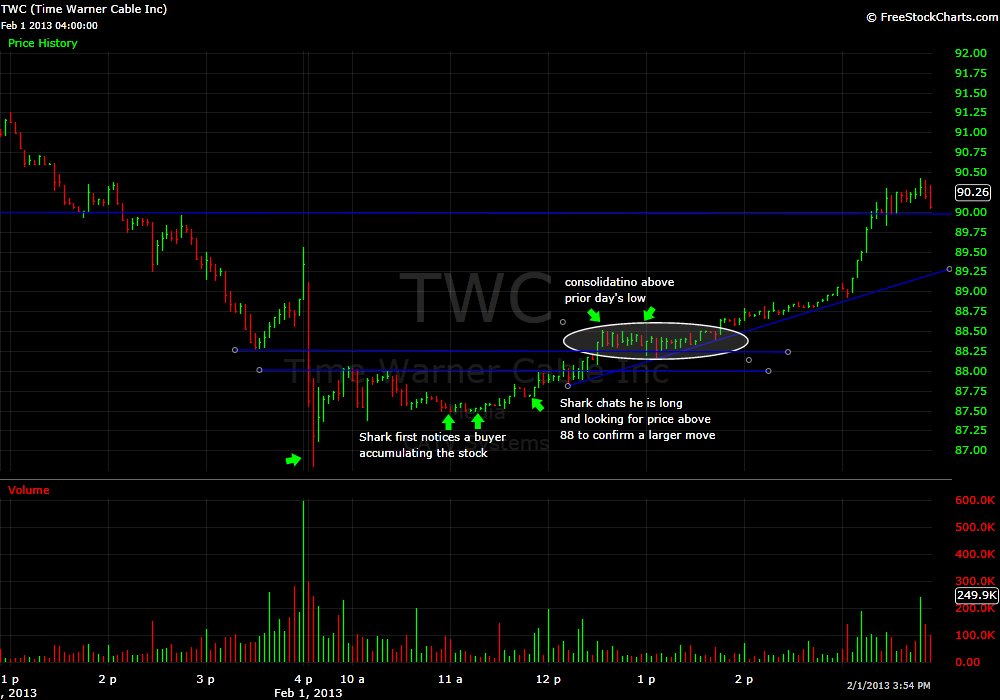

I grabbed the chats from 2/1/13 regarding TWC. There are some interesting things can be learned from this conversation. My thoughts are in blue below each chat that was exchanged.

11:54a Shark: i am long this twc and really like the bounce potential… its a real company got really stretched out and easy to see the buyer on teh tape with the uptick rule above the fig there isn’t many levels form a point and change

Shark is a senior trader on our desk and I have noticed in the past few months he tends to put his “conviction trades” in the chat.

TWC was a stock that had been very In Play the prior day and was on our list of top “2nd Day Plays”. He conveys a lot of information with his two sentences: 1) He says he is long which means he is putting his money where his mouth is 2) He says he really “like(s) the bounce potential”. This means the stock has an excellent risk/reward 3) he uses the words that TWC is a “real company”. The idea of a “real company” has been pushed very hard by Bella recently. The idea is simply that in a strong market when a stock gets hammered after an earnings report many will view the beat down as a buying opportunity. 4) He says he has spotted a buyer on the Tape. Reading The Tape is a skill that 100% of the better traders on our desk have developed. 5) he references the “uptick rule” which is a stupid regulation that distorts price behavior. but like most good traders Shark has found a way to use that price distortion to his advantage and now he more easily spots buyers 6) he says there aren’t many “levels” after the stock trades above the whole # which means he is looking to capture a larger move in the stock, which should add confidence to less experienced traders to hold positions11:54a Shark: gotta hold a bid above 88 to get in motion

He is just reminding everyone that once the stock gets above 88 he will have conviction for a larger move12:29p pdmoney: can you say dumb*ss?

12:29p pdmoney: TWC…nice calling

12:30p pdmoney: how many more times I gonna do that? In and I bailed to soon

pdmoney is an experienced financial professional attempting to become a pro trader. he frankly shares his thoughts in the chat and some of his comments are very instructive for the most common pitfalls faced by all developing traders. he got involved in the trade from the Shark call out but he was unable to hold his winner. see this blog post for more on that problem.12:31p (SMB) Gman1: pdmoney..move just starting.. could go up to 90-91

Gman jumps in as a senior trader to offer encouragement to pdmoney letting him know he may have sold early but the trade still offers a lot of potential so stick with it. Another common problem with less experienced traders is once they get out they can’t figure out how to get back in. This reassurance from Gman is a gentle nudge to help overcome that issue.12:32p pdmoney: looks like it could.

12:32p pdmoney: at least to 50 cents

12:34p pdmoney: that quick move when it jumped to 26 cents then dropped to like 8 cents got me

12:35p pdmoney: 50 cents near the open looked like it could be resistance

pdmoney is now describing the price action in TWC trying to figure out if there is a low risk play he can make to get involved.12:45p pdmoney: TWC still doesnt like 50 cents

sellers still not lifting from 88.50 so not getting involved. if this level finally lifts after a long period of consolidation it can lead to a higher trading range and is a spot for pdmoney to get involved again. the stock is still 1.5-2.5 points away from the upside potential Gman chatted earlier.1:34p pdmoney: can it get trhough this time?

1:39p Kevin: TWC very tight at .50

1:40p pdmoney: doesnt want to let it go

still struggling to get through the 88.50 level but notice it hasn’t pulled back at all. Kevin chats that it is “very tight” at .50. the tighter the consolidation the lower the risk and more likely it will burst through resistance. I wonder where he learned that 🙂1:43p pdmoney: wouldnt the cockroach move be to lift then crush it?

1:44p pdmoney: bingo

this is simply “negative self talk”. pdmoney is now trying to convince himself after watching the stock consolidate against resistance for an hour that when it lifts he shouldn’t buy because it could lead to some time of shakeout. his self talk is the opposite of what you would expect from a confident and successful trader. and it is one of my biggerst pet peeves on the desk when I hear it from senior traders. if you are going to have a negative attitude you will fail. and your failure is infectious. learn to be positive. if the price action you are observing indicates a stock has a greater probability to trade in a certain direction then make the trade and be confident it will work. otherwise you have already lost.as you can see from the chart the 88.50 seller lifted and it never looked back. by the way this is not to say you shouldn’t have a trading plan for the breakout failure. but please spare everyone your negative BS. save it for the therapy couch!

2:58p pdmoney: Hi, my name is PDMoney and I suffer from Trader Wuss Sydrome (As Mike mentioned in the playbook webinar)

pdmoney being self deprecating and honest at the same time. he understands that he needs to pull the trigger and hold his winners to be successful3:00p Muscatello: hi pdmoney

3:00p pdmoney: 🙂

3:01p pdmoney: watching TWC been like watcying grass grow but inched higher

TWC has started to trade tightly again. But then almost like magic two minutes after pdmoney makes this statement it explodes to the upside for another 1.5 move3:16p pdmoney: darn, had to get up for a few minutes and missed that TWC move…always happens that way

pdmoney’s bathroom break didn’t cause him to miss the move. it was the lack of execution during the prior two hours.3:17p Rakesh: Does anyone know what stock GMan and Shark are trading?

Rakesh clearly late to the party on this one. He must have heard Gman and Shark on the audio feed going nuts on that crazy final pop!3:19p pdmoney: twc

3:19p pdmoney: all you needed today since 87.50

You hear this statement all the time from traders. A statement of regret. The question is what are you going to do to be prepared for the next opportunity similar to TWC at 87.50? Are you going to journal, do visualization exercises daily, create detailed trading plans, and consistently push yourself to get better every day? That is what Shark and the other traders on our desk have become successful.

Steven Spencer is the co-founder of SMB Capital and SMB University and has traded professionally for 16 years. His email is [email protected].

No relevant positions

3 Comments on “A Trading Conversation”

Great post, thanks! Would you ever consider writing a post about how to use the uptick rule to read the tape?

Thanks Steve – another really valuable insight as always. Having the opportunity to learn from the sharing you guys do on the blog is invaluable.

I’m no expert but sounded like pdmoney might have needed a more comprehensive plan about how he was going to trade TWC – this may have removed some of his uncertainty when it was consolidating, especially to help try and develop a mind-set where the first option is not to bail when the market pauses to digest (I say that from my own experience). Perhaps he’s was waiting for excessive price confirmation and so talks himself out of the trade by which time his risk/reward turns sour when he gets it and he can comfort chastise himself but without having had to endure what he sees as the emotional pain of the uncertainty of risk. The fact he even acknowledge the low risk entry and still didn’t take it strongly suggests for me there’s some stuff to work hard on his mental game for overcoming hesitancy.

I mean this all in a very constructive way and applaud pdmoney for his honesty. I’ve made enough mistakes in my trading, still make them now and then and will keep making them – it’s how we respond to them that really matters (excluding any ‘give up trading, you’re an idiot’ ones of course!).

I hope pdmoney reads your comments and takes them on board and uses this experience to keep developing as a trader. It’s easy to analyse what we did well, accepting what we didn’t do well or could improve upon and then finding ways to positively affect it is much more of a challenge. Like you say, all of those techniques need to become part of his routine to help him keep on developing. If he can be as honest inwardly as he be can externally then I’d say he has a good chance of negotiating these barriers.

I know I’m preaching to the cardinal somewhat but felt connected enough with the experience to want to comment.

Best regards

Thanks Steve…chat and VTF been a big help…I know I ramble on a bit in there. The hesitation and mental game are my biggest hurdles to overcome. I also agree with Peter that having the well developed plan in place is something that would help. BTW, the comment about the cockroach move was jokingly in response to a comment Gman had just made on the VTF….it wasnt negatve self talk. However, your point is well taken. I know beating myself up over missed opportunity or dumb mistakes does no good. In just the past week in the VTF I have realized how flawed whatever it was I was doing prior to this has been. No real method. Not much of a plan. Everything you wrote in this post will be gone over and over in my head until it sticks. I’ve been going over the SMB blog, watching the webinars and taking in everything that is said during the morning meetings and throughout the day on the VTF. I’ll get there!