In this video I discuss how the character of the market has recently changed and how short term traders can capitalize by trading market ETFs such as SPY and futures contracts. no relevant positions Find out how you can get these ideas each morning and listen to our desk trade live below

4 Lessons Learned From Training Successful Traders

In this video, Mike Bellafiore discusses an article him and Steve Spencer co-authored with Dr. Brett Steenbarger. In the article, they explore insights from SMB’s trading desk.

SMBU’s Options Tribe Webinar: Gareth Ryan: Income opportunities for the summer using SPY options

This week, Gareth Ryan from IUR Capital presents options income strategies that could be used by investors this upcoming summer. He will discuss several key areas of both the equity and options markets including, strike positioning and time horizon with credit spreads. He will also discuss both near-term and longer term strategies with a focus on risk.

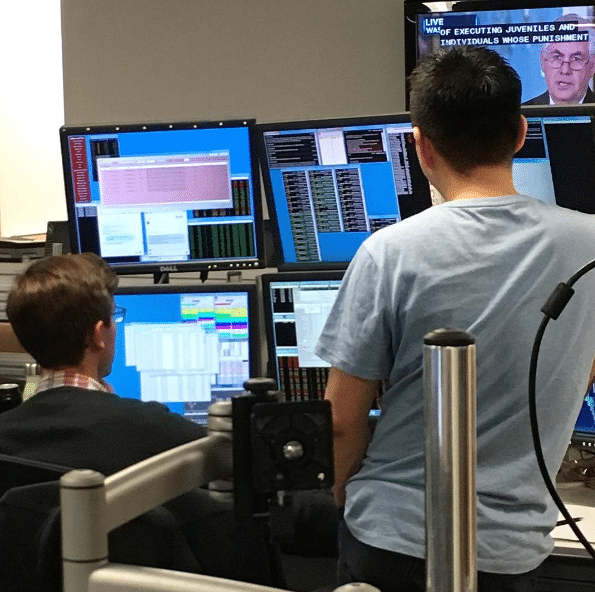

Does the layout of your charts matter?

Sometimes it’s the simplest of things that can give us just the nudge we need on our path towards consistency. The layout of your charts and order execution windows does have an impact on your ability to perform.

7 ideas for improving your trading consistency

I was recently a guest lecturer at Stony Brook University sharing my knowledge of trading and trader development with interested students. At the end of my lecture, a student approached and asked, “How can I improve my trading consistency?” We have polled our trading community for the top trading issues they would like to solve, and trading consistency consistently makes … Read More

5 ways our top traders are working to improve

I was on the West Coast last month to present to the Scottsdale (Phoenix) Traders and Investors Meetup Group. After my presentation, an astute and succeeding retail trader approached and asked, “What do your top traders do to improve?” At SMB, our top traders have been homegrown. We hired them. Trained them from scratch. Provided capital, technology, coaching and … Read More

Continuous Improvement is a Best Practice of Elite Traders

In this video, Seth Freudberg discusses an example of a trader on SMB’s Options Trading Desk who did a great deal of work to take a solid trade and improve it’s expectancy through a methodical optimization process. Some traders are satisfied with options strategies that work well and a satisfactory level of profit. Elite traders, however are always seeking ways to improve strategies that they employ, even if they are yielding reasonable profits.

SMBU’s Options Tribe Webinar: Bubba Horwitz of Bubbatrading.com: Investment Portfolio Hedging Through the Use of Options

Bubba Horwitz of Bubbatrading.com makes his debut appearance on the Options Tribe this week to discuss techniques for hedging a trader’s investment portfolio through the use options.

- Page 1 of 2

- 1

- 2