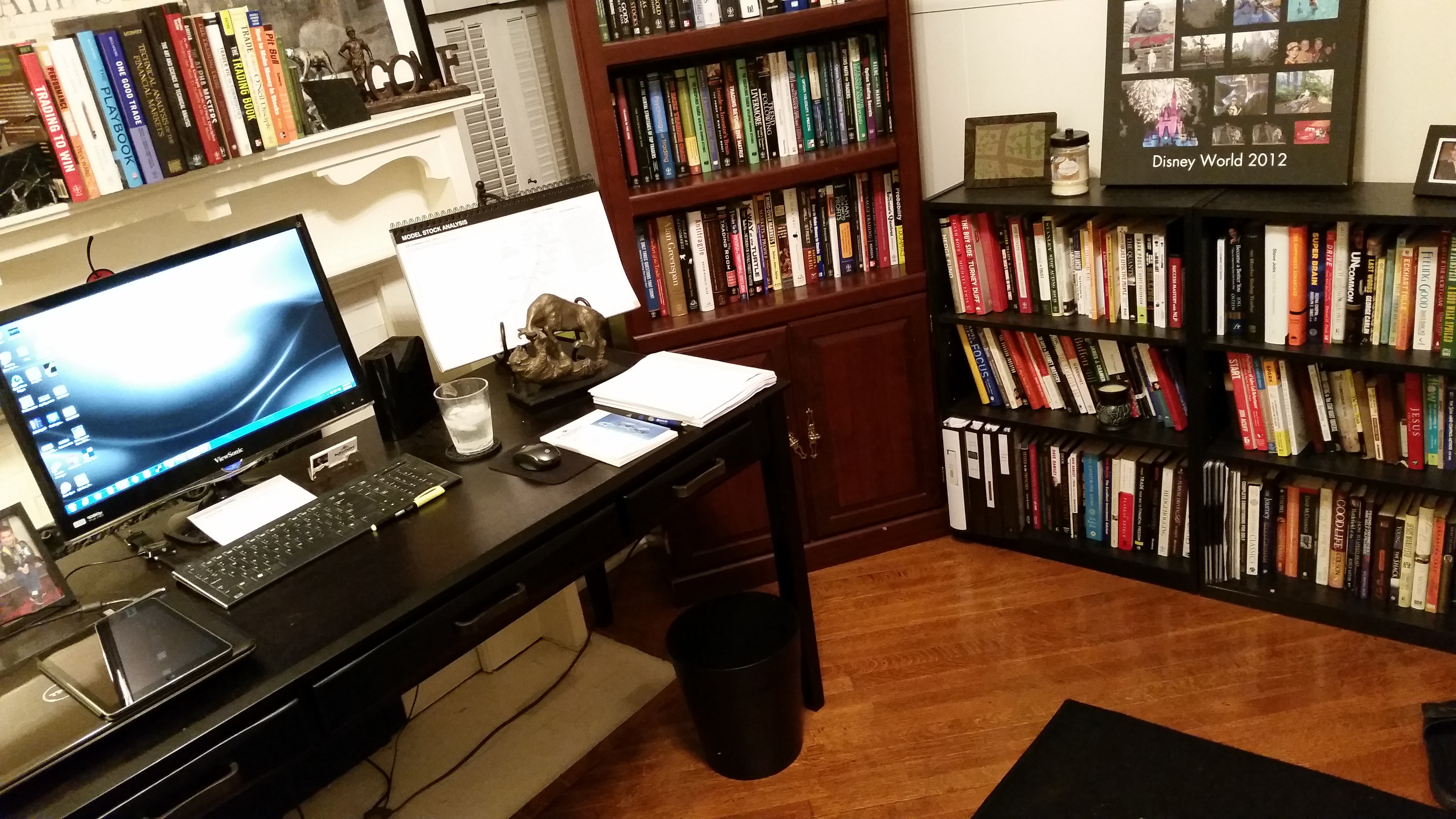

I had a wonderful conversation with a retail trader who has read 194 trading books. Wow! This gentlemen has a passion for trading and reading about trading. I was actually speaking to him about our firm backing his trading. He has developed a track record while working full-time in the Heartland. For those of you trading retail who dream of … Read More

The First Trade We Teach (An Example with $DSW)

Good afternoon. I hope this email finds you well. I have spent many hours over the past few weeks reviewing your YouTube videos, blog posts and anything else that I can get my hands on that offers a glimpse into how your trading desk makes money. I’m about 2/3 of the way through your book One Good Trade I have been … Read More

Should You Quit Your Job to Trade?

Dear Mr. Bellafiore, Hello my name is Jeffrey, first off I’d like to thank you for the information in your book “one good trade” it’s been very helpful. I’ve been day trading for 2 1/2 years now. I can’t trade stocks because of my work schedule but do take advantage of the Future and Currency markets. I’ve come to realize … Read More

Options Trading for Income with John Locke for August 25, 2014

Risk Disclosure No relevant positions John Locke – www.lockeinyoursuccess.com

Today I Will Trade Big!

An experienced trader stepped into my office frustrated with me. He wanted to know why I questioned his position size in a $TWTR breakout trade. The exchange we had offers a lesson on getting bigger as a trader for the trading community. First, let me say that I loved this trade position in $TWTR. And I loved that he was … Read More

Enhancing Trader Performance: Letting Go

*****David Blair, The Crosshairs Trader, is a blogger/trader/educator who does a wonderful job of sharing research on elite performance and how it relates to trading. Below is his latest post for the SMB trading community.***** — Editor’s Note I was introduced to trading by a good friend of mine years ago. Although Johnny has since passed on, having lost his hard fought … Read More

Shorting DGLY Can Get FGLY!

Here is a short clip from our pre-market meeting on August 25th (filmed at my dining room table in Nantucket;). We take a look at DGLY which was gapping above $9 in the pre-market. I offered some thoughts on how many traders focus on capturing the pull back from $8 to $7 and often miss the larger opportunity to the upside that … Read More

Trade with a True Catalyst

Often new and retail traders do not trade stocks with a true catalyst. By a true catalyst, I mean an event that will cause significant new buying or selling. Said another way, price moving buying or selling. The new trader and retail trader wonder: Why the heck is my stock not moving like I thought? The answer may be because they … Read More