During SMB’s most recent The PlayBook Checkup with Bella we discuss: A Consolidation Trade ($TDC). This is a basic intraday technical analysis pattern that every developing trader should learn. We discuss: Who cares what $MS thinks about $TDC and how this should affect your trading? A 52-week high is more important than an intraday high in $SPY A news pattern … Read More

Trading Lesson: Fade Trade—$TSLA

Tesla has demonstrated itself to be one of the very best short term trading vehicles in 2013 (no pun intended). After putting in an all time high above 190 it has presented numerous setups on both the long and short side. READING THE TAPE This trade began as a “pattern recognition” trade but morphed into a “tape trade” as there … Read More

Trading Lesson: 2nd Day Trade—$ADBE

Adobe (ADBE) announced their earnings recently and the stock had a big change in price the following day. The stock had heavy volume, which is something I look for to setup a trade for the next trading session. This is one of the easier trades we teach in our training program and it’s called “2nd Day Plays”. After a stock has some type … Read More

Can You Momentum Trade Oil Like Our Trainee?

Our trainee Petr takes a momentum trade in the WTI cdf and makes 5:1 RR. Can you trade like this? Subscribe: http://bit.ly/utraderyt Help me write my book: http://www.unconventionaltrader.com Training Info: http://www.bit.ly/smbhome My analysis on TradingView.com: http://bit.ly/tviewprfle Twitter: http://www.twitter.com/marcpmarkets Webinar and Trade Review Archive: http://bit.ly/archpge Marc Principato, CMT Risk Disclaimer *No Relevant Positions

All Hedging is Not Created Equal

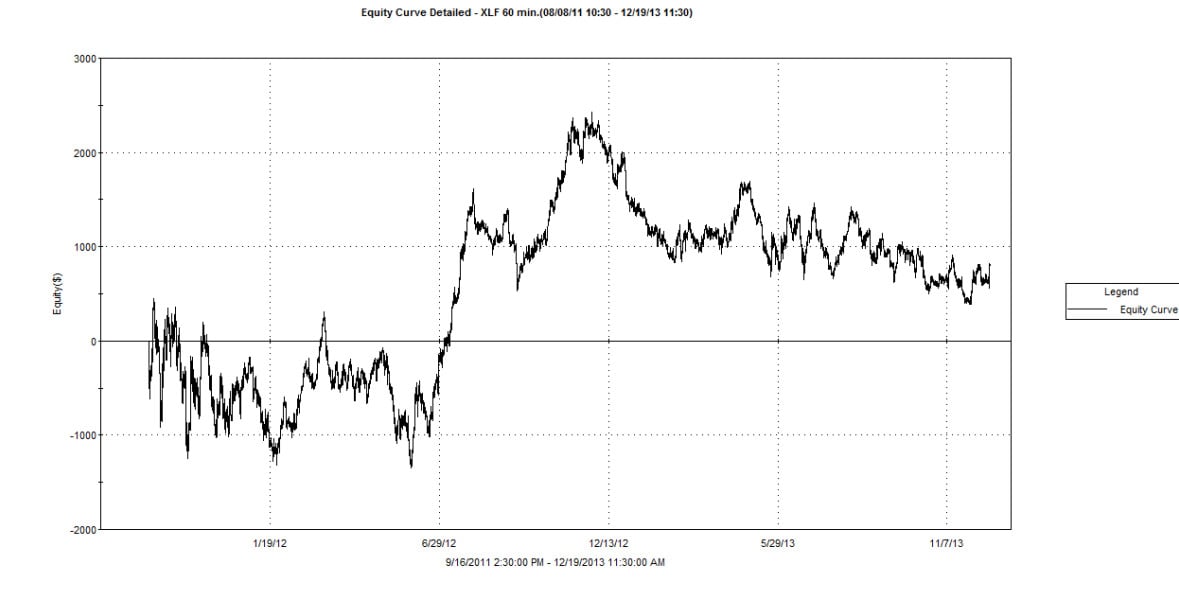

In this post I will show you a strategy that can be long and short financials at the same time and end profitably. The concept is based on pairing instruments that have different natures. The nature of leveraged instruments is to increase the impact of one-way movements. The nature of unlevered broad-based indexes/funds tends to have more reversion and overlapping … Read More

GBPUSD Pullback Possibilities?

The GBPUSD has been somewhat choppy recently but structure still paints a picture of strength. Where are the attractive price levels? Subscribe: http://bit.ly/utraderyt Help me write my book: http://www.unconventionaltrader.com Training Info: http://www.bit.ly/smbhome My analysis on TradingView.com: http://bit.ly/tviewprfle Twitter: http://www.twitter.com/marcpmarkets Webinar and Trade Review Archive: http://bit.ly/archpge Marc Principato, CMT Risk Disclaimer *No Relevant Positions

Free Options Webinar: Craig Hilsenrath of Optionworkbench.com: Improving Options Portfolio Returns Using Probabilities and Statistics

Tuesday January 7, 2014 at 5pm ET Each Tuesday, SMB hosts an Options Tribe meeting where veteran traders and experts in the world of options trading share live presentations. This meeting is free to the public on the first Tuesday of each month. All other meetings require an annual membership to OptionsTribe.com. To register or join, please use the invitation … Read More

How Much Do You Know About Price and Time?

Here is another sample from my upcoming Mentoring Series. This segment goes into important details about time and price. Marc Principato, CMT Risk Disclaimer *No Relevant Positions