In this video, Shark reviews a trade he made in PAY on February 22nd. He discusses the big picture, his thought process throughout the trade, and the trade management skills he brought to the trade. This webinar is no longer available *No Relevant Positions

Recording: Greg Loehr: Trading Broken Wing Butterflies When the $VIX is in the Basement

SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by veteran options traders and experts in the world of options trading. In this presentation, Greg Loehr of Optionsbuzz.com discussed the … Read More

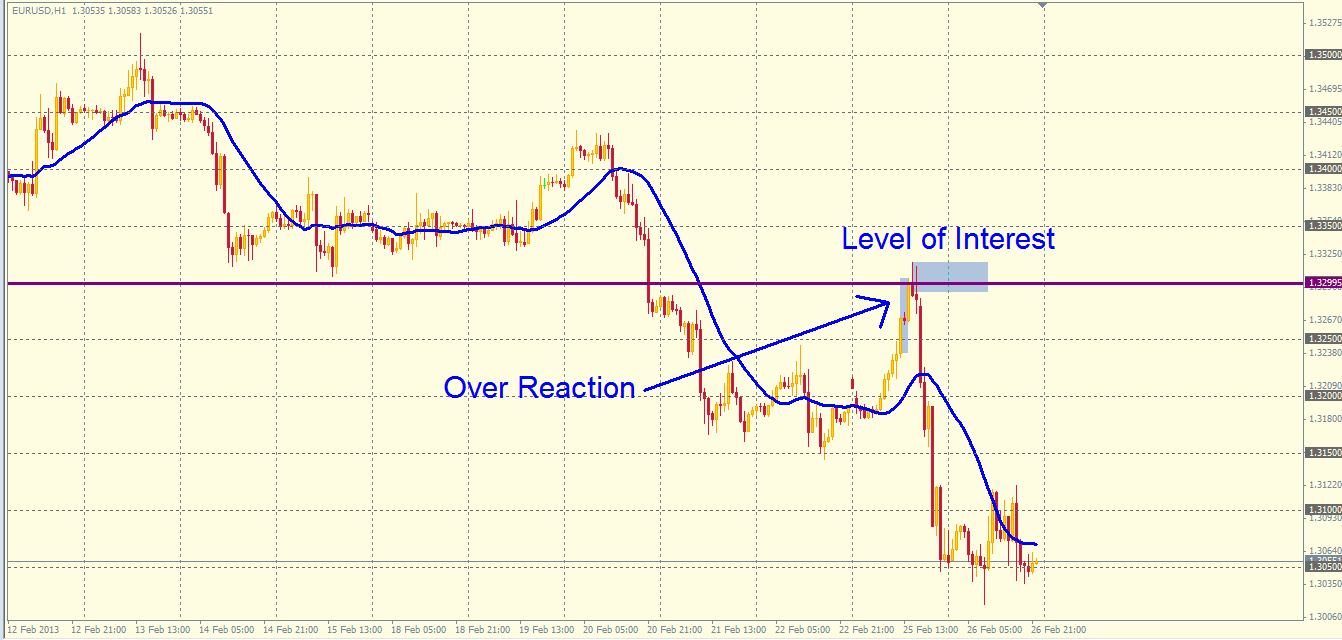

One’s Over Reaction is Another’s Opportunity

Volatility has ticked up in recent weeks. It’s about time. The major U.S. equity indices and currency markets have presented some sizable intraday movements. Uncertainty is beginning to re enter the markets. This is the time when traders shine the most. This is when the average traders improve and the good traders become great. Investors and uninformed watch their accounts … Read More

The Market Sells Off. Now What?

I was off the desk today travelling and visiting with family, but checked in several times to see how our traders were doing. It was an exciting day in the market. It is the type of day you typically see only a handful of times each year and as a short term trader you dream about being able to “crush it” … Read More

My Thought Process: $BHP

BHP was gapping lower and trading very actively in the pre-market. This message was to highlight it would be one of the best stocks to trade on the Open and my bias would be informed on which side of 78.50 it started the day. I initiated a short right on the Open against a 78.36 seller. This was the first … Read More

Did The SEC Overreach in Freezing HNZ Account?

I read an interesting piece on the CNBC website by John Carney regarding the SEC freezing the assets of a Goldman trading account that made a very suspicious trade in HNZ options right before the takeover was announced. John raised the idea that the SEC is overreaching by freezing the assets of the account without any evidence beyond the suspicious … Read More

Should Short Term Traders Consider News–Part III

On Friday I was chatting with a non-SMB prop trader that I trained several years ago. He was long DLTR when the WMT “news” broke around 2:00PM. From the chat messages you can see that we were in agreement that there was a short term “fading” opportunity in the retail names that had been quickly hammered based on a leaked … Read More

SMB Trade of the Week: Failed Breakout (CMCSA)

For the intraday trader we look for opportunities where stocks are: 1) Clean 2) Trend 3) Wound up to move 4) Controllable, meaning you can control your risk 5) Scaleable, meaning you can add significant size In our SMB Trade of the Week we had all of these. See the power point slides above. Would you have made this … Read More