I have been inspired to write a quick post from a tweet sent out earlier from @apextrader. He mentions that he got long YOKU around 32.50 and that it has gone back up but been a fairly bumpy ride. Why did he make that trade? And why are so few able to execute this trade? YOKU recently was beaten down … Read More

SMB Radar Update for June 30, 2011

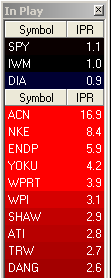

The Strong/Weak Today column ranks stocks based on the price change relative to the stock’s opening price. These stocks tend to have strong/weak opening drives and continuation moves. The idea here is to find opportunity in the strongest/weakest stocks in the market. When looking through the column, we always take note at how In Play the stock is to gauge … Read More

SMB Morning Rundown – June 30, 2011

The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open.

SMB Morning Rundown – June 29, 2011

The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open.

Market View Updated

Day 17 completed on the S&P 500 consolidation. I have updated the chart to reflect today’s action and have a rough tabulation of the amount of time we have spent trading within each “zone”. The most interesting thing about these 17 days is that we have only spent one full day between 128 and 129. The rest of the time … Read More

SMB Radar Update for June 28, 2011

These are today’s top stocks on the In Play column on the SMB Radar. This is the most important function of the scanner. The Radar uses a number of proprietary algorithms on a prescreened universe of stocks and processes every tick in search of finding stocks that are In Play. These stocks have unusually high order flow that indicates heavy … Read More