Bella,

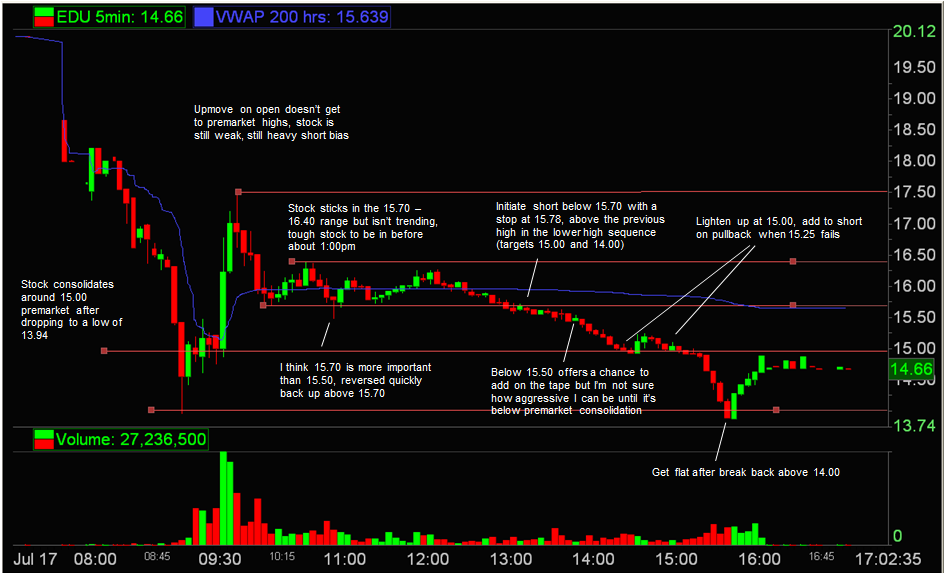

I thought EDU offered some great opportunities to use the tape and levels from yesterday to catch most of the downtrend we saw today. EDU was heavily in play yesterday on SEC investigation news (roughly 20x average daily volume), and today it was even more active (roughly 35x average daily volume). My one concern in this trade is how to get short for max size and stay in it until the trend breaks, or in this case until the close.

I liked the setup at 10.30 when EDU pulled in to 14.00 and eventually held below, but I didn’t put anything on there because it only had $0.15 to go on the downside until the low from the previous day and it didn’t seem like good enough risk reward. In short I was looking for an offer to hold making a new low. This is a conservative approach, but does the In Play magnitude of the stock warrant a step up in aggression?

I finally got the setup I was looking for when EDU couldn’t get back above 12.95 after pushing through the intraday low from earlier. In this case, with so many factors in favor of the trade, do you go to max size right away or is that not a good approach because of all the times you’ll end up going to max size in the long run only to not have it work?

Generally, is there ever a time when as a trader you have to push yourself in the direction of a more aggressive style based on the conditions of a particular stock?

BELLA

Are there times when you should be more aggressive than normal because of the potential opportunity with a stock? Yes. When something has more opportunity, in this case towards the downside, than a typical stock you want to take on more risk. It is your job to take on more risk. That mean starting your position at a price more uncomfortable. That may mean adding size to your position that makes you feel uncomfortable. As GMan says, “If you are in a trade that is working and you are comfortable then you do not have enough size.”

A Stock In Play may cause you to start your short at prices you might not with another opportunity. One trading tip. The best stocks, in this case the best shorts, are hard to get. It will be hard to get short at a price where you feel comfortable. If the stock is going to be so weak that means there will be competitor shorts eager to short. They will cut you. They will steal your shorts. So you may not be able to get short save at a price uncomfortable.

We always control our risk first. So we cannot get big unless we can spot our exit, are confident we can in fact exit at that price, and with the size we have. Do not go MAX SIZE unless you can control your risk if the stock trades against you. If you love a play, and you can control your risk then you MUST be at MAX SIZE. It is your job to be at MAX SIZE. Not being as big as you can in your best trades should be considered a trading loss. Track how much PnL you left on the table when not MAX SIZE in your best setups.

When the market overall is In Play you must be more aggressive. After the recent Supreme Court announcement came out you had to be bigger and more aggressive in the health care names. VVUS EDU ROVI were stocks the past two session you had to be more aggressive in. Why? They offered more opportunity. It is too risky to miss a potential opportunity in a stock that may move significantly.

I hope that helps. Great questions. Keep working on your trading game!

Bella

no relevant positions