JBL was on the minds of most intraday traders around me this AM. It was mentioned in our SMB Training AM Meeting. Before the open I ask traders around me what they will be trading. Adam? Sammy? Andrew? Jeff? Peter? Tarhini? All but one did not mention JBL as one of the top three stocks on their screens.

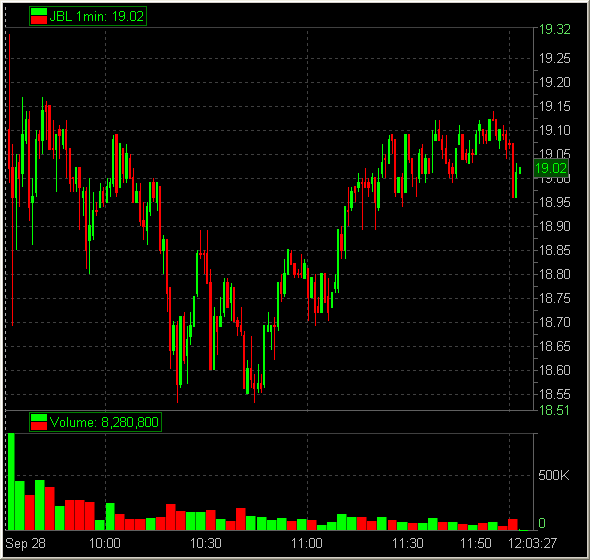

We opened with 15 minutes of nothingness in JBL. GMan mentioned he saw more weakness than strength at 19.13ish. Some started short positions there. I was flat and messing around in AVGO, letting that stock beat me a few times and SPY. When JBL broke to the downside below 18.90 I became interested. I was looking for an opening drive play.

I shorted some at 89c into a spike and then 94c and then even then at 97c and then finally at 4c. I set my stops for above 15c. JBL stopped near 10c and then started ticking down. When I play for an opening drive I look for a significant downmove. I am not covering in the 90s which it touched. I am looking for a break of the low and perhaps a move to fill in the gap of more than a point lower.

Oh how I didn’t love the way JBL moved. The ticks down to the 90s were mild. This is not what heavy selling looks like. It ticked back up towards the whole and even thru. This is not what a really weak stock looks like said my inner trading voice (see The Inner Voice of Trading from Michael Martin.) Even that move from the break of the range below 90c all the way back up to 10c was not what I was looking for.

Stocks that are really weak generally make a new low and then tick up every so slightly and met with an overly aggressive seller at a price much lower than you would expect. We saw none of this on this open with our JBL.

As the story goes I was still short JBL and the market came off hard. JBL went down. I took some off into the down move but maintained a short. Fortune rewards the lucky? One never knows but JBL did not seem to come off because it was week rather it was following the weak market. SPY had trouble with the 117 level. The selling was just not there on the SPY tape. And I started adjusting my JBL covers.

Normally I would hold JBL for a bigger move. But now near 50c with SPY clearly holding 117 and ticking higher and a very unconvincing weak downmove I gave the 58c one chance and covered when he lifted. I got up from my trading desk and head towards my office. I wondered to my trading self I bet that is the bottom today in JBL.

Bella

One Good Trade

4 Comments on “Why I covered JBL at the bottom :)”

Hi Mike,

I was watching JBL on the open. I wanted to be short at 19.00 but failed to pull the trigger. Then it dropped and I missed the move. When it pulled back to 18.90 I didn’t get back it. I kept saying to myself I wanted to be short at 19, not 18.90 and couldn’t justify paying down the 10 cents. What can I do mentally to make that trade?

Thanks,

Steve

School example of double bottom at 55 with 85 as conformation and 1915 as target

short a little just to be in it at 90c and then get full size when you really see something from the stock, perhaps on the tape or your charts. piece into the trade is how we describe it.

short a little just to be in it at 90c and then get full size when you really see something from the stock, perhaps on the tape or your charts. piece into the trade is how we describe it.