As a partner of a trading desk I get to observe many different trading strategies at work. One of the most interesting aspects of this to me is seeing which traders at any given point in time are pulling money out of the market. Five weeks into 2014 and three separate groups have done extremely well. And they have done well at a time when I see a lot of chatter on social media of most traders/investors struggling.

different trading strategies at work. One of the most interesting aspects of this to me is seeing which traders at any given point in time are pulling money out of the market. Five weeks into 2014 and three separate groups have done extremely well. And they have done well at a time when I see a lot of chatter on social media of most traders/investors struggling.

This is who I see doing very well right now. I will offer a few comments on each to give you a bit more color on how they are maximizing their trading styles.

- Traders positioned for a market pull back: After 30%+ gains in 2013 most market participants were looking for some type of a pull back this year, but very few had the balls to be heavily short after the butt whipping shorts had received the prior two years. However, we have one trader who maintained a short book during Q4 of 2013 and was able to stay profitable, and when we finally got the sell off he was looking for in late January he booked profits and even got long the market. This trading style is not for the faint of heart.

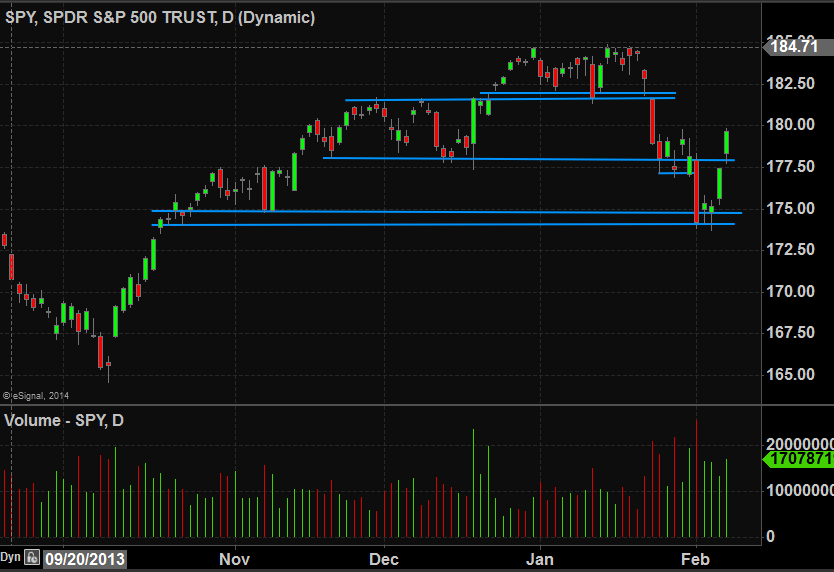

- Traders who paired back their long books and were aggressive buyers as the market sold off to December support. If you believe as I do that we were do for a pull back but would rebound strongly this was a good strategy to employ. The main factors in how well these traders navigated the market relate to how aggressive they were in reducing risk on the first signs of weakness in late January (SPY below 181), and how much risk they put back on when we hit December support (SPY 174).

- Traders who are involved in OTC stocks. Especially stocks related to the Marijuana industry. We have a small group of traders who trade OTC stocks very well and with the legalization in Colorado there were some incredible moves the past two weeks. A large amount of money was made in both swing and momentum trading these stocks. You don’t see us write about these on the blog as they can be a bit trickier to navigate than listed stocks that are part of an electronic market with automatic execution.

I will now answer into which of the above categories I fit before I get the Twitter and StockTwits questions. Category #2 most closely resembles my trading style and during the initial sell off in the SPY from 184 I was able to position myself net short to avoid a draw down. With The market rebound to the top of a prior trading range Friday (SPY 179-179.50) I pared back most of my long positions and opened a SPY short at 179.85.

Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, options, forex and futures. He has traded professionally for 17 years. His email address is: [email protected].

Steven Spencer is currently long ADBE, CROX, FB, SBUX, SWKS, WFM, YHOO & short AKAM, SPY