(May 25th 2016) I had a very disappointing day. I Lost money in trades that weren’t part of my pre-market game plan. And I Didn’t make money in the trades I outlined in our AM Meeting. When the day is over and I review my work I’m primarily measuring my results against how I executed on the opportunities that were identified prior to the market Open. To give you a sense of the opportunity that was available today I will share the written portion of my morning game plan, and then break down a few stocks based on their price action and key S/R levels.

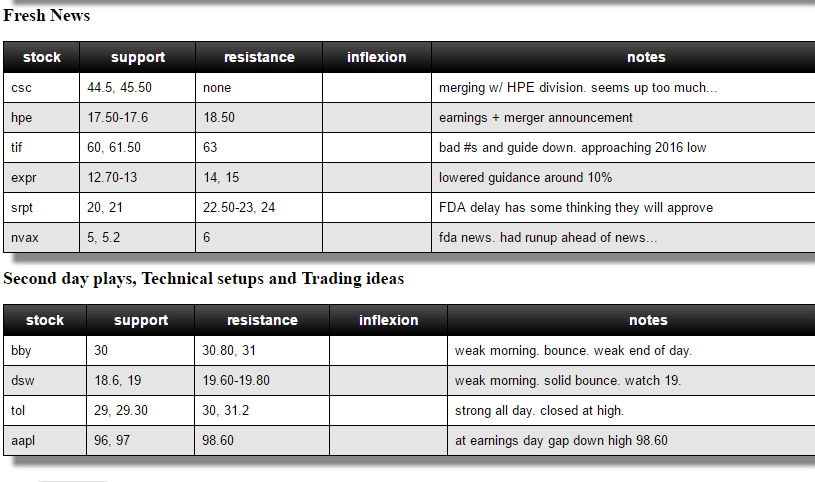

The first two stocks in the game plan are CSC and HPE. They were involved in a merger of sorts and both stocks were gapping higher in the pre-market. CSC was interesting in that it was gapping above all known resistance. You can see in the “notes” that I mentioned that it seemed like the gap was too large and there might be some profit taking when the market opened. It is 100% OK to have a bias in trading. Especially if you have been trading for many years. After thousands of setups you develop a feel for more likely scenarios. But what is not OK is if the price action isn’t confirming your bias not adjusting accordingly. Let’s take a look at the intra-chart for CSC.

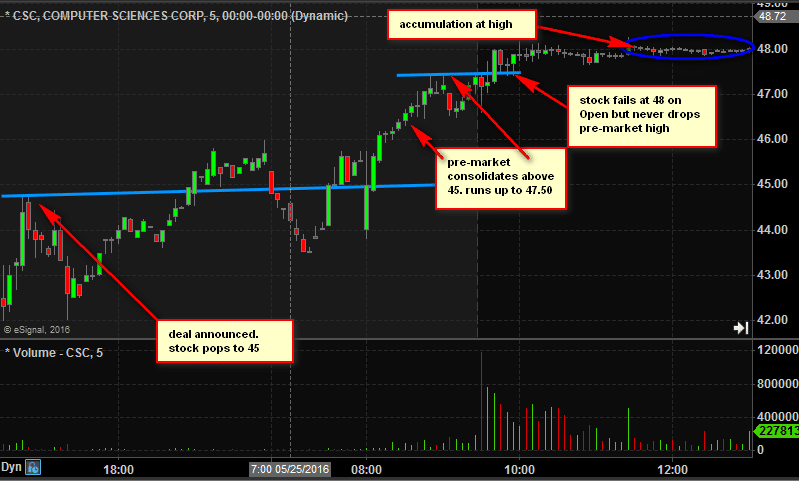

You can see that when the news was announced Tuesday CSC popped to 45 in after hours trading. The next morning it ran from 45 to 47.50 in the pre-market. Bullish price action. What I discussed in our AM Meeting was a possible quick pop on the Open to 48 then profit taking of $2-$3. That profit taking never materialized. CSC never dropped below 47.50 in the first 30 minutes of trading. It then consolidated in a tight range just below 48 for a few hours. I had a short position from in front of 48 with a stop above 48.20. By midday with a lack of sellers coming in the rational thing to do was to put in an order to cover and get long on a break of the tight consolidation. I just kept my stop in and then left the desk. Here is what happened.

At 1:25PM the buyers got more aggressive and CSC made a new intra-day high. Many traders on the desk got long or added to existing long positions. This trade was a layup. My stop was triggered but I hadn’t entered a script (trading program that executes pre-determined series of instructions) to get long. CSC moved a $1 higher after breaking above 48. Traders on the desk road the stock higher while I sat on the sidelines. A missed opportunity that offered a clean entry with over $2 of upside.

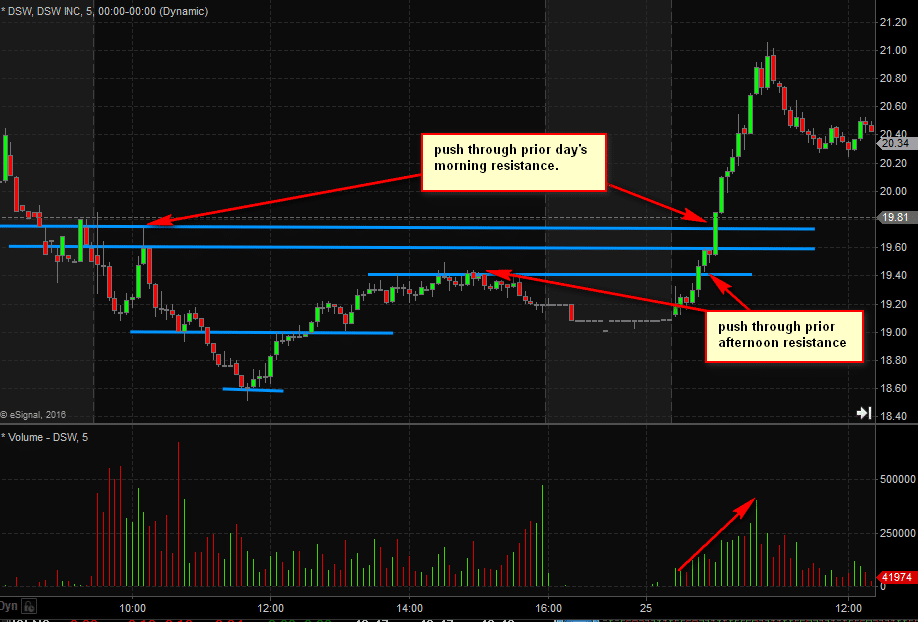

The other stock I wanted to discuss is DSW, which is what we call a “Second Day Play”. I had traded DSW on Tuesday following its earnings report. It traded very cleanly. Trended lower on the Open and then had a strong bounce in the afternoon. As traders we want to gravitate towards stocks that trade cleanly. There is so much random price action in the market that often as traders we will be “wicked out” of a position by a quick gyration against a trend, so if we find a stock that trends cleanly we want to focus our attention there.

DSW opened just above 19 support and moved sideways for about 20 minutes. As it began to move higher several people shared this information in our chat program. As it began to hold above 19.50. Buyers were in control so some traders got long. The stronger signal to me was when it easily traded through 19.60-19.80 an area of resistance from the prior Open. Once above that level there was no reason not to initiate or add to a long position with a stop below 19.50.

A few of the other names moved cleanly off of key levels from the written game plan. AAPL in particular traded above its post earnings high of 98.60 and then retested that level before moving up another $1. This was a day of solid opportunity and excellent risk to reward. Our job as short term traders is to prepare each day and then execute on these opportunities. So in that respect my day was a failure. What processes can I put in place to avoid repeating the same mistakes? How can I better use available technology to alert me to each opportunity and/or execute on them? The answers to these question will allow me to improve going forward.

Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, options, forex and futures. He has traded professionally for 19 years. His email address is: [email protected].

No relevant positions