In running back tests, it’s important to understand the impact of volatility and position size. A consistent position size in number of shares or dollar amount can greatly skew historic results. If optimizing, this may lead to curve-fitting the system to periods of high volatility. Here are some examples of the impact of fixed-position sizing vs volatility-based sizing:

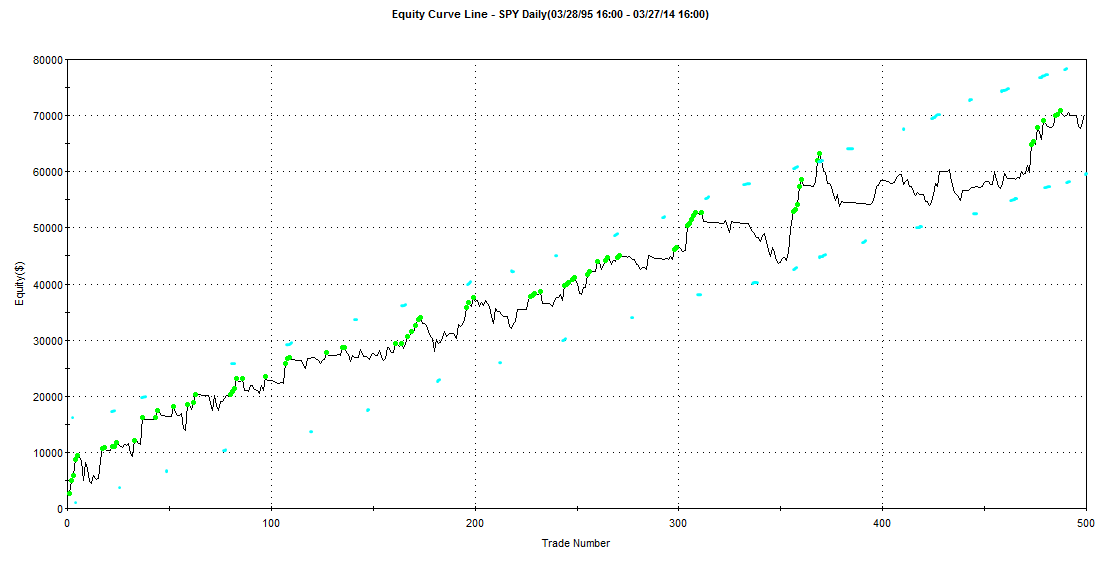

The first uses a fixed 1,000 share position size. When the stock price is low, position sizes are reduced and the returns appear smaller. During high-volatility markets and when the stock price is higher (right half of the chart), the P&L swings are exponentially larger. This does not accurately represent the history of the strategy or the market.

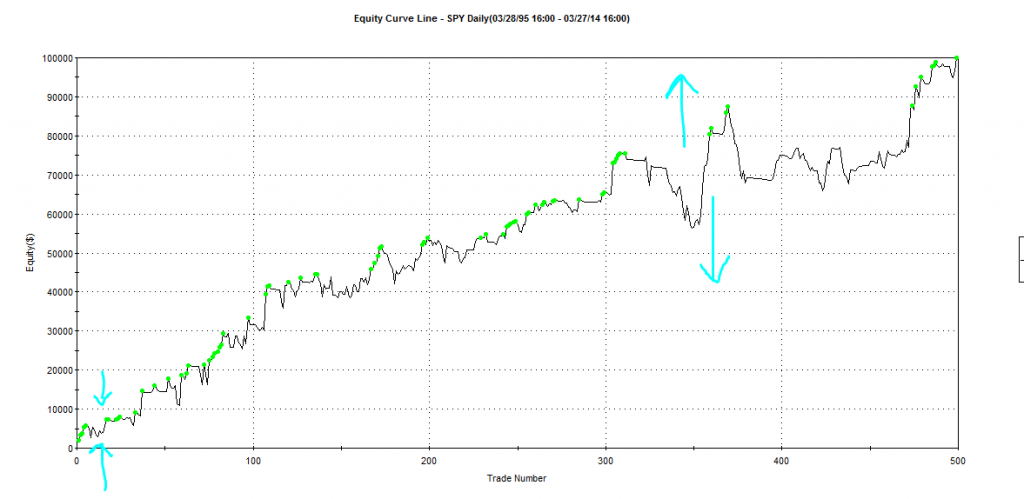

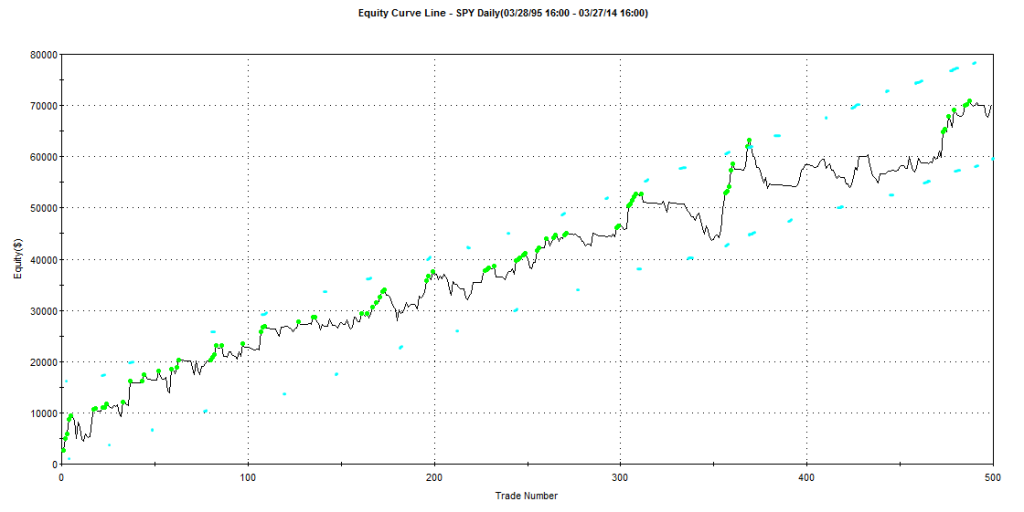

The second is the same strategy except now we are using a very basic volatility-based position size. The idea is that we want to have a very similar risk/reward ratio on each trade regardless of market volatility. The method I used in this strategy aims to have a $1,000 P&L change if the market moves 1 ATR (Average True Range). As you can see, the lower volatility market conditions generate higher returns—and the higher volatility market conditions have smaller swings.

Using a volatility-based position size helps to normalize historic signal returns so that you can find something that is more statistically valid in all market conditions.

Andrew Falde

No relevant positions