Many short term traders get killed trading weak stocks on the short side. What is the root cause? The most common error is they have poor entry prices. We all know that a stock in rapid decline is on the radar of every day trader and hedge fund on the Street. This attention creates spikes that some interpret as a possible reversal. Short term traders must always protect against a possible reversal so they will cover and take a loss even if they believe the stock will trader lower. Let’s look at a couple of recent examples on how to get involved relatively safely in short positions that offer great potential reward.

On January 21, USB reported earnings and was In Play. Our most recent trainee to go Live said she would watch it for a good trading opportunity on the Open. As the market opened USB showed weakness. Our young trainee indicated to me it was very weak and I punched it up on my platform. But I was actively trading IBM so I didn’t enter a trade in USB. During the next minute USB rapidly declines another point. This is a large move for a $15 stock. Now it was truly on my radar! I offerred 1,000 shares at resistance around $14. My offer was not taken and the stock quickly dropped another point.

Many traders would aggressively chase this stock and get short as long as the price was declining. This is not necessary. Once a stock has a powerful down move there is a very good chance (especially in this market) that there will be additional safe entry points before a further decline. So after USB declined to 13 I waited for it to pop back up. It very quickly moved above 14 but could not hold a bid above 14.20. I was able to establish a short position at 14.15. When it dropped below 14 I added to my position expecting a powerful down move through the low.

The stock dropped about 1.5 points in the next few minutes. I never risked more than 10 cents because of the resistance at the 14.20 area and was able to participate in the large down move. This wasn’t the only way I could have traded USB but it was a very safe trade that offered a ton of upside.

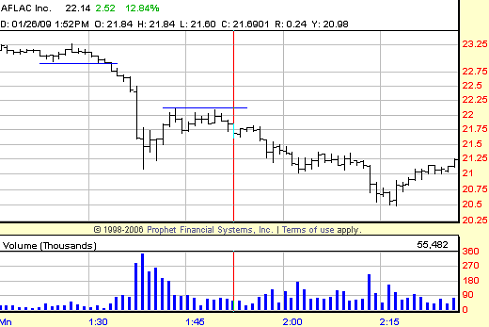

On January 26, AFL had a sharp down move below 23. It dropped to around 21.25. The discussion in my row was where should we look to get short more. We had been waiting for a couple of days for AFL to trade down sharply as the recent price action indicated it would eventually trade significantly lower.

In this case I actually aggressively hit the bid when my alert was triggered as I had traded the stock during the two previous sessions and understood that the downward pressure through 23 would be significant. But I did cover into the initial sharp down move because it was extremely likely that AFL would offer another great entry point. In fact, I made more money on my second short than I had on the first.

AFL bounced to around 22. It was having trouble holding the bid above 22.10. So Connor and I both established short positions. We were willing to risk ten cents. We had already seen a vicious down move so we knew that there was at least one point of downside if the stock failed to hold above 22. Within 15 minutes it traded through the low.

Both of these trades were low risk and offered a ton of upside. We were always in control of our positions and therefore had almost no stress. If you are carefully following the market you can always find low risk high reward entry points for an In Play stock. It just requires being patient.