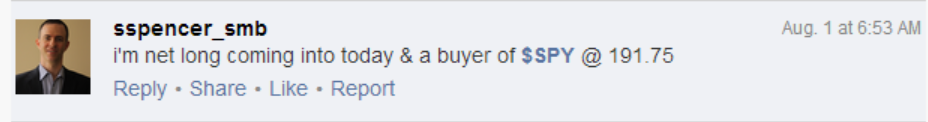

Short term traders can greatly increase their risk/reward and win rate by making sure that they are in the most “In Play” names each day. Occasionally, the market itself becomes “In Play” following a major technical break and I will trade it via index ETFs. Friday morning I shared a price on StockTwits I wanted to get long the market via the SPY.

I made this SPY trade and several others on Friday which turned out to be profitable. I received the following email from one of SMB’s student’s asking me to clarify my thought process which I am happy to do. My thoughts are in blue.

Hi Steve,

I followed your spy recommendations yday: simply great calls! I was wondering:

a) Why didn’t you believe in a follow through uptrend move, maybe after a consolidation period, to levels beyond 193.5?

I thought that Thursday’s sell caused some damage to the large caps and was likely to lead to further downside in the market in the coming days. My long idea at 191.75 was a position taken for an “oversold bounce”. This is different in nature than a “trend trade” that I would enter and look to continue to hold for a longer period of time. The 193.50 level was based on my observation that after the market closed it was bid up from around 193 to 193.50 in the after hours and was likely to be an area where the market could fail the next day. The large gap lower on Friday made this an even likelier failure area from my perspective as the distance from per-market support was almost $2. If the market hadn’t gapped lower Friday I would have considered it more likely for a bounce to take us to SPY 194 or as high as 194.50.

There were several pieces of information that I leaned on for my idea to be long for the “oversold bounce”. Number one, following a “trend day” the most common pattern I have scene for the past few years is a “range day”. It is very rare to see two trend days in row and therefore a large gap down most likely would see a bounce inside the prior day’s range. Typically we call this a “faux inside day” (a term i coined about a year ago) where we start the day inside the prior trend day’s range and then move outside but eventually close inside. On Friday we actually gapped outside of Thursday’s range so a trader I work with suggested we might have a “faux outside day”. His play on words simply meant that he assumed the gap lower would be filled during an ensuing bounce. I also received a heads up from Brett Steenbarger that the Quantifiable Edges blog had done several “bullish” quant studies following Thursday’s market move.

b) Why did you short with conviction and did you hold it all the way to the bottom(!) rather than buying a pullback?

I did not hold the short all the way back to the bottom of the days’ range. When I established the short position I was operating under the assumption the most likely support would be above 192 where the market supported right on the Open. So I placed bids in to scale out of the majority of my short by 192.30. As it got closer to 191.75 I covered the last piece.

c) Why, after having cashed in on the short, did you buy back, although after such an intraday up-and-down reversal, the market seemed quite weak (at least to me)?

This goes back to some of the points made in my answer to part a) of your question. The odds still favored us moving back inside of the prior days range which could take us back to 193. At this point I tweeted that I was bidding 191.55 which was twenty cents lower than where I got long in the pre-market prior to the job’s report being announced. Prior to the market Open I had discussed with a top trader on the desk that we had strong support 191.50-191.75, so when we took out the opening low I thought we would touch the bottom of this support range. Unfortunately, the low tick was 191.57 and I didn’t attempt to “pay up” so I missed the $1.50 up move from there.

However, when the SPY got positive for the day again I reloaded on the short side with my largest position of the day. I had a few reasons for this. One, based on the up/down action for the day I thought there was a good chance we would test negative again even if we closed positive. Two, I saw a bit of a divergence in the IWM and SPY and thought this would narrow by the close so I wanted to be short the SPY against my IWM long. Three, my portfolio was slightly more long than I wanted for the weekend so I was incentivized to be short some extra SPY as well.

Fascinating stuff, definitely a good learning session for me (I traded the DAX on the long side all day (Dax is below 200MA though) and gave back all the gains I made on Thursday on the short side, somewhat frustrating)

have a nice weekend,

J

One thing I definitely took away from Friday’s trading action is that I was able to play to my strengths following a strong trend day. I’m usually pretty good at judging important support/resistance levels after the market or a stock has made a strong impulsive move. I used that skill to bid for longs and offer for shorts at the best possible prices.

All of the trades highlighted above can be viewed in SMB Real Time as they occur. I’m also on a mic during the Open and Close explaining my thought process.

Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, options, forex and futures. He has traded professionally for 18 years. His email address is: [email protected].

Steven Spencer is currently long CHRW, CROX, EXPE, FB, GM, GPRO, GRMN, HON, IWM, GNK, LNKD, QCOM, SBUX, SPWR, SWKS, WFM, WIN, YUM and short ADP, DGX, GPC, KKD, MAT, NOC, PAYX, SPY, WEC, X, ZQK

[useful_banner_manager banners=9 count=1]