New blog format: Short trading lessons with charts for illustration.

Trading Lesson #1: Second Day Play–Buying A Strong Stock After It Pulls Back To Prior Afternoon’s Support Area

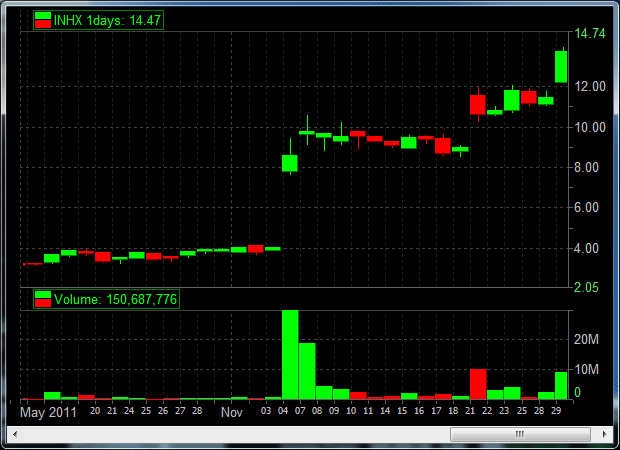

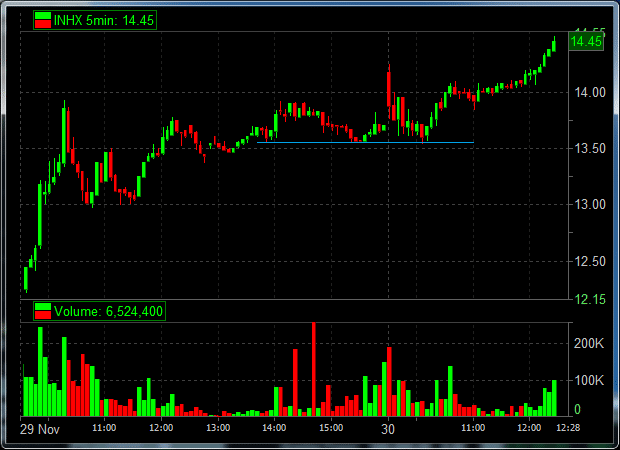

INHX was on our radar yesterday after another fresh news drug catalyst. As you can see from the two charts below INHX is trending higher on multiple time frames.

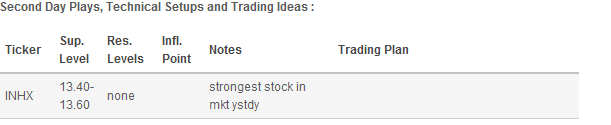

Here is the info from this morning’s gameplan:

We had a stock that had an explosive move the prior day and closed in the top 20% of its intraday range. The first trade we look to make the following day in this stock is a pullback to the prior afternoon’s support area.

Disclosure: no relevant positions

Steven Spencer is the co-founder of SMB Capital and SMB Training and has traded professionally for over 15 years. His email is [email protected]

One Comment on “Trading Lesson #1: Buying A Strong Stock At Prior Day’s Afternoon Support”

This is a great lesson. Thanks for sharing. I ran a scan for similar stocks EOD yesterday. Being a monster up date, I was not surprised to find about 30 stocks that passed my scan (I put in a closing price range and a volume criteria to filter out penny stocks and low volume stocks). I marked off the support levels for each stock, put them on my watch list, set alerts, and watched all day today. This being a new idea to me, I would not trade live moeny without at least a month’s practice. Anyway, WOW. I bet your traders printed money today with TXI. Others like X and ATI worked well. The methodology didn’t work exactly right for all 30+ stocks, of course, but I can see the tremendous value in it. Definitely adding it to my trading plan. Looking forward to the next lesson.