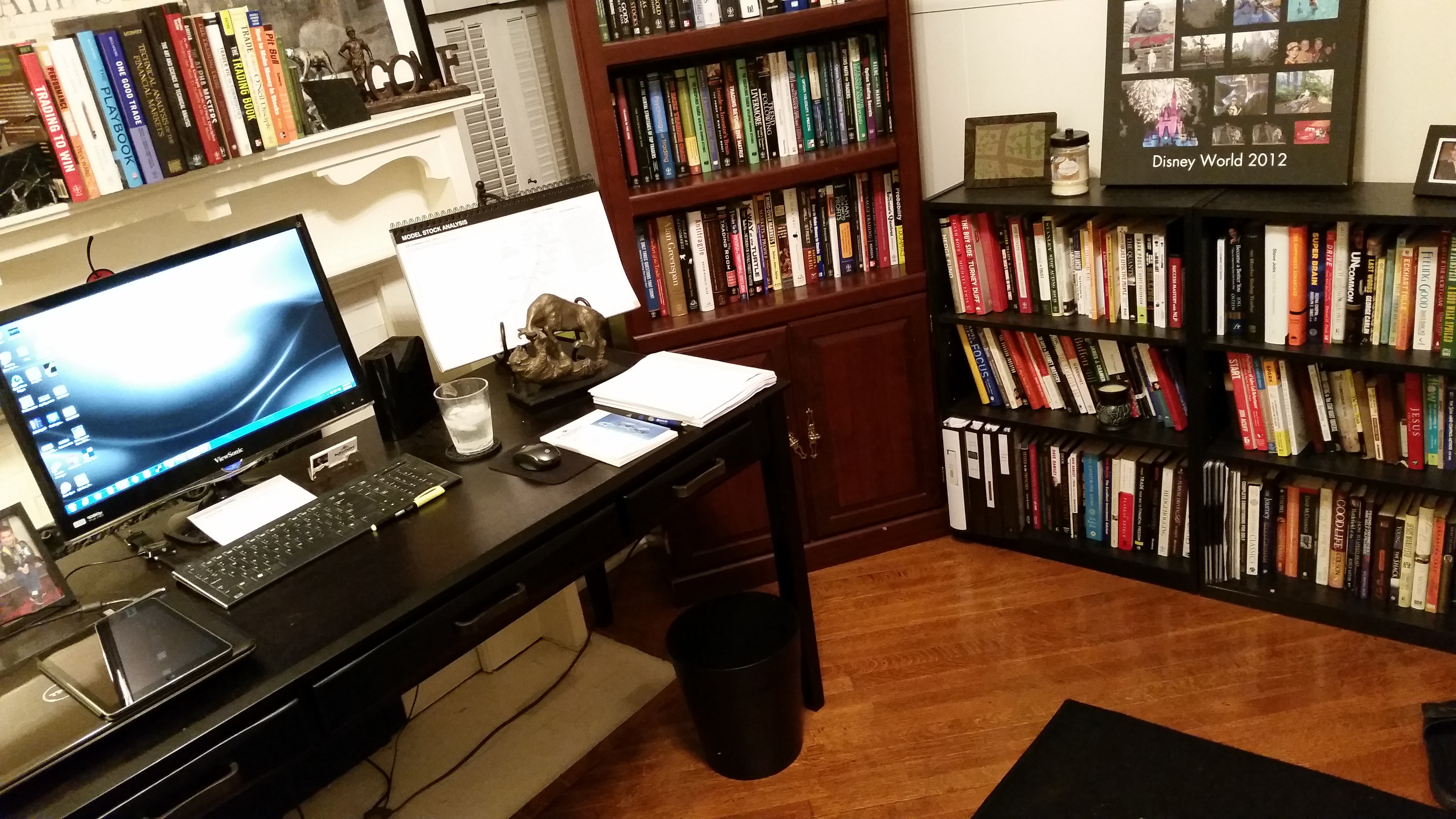

I had a wonderful conversation with a retail trader who has read 194 trading books. Wow!

This gentlemen has a passion for trading and reading about trading. I was actually speaking to him about our firm backing his trading. He has developed a track record while working full-time in the Heartland.

For those of you trading retail who dream of one day trading pro, here is one guy taking the steps to achieve that goal. It can be done!

I thought it would be interesting to the trading community to learn his Top Ten Trading Books since he has read so many. (In any list like this, there will be many great contributions to the trading literature excluded. My apologies in advance to those outstanding authors and hope those who read this blog will add their favorites in the comments section.) Below is his aspiring pro trader’s list.

Top Ten Trading Books I Have Read (in no particular order)

1. Reminiscences of a Stock Operator by Edwin Lefevre (the Illustrated Edition!)

– This was probably one of the first couple of trading books I ever read and it completely captured my imagination. At the time of reading this, I was just starting to trade stocks and it was then that I fell in love with trading.

2. The Market Wizard Books by Jack Schwager (Market Wizards, Hedge Fund Market Wizards, The New Market Wizards, and Stock Market Wizards)

– I really enjoy these books and keep coming back to them to reread. I believe there is a great deal of wisdom to be gained from learning from the people who are the best in the world in an area where you also strive to excel. I think I most enjoyed the original Market Wizards book with Paul Tudor Jones, Ed Seykota, Bruce Kovner, Michael Marcus, William O’Neill, Marty Schwartz, etc.

3. How to Make Money in Stocks (4th Edition) by William O’Neill

– This was also one of the very first if not the first books on trading I ever read. I love that it combines the basics of technical analysis along with important fundamental components that make for big stock moves.

4. The Playbook by Mike Bellafiore

– One Good Trade introduced me to the world of proprietary trading. But The Playbook was more influential on my trading. That book really got through to me what kind of work is needed and expected of a successful trader. It gave me an idea of what kind of “process” I should be going through each day in order to prepare and then review in order to keep getting better each day.

5. Market In Profile by Jim Dalton

– This was Jim’s second book on Market Profile but I believe it is the better of the two. This book contains more of the nuances of Market Profile and contains more of his recent thinking regarding the profile as compared to his first book. My knowledge of the profile and the help I’ve gotten from Jim has helped me tremendously.

6. Trading In The Zone by Mark Douglas

– This book helped me to think in terms of finding an edge and then acting consistently, without hesitation, and with discipline to exploit my edge. The book talked a great deal about thinking in probabilities. Overall, this was a great book for developing the proper trading mindset.

7. Trading To Win by Ari Kiev

– This is a book I’m just now reading and it’s already in my top ten. Might be subject to recency bias? I consider myself a student of trading psychology because I will do whatever it takes to enhance my edge. The great thing about this book is that it gets specific with ideas for visualization exercises as well as ideas for how to center yourself.

8. Enhancing Trader Performance by Brett Steenbarger

– I love all of Dr. Steenbarger’s work and I always read his blog. This book includes sections on cognitive behavioral techniques to enhance trading performance.

9. The Psychology of Trading by Brett Steenbarger

– Another great book. My biggest takeaway from this book was about how we should learn to observe ourselves while we are trading. Dr. Steenbarger calls it “invoking our internal observer.”

10. Thinking, Fast and Slow by Daniel Kahneman

– This is not specifically a trading book but I think it has many applications to trading. This book talks about the difference between your System 1 (intuitive/fast) thinking and your System 2 (Slow) thinking. The book goes on to describe the amazing thinking your system 1 can do but also describe where your system 1 thinking can get you into trouble. You can benefit greatly be recognizing when your system 1 is in control and then using your system 2 in conjunction with system 1 for better decision making.

At SMBU we ask: What books would you have included?

“You can be better tomorrow than you are today!”

Mike Bellafiore is the Co-Founder of SMB Capital and SMBU, which provides trading education in stocks, options, forex and futures. Bella is the author of One Good Tradeand The PlayBook. He welcomes your trading questions at [email protected].

no relevant positions

12 Comments on “Top Ten Trading Books”

The best book in trading world is “Jesse Livermores book!!How to trade in stocks” original book from 1930!!! Let me know if anyone needs have a PDF!!!

Richard Wycoff’s Wall Street ventures and Adventures, through Forty Years is fascinating account of the market and participants psychology 100 years ago. For those even more into history, Financial prediction from Babylonian Tablets to Bloomberg Terminals – The Evolution of Technical Analysis by Andrew Lo and Jasmina Hasanhodzic is a good history primer, and in the same vein Charles Mackay, Extraordinary Popular Delusions and the Madness of Crowds – what happens when every now and again the idiots get in control.

Someone (?) once said the most dangerous 4 words in the market are “this time it’s different”.

One Good Trade(audible version) for me would be up there. The combination of the narrator and the content did it for me. Looking back after listening, for my trading, it was a pivotal moment that started to change the way I approached intraday trading. I would say i was lost trading that time frame and those type of stocks before then.

Gotta give some much appreciation to Mr. Mike B. for having the audible version and writing one good trade. I just don’t think it would of had that amount of impact if i just read the book.

Of course Market Wizards is up there(which has been mentioned) If your a trader and you haven’t read those books it’s like not reading the bible if your a religious type. I don’t recommend the audible versions of those.

Not a book or anything but Andrew Menaker’s webinars and audios about Psychology of trading is I think some of the best that i have heard. Things like “trying to be perfect in trades” and “why people hesitate when entering trades” was as if he was speaking directly about some of the problems i had in my own trading.

I loved all of these. Dr Steenbarger and Ari Kiev have made enormous contributions in their books. One other amazing work is “Alchemy of Finance” by Soros. It’s like a brain transplant from a genius

I think I touched the 100 read books in trading 🙂

*very* nice! Top Ten?

Brett Steenbarger and Mark Douglas are my top favorite authors, they have completely changed my view about the markets and being a (retail) trader. Of course, I’ve read several books about technical indicators, but there’s only so much one can say about a technical indicator. With each book, it just becomes more of the same which is really not rocket science. After that, it comes down to that other 80%, which is the trader’s attitude and mentality.

*excellent* choices! Thxs for sharing!

The Rise of Superman. Its a book about the science of the flow state and the best way to achieve it. “Market Mindgames” All about the science of decision making when it comes to the market. and my favorite “The War of Art” All about just getting in there and getting it done.

Here’s 4 non-trading books I found very helpful. I am still in the learning phase.

Power of Habit – why repititions matter

The Talent Code – more good stuff about how we achieve super-performance

The Dip – for pressing through the learning period

Secrets of the Millionaire Mind – if you have issues with money, bit too self-help but food for thought

Just saw your question, here are they

1- One Good Trade, by Mike Bellafiore (first on the list for a reason)

2- The PlayBook, , by Mike Bellafiore

3- Blink, The Power of thinking without thinking, by Malcolm Gladwell

4- Outliers, by Malcolm Gladwell

5- The daily trading couch, by Dr. Brett Steenbarger

6- The StockTwits Edge, by professional traders editors are Howard Lindzon, Philip Pearlman and Ivaylo Ivanhoff

7- The art and science of technical analysis, by Adam Grimes

8- Encyclopedia of chart patterns, by Thomas N. Bulkowski

9- Enchancing Trading Performance, by Dr. Brett Steenbarger

10- Market Mind Games, by Denise Shull

Mike, Jimmy from Chicago here. Had lunch a couple months back when you were in town…anyway a new one I just got is Traders of the New Era…about to start it