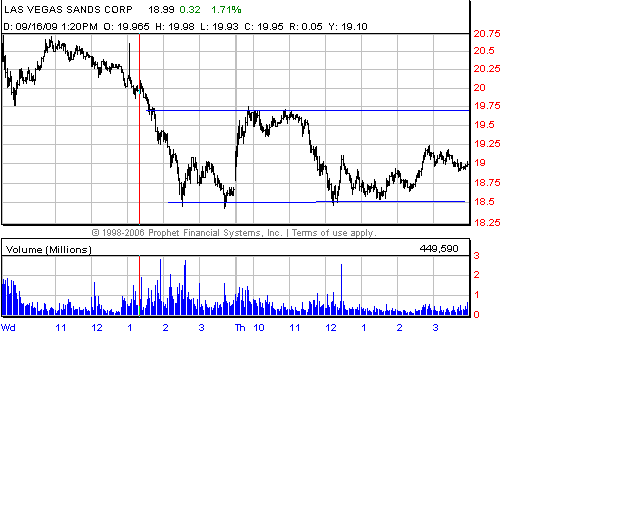

LVS has been on SMB’s radar for the past couple of weeks. It made a nice run from 15 to 20. Yesterday, it showed signs that it was going to give back some of its recent gains. It sold off hard from 20 to 18.50. Gman, our head trader, was short it for most of the afternoon. He identified some unusual selling at 19.70 before it made its final down move to 18.50. We highlighted LVS on our Stocks In Play call this morning and tweeted it as our best trade idea.

Then why did less than 10% of our desk capitalize on this great trading opportunity? Perhaps they were looking at the triple leveraged ETFs or some of the other In Play names for the day? This certainly partially explains why Gman was the only trader on our desk to crush the LVS down move. But as professional traders we MUST differentiate between good opportunities and great opportunities. LVS was a great opportunity.

Quite often as active intraday traders we lose the forest for the trees. We become so intent on each tick in the stocks that we are trading that we fail to see the big picture for the day. We may also miss some of the greatest risk/reward trades that present themselves. This is even more common on a desk as young as ours where the average level of experience is less than 18 months. It isn’t a coincidence that Gman who has been trading with us for over three years now made sure that he didn’t miss the shorting opportunities in LVS and MGM. He realizes that at the end of the month being in those setups will make a dramatic difference in his numbers.

Often when I talk to potential trainees for our desk they ask me if we mandate that our traders trade specific stocks. I explain to them that we have a morning meeting where I highlight the best In Play stocks for the day but we leave it up to the individual trader to determine which stock(s) to trade. We believe that a certain amount of freedom is necessary for the novice trader to fully develop their own trading style. We all have different personalities and risk tolerances so we will trade different stocks and different setups. But ultimately those who fail to get into the easiest trades will be weeded out by the market. That is why Bella asks me to catalog the greatest risk/reward trades that we identify and memorialize them in our archives under the category of “Spencer Easy Plays”.

So just as properly preparing for the day, getting adequate rest, communicating with others on the desk, identifying stocks with low risk and high reward are an essential part of becoming a consistently profitable trader so is making sure that you make the trades that are identified each morning as the “best” trading ideas for the day.

Don’t forget to follow us on Twitter!