During mentoring sessions after the open with our newer traders, I ask each of them what they traded.

First up today was a trader who shorted a failed breakout in ENOC. He likes that chart pattern. But is that simple chart pattern enough to trade this pattern with edge? No.

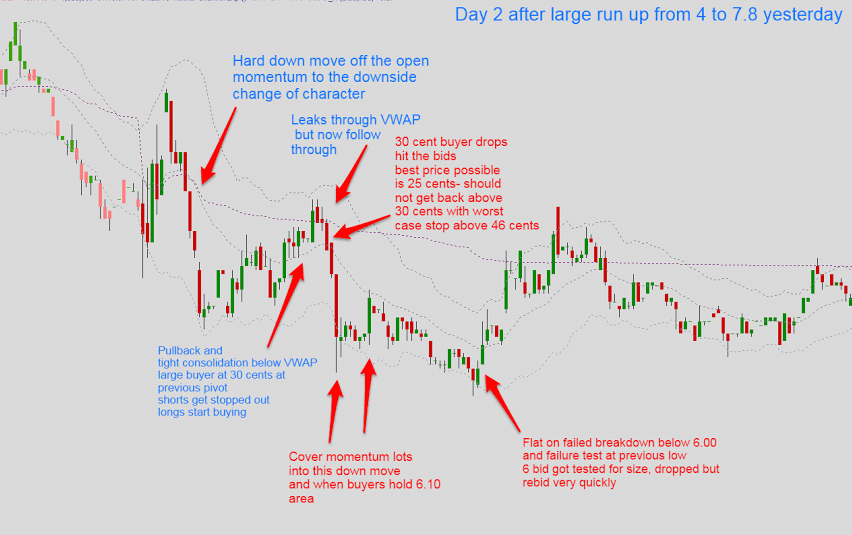

There was more to this trade than a failed breakout. It had run up a bunch yesterday. It gapped down on the open. It was holding below VWAP for a significant period of time. All of this made the failed breakout more likely to work.

So was this added information enough to trade this setup with edge? No.

Even with this added information that shorting of the failed breakout is not enough. You need more edge. And this is where the unsuccessful trader tends to fail. They trade simple patterns that do not have edge, but think they do.

There are different ways to find edge, after spotting interesting chart patterns. One way is to Read the Tape. (It’s not the only way.) For example during the failed breakout, notice bids far from the offer. Or a spike above the breakout area and then a fast return below. These are some tells of a potential failed breakout.

Here is how one trader attacked this setup:

The point is to overlay another indicator(s) onto this failed breakout pattern. These extra indicators, this extra information, are the difference between trading with edge and trading without edge.

*no relevant positions