Hey Mr. Spencer. I was a participant in the SMB-U webinar on Tuesday morning and I have some clarifying questions I hope you could answer. 1. You discussed the importance of only trading securities with 1/5 risk reward. I understand the concept, but I’m not sure I understand how those levels are quantified. What I thought was being said was … Read More

Amplify Your Investing and Trading Success: New Visualization Therapy Exercises

Visualization and mental practice are tools that can take you to the next level of performance in your trading and investing. These tools can have a transformational impact on your mental game, helping you to execute better in every facet of your investing and trading. In fact, they are so important that I have compiled a resource page on … Read More

Making Your Visualizations Better

Making Your Visualzations Better

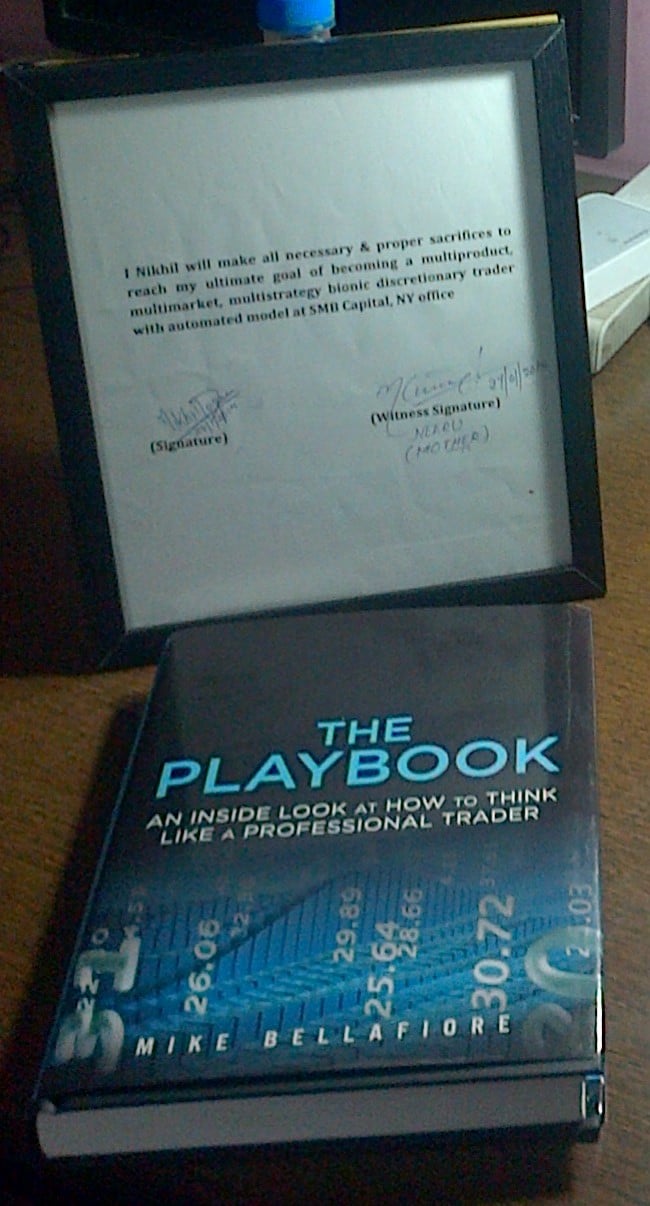

A Trader’s Contract

Jimmer Fredette was a star college basketball player, a Naismith College Player of the Year. A couple of years ago I wrote a blog post about a contract he signed with his brother to play in the NBA. I__________________ will make all necessary and proper sacrifices to reach my ultimate goal of making it to the NBA. ________________ ______________________ Name (Signature) … Read More

First Visualize Yourself Being Great

Recently we shared an awesome video interview with legendary guitarist Steve Vai on how to become successful thanks to Z$. Reader Derek was so generous to shoot me an email on another gem from Mr. Vai (see below). Here Vai, like NCAA leading scorer Jimmer Fredette, preaches the importance of visualizing yourself being great as a catalyst to becoming great. … Read More

The Importance of Visualization Exercises: A Testimonial

Mr Bellafiore, I must stop by to thank you for your amazing work on the SMB blog as well as the Stocktwits University shows. I have recently gotten into trading, replacing flying airplanes with AA to doing this full time (at least trying my best). Your visualization techniques are exactly what we do in the airline business on top of simulator … Read More

Learning to Take Pain

In our training program we (over)emphasize finding opportunities where the risk is one unit and the reward is at least five units. Most of the setups our new traders learn (50% I would guesstimate) are opportunities where the risk is literally one to two pennies. If overly abused, these setups can progressively hinder the ability of the trader to pull … Read More