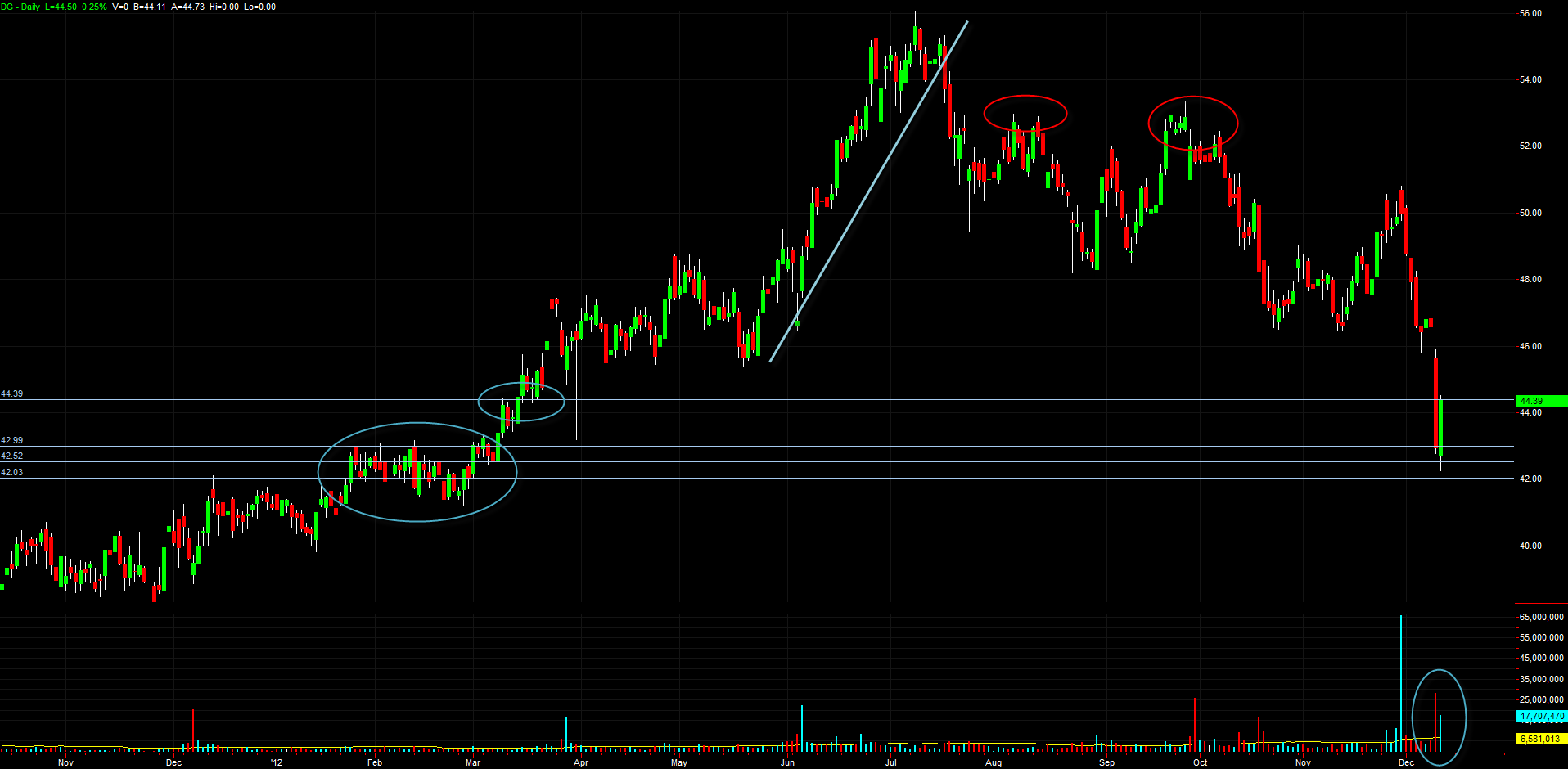

This guest post from experienced futures trader Bruss Bowman provides an excellent example of how to incorporate higher time frame price action into a possible lower time frame trade. It is clear from the post that Bruss in a methodical thinker who is also flexible in his thesis if price behavior fails to confirm. Reversal Rehearsal: Stock Study in DG … Read More

Over Trading

STEVE- Good evening! I have been enjoying my trial membership to the “Stocks in Play” feature of SMB, and I am considering signing up for the In play/Radar/Chat side of things. I have thoroughly enjoyed the morning meeting’s, and have really appreciated the information put out there. I came to know of SMB largely by reading “One Good Trade”, and … Read More

Trading A VERY Large Gap–Trade Review $ANF

Steve Spencer reviews how to approach trading a very large gap in ANF. Steven Spencer is the co-founder of SMB Capital and SMB University and has traded professionally for 16 years. His email is [email protected]. No relevant positions

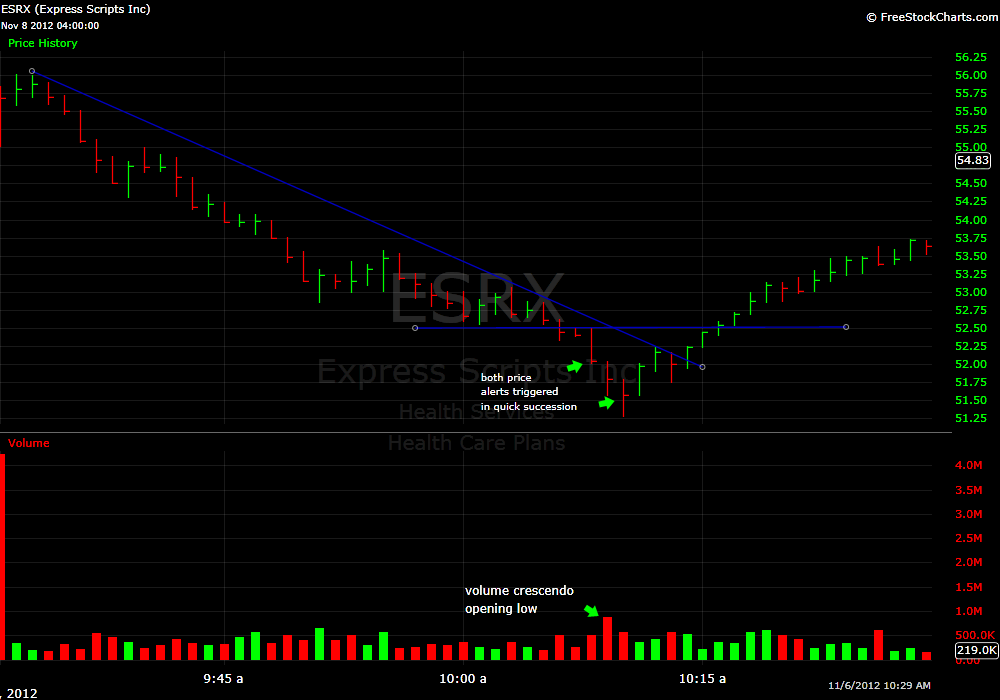

ESRX Crescendo

Sorry for the delay on this post. A few had asked about the message I shared on StockTwits Tuesday morning regarding ESRX putting in a bottom. Tuesday morning ESRX was on the top of our list of In Play stocks. Was gapping down and set up for a nice short right on the Open. Our “best case” scenario for downside … Read More

IF I Develop a Trading Plan THEN My Results Will Improve: EXPE (10.26.12)

I tweeted this week that trading is about having a series of if/then statements and not about making predictions. In practical terms this means that traders are game planning for every stock on their watch list. They are making decisions on how to trade each name based on price action, market conditions and news catalysts. For every stock I look … Read More

The Apple Story

There have been very competent traders discussing signs of weakness in AAPL since it failed at 680ish. And since then there have been several excellent swing shorts AND swing longs. The price action has loosened up as the debate continues on where it should be priced coming into its earnings release this week and after its disappointing Iphone 5 release. … Read More

Live From the Trading Floor – 10.17.12

Steve will be broadcasting every Monday, Wednesday and Friday at 11:15 am EDT and you will have the opportunity to chat with him through our new Stocktwits chat feature. Don’t miss it! In today’s show Steve Breaks down the big picture via the SPY (0-2) Talks earnings stocks IBM CREE Discusses why he traded FTNT long (6-7) Discusses 2nd Day … Read More

Live From The Trading Floor – 10.15.12

Steve will be broadcasting every Monday, Wednesday and Friday at 11:15 am EDT and you will have the opportunity to chat with him through our new Stocktwits chat feature. Don’t miss it! In todays show Steve Discusses AAPL’s recent price action and whether it is bottoming (1-4) Discusses LLY as a follow through trade (4-6) Discusses C as an earnings … Read More

- Page 1 of 2

- 1

- 2