This week we wrote about how we were hawking a Tesla Bounce Trade. See Four keys for a Tesla Bounce Trade. Friday we took that trade. And we took a rip. See Taking a Rip in Tesla. This weekend we challenged our traders to consider why the trade failed. See Why did we take a rip in Tesla? Look the rip … Read More

6 critical trading lessons from crazy $CAR

These are crazy times to trade and $CAR was crazy for even this market. This is what traders on our desk are saying about this market and this most recent $CAR trading opportunity. One elite trader at our firm in an AAR (After Action Report) to other select elite traders described these trading times this way: What a crazy time … Read More

This trader’s trading journey……continuing

It hit my inbox. Delta boasting that I could be seated in a Virgin lounge (their partner) 10 minutes after drop off at Heathrow airport in London. Something about a private entrance and private security and clear directions to this private drop off. 10 minutes through security as an american in Europe? Was this possible? I asked my London Black … Read More

Top trading tweets to help you improve your trading (from the prop desk)

#10 Top trading tweet #9 Top trading tweet #8 Top trading tweet #7 Top trading tweet #6 Top trading tweet #5 Top trading tweet #4 Top trading tweet #3 Top trading tweet #2 Top trading tweet #1 Top trading tweet *no relevant positions

Weekend learning for traders from SMB – August 18, 2018

Here are the top learning links from us this week. We hope they help your trading. 3 trade examples using our most effective trading indicator- Reading the Tape Why do stocks completely reverse on Day 2 How to think about Reading the Tape This trader wants it all and wants it now Two different paths to improved trading consistency How … Read More

Weekend trading lessons from the prop desk at SMB

Below we share some videos to help you improve your trading this weekend. It is the work we do when markets are closed that shapes trading performance in real-time. “You can be better tomorrow than you are today!”- Mike Bellafiore Weekend video trading lessons from SMB The worst trade of the week 5 things profitable traders do How to profit … Read More

New Webinar: Two trading strategies working best in this trading environment on the prop desk

Merritt Black and I are hosting a NEW webinar: Two Trading Strategies Working Best In This Trading Environment on the Prop Desk. Merritt will present one strategy. And I will present a strategy with the benefits to your trading of: highlighting two trading indicators to help you make better trading decisions giving you a new strategy to test for … Read More

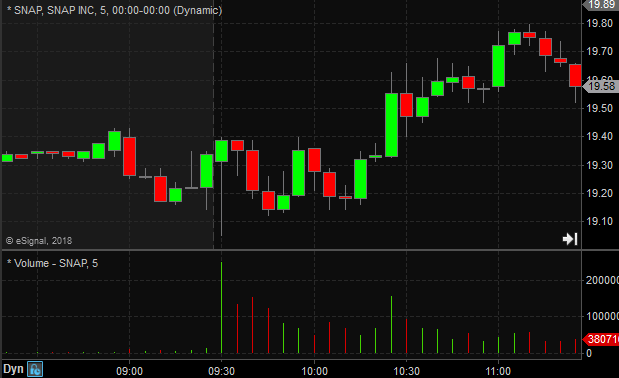

Trade Review–WMT HD SPY

The top In Play names this morning: WMT was my focus as the lowering of FY19 guidance was potentially a very strong catalyst. Early indications from pre-market trading were many traders were attempting to dump the stock ahead larger selling that would come after the opening bell. You can see my discussion of WMT in the AM Meeting here. With … Read More