Discretionary traders, systems traders, neutral, mean reversion, momentum, swing, and day traders… ALL of these trading styles and niches rely, to one extent or another, on using probabilities. Discretionary traders keep probabilities in mind when making trading decisions. Systems traders rely heavily on many aspect of probabilities to create automated or nearly-automated systems. Neutral traders need to understand tail risks … Read More

Duration: The Sixth Step to Systems Success

Number six in our seven steps is Duration. Duration represents the expected length of time in winning trades, losing trades, and all trades. Almost without exception we find that trend- and momentum-oriented signals have a shorter duration for losing signals and a longer duration for winning signals. The reverse is true for mean-reversion trades. Knowing your expected duration is important … Read More

What is Your Idea of Back Testing?

Trade decisions are often based on what a trader observes on the chart. The thought process often starts with something like this: “The last time this happened ABC moved 5%” “Last year at this time the market stayed in a 2% range” “If I had bought the last three breakouts, then I would be up $5k right now!” “The MACD … Read More

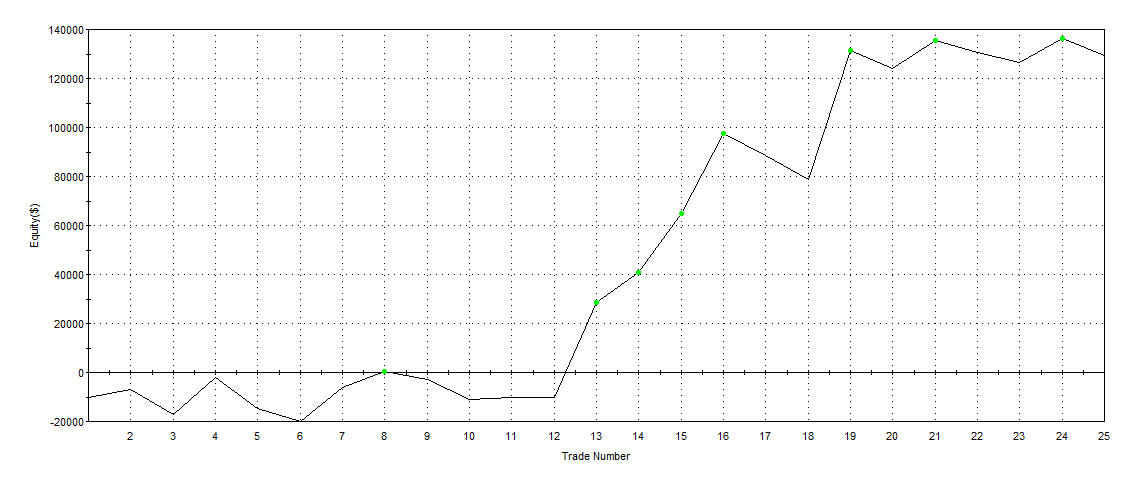

Evaluating your trading results (4/4)

How to use statistics to analyze your trading setups and individual trades.

Evaluating your trading results (3/4)

Some ideas for doing statistical analysis of your daily trading results

Finding a trading edge: a case study

Finding a trading edge in the SMB Radar’s In Play list.

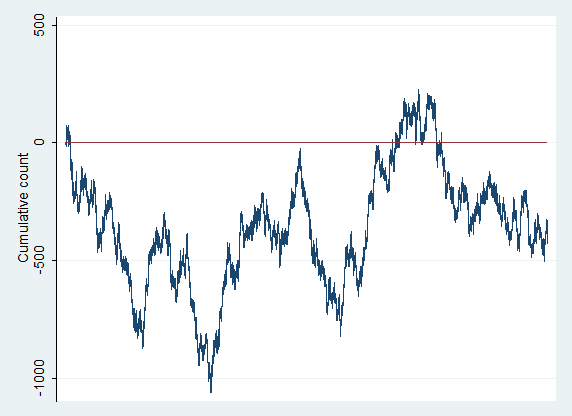

Exploring Randomness: Thought-Provoking Insights and Reflections

Thinking about randomness can be challenging, but there are some important lessons to be learned here.

Gaining an Edge: The Importance of Using Statistics in Your Trading

I received this email from a reader, excellent developing trader, and potential future trading star. It needs no editing and has awesome value to traders. SMB Chop Tracker Bella, Came across this article that I thought you might like. It’s written by one of my brother’s poker friends. This guy happens to be one of the best NBA sports bettors … Read More

- Page 1 of 2

- 1

- 2