I am in Sydney on business, meeting with trading firms and traders. Yesterday, I had the opportunity to stand (literally) with Austin Mitchum, @AustinMitchyblu, and observe/participate in his trading of ASX equities. I thought I would share a few observations. 1. One Good Trade Somebody coined this phrase somewhere or wrote a book about it. Strikes me as genius, so … Read More

Fail, Win, and Then Fail Some More: The Path to Becoming a Winning Trader

Part II of our training program on our prop desk in NYC is Trader Development. There is a lot of necessary and wonderful failing that goes on during Trader Development. During this process traders experiment with different setups that we highlight. There are trading strategies worth exploration that active traders use to win. We continually point them out daily during … Read More

Competition at a prop firm fuels increased PnL

People often ask ne the value of trading at a prop firm. And there are many value adds that a prop firm brings to a trader, but I want to focus on one powerful performance driver. Competition! When SMB first formed a JV with the Kershner Trading Group our younger traders were in awe at the PnL numbers of the … Read More

Win the Trading Day!

This is part 3 of our trader survey that breaks down the results from our trading community. You will be amazed at what you learn about the challenges and successes that traders in our community are having.

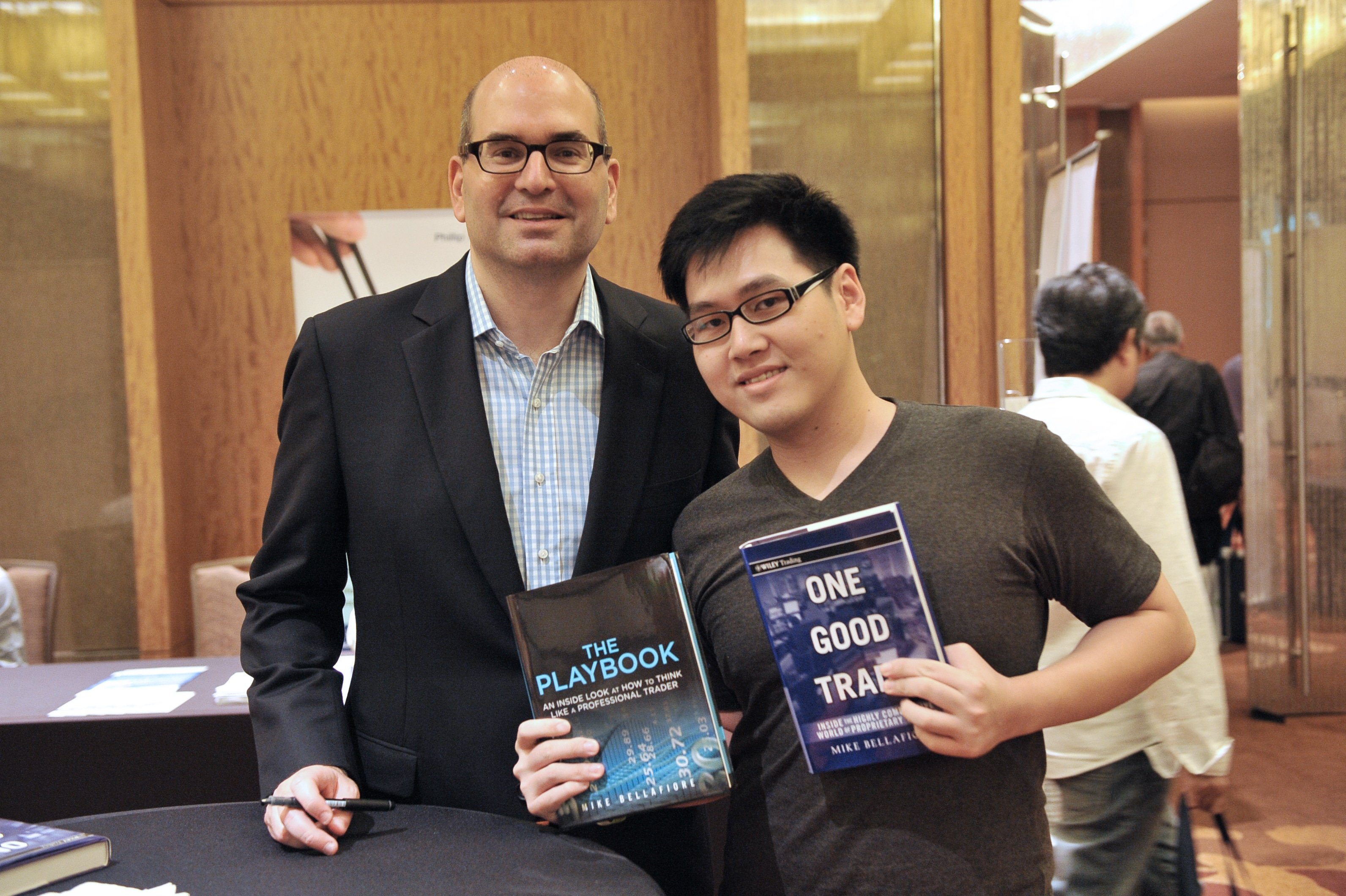

40 trading lessons from The PlayBook

An experienced and successful trader is starting with our desk, powered by Kershner Trading Group, next month. He is one of the more diligent traders you could meet. I have compared him to Tim Tebow in One Good Trade for work ethic. He just powered through One Good Trade and The PlayBook to improve his trading game and better prepare … Read More

Revisiting #NewNormal and $SPX 1680

Now is a good time to look back at the #NewNormal and discuss possible trading patterns for US equities for the remainder of 2013. The #NewNormal was a description I came up with in late 2012 to describe the slow steady grind higher in US equities that was rarely interrupted by periods of higher volatility. This state of the market … Read More

Finding The Bounce– $SPY

On Thursday June 20th I wrote “Looking For The Bounce” where I discussed a long SPY trade that never materialized so I exited for a loss. Yesterday, the market setup for another bounce attempt and I took it. Many short term trading setups trigger after three trading days. After the market’s large sell offs on Wednesday and Thursday many short … Read More

Free Webinar Recording – Trading Follow Through Trades with Steve Spencer

The theme for Steve Spencer’s 2012 Webinar Series will be “Do the Right Thing”. On the third webinar of the year, Steve discussed how to enter follow through trades in the days following a powerful earnings move. He discussed GMCR, FSLR, FOSL, KORS and LNKD. Trading Follow Through Trades with Steve Spencer from smbcapital