One developing trader at our firm is not viewing his trading future only as a discretionary trader, but as a hybrid trader. A hybrid trader uses technology to make better trade decisions, and pulls money out of the market as a discretionary trader, discretionary trader armed with tools to make better trade decisions, and with automated models. Here is that … Read More

Collaborating to build automated models

In his Daily Report Card, a developing hybrid trader noted the important value talking to another trader on the desk about his idea for an automated trading model. (A hybrid trader is one who profits with discretion, AND discretion armed with technology, AND automated models. They are not just a discretionary trader, pushing buttons based upon what they see in … Read More

Optimizing Discretionary Trading with Automation

At our firm, traders can be discretionary traders, automated traders or hybrid traders. Discretionary traders push the buttons and make their own decisions. Automated traders develop and idea, backtest, forward test, and then let computers run the strategy. Hybrid traders do a little of both and use technology to inform better discretionary trading. Often we hear in the Financial News … Read More

The trading exit is not what you want but rather what it should be

A trader read yesterday’s post Expectations poison good trading and remarked: I would like to focus on this savvy reader’s observation: “I’ve sometimes used the standard of what I WANT the market to do. (how ridiculous is that!)” Well…. from my seat it is not too ridiculous at all. I have been guilty of this. I have seen profitable traders … Read More

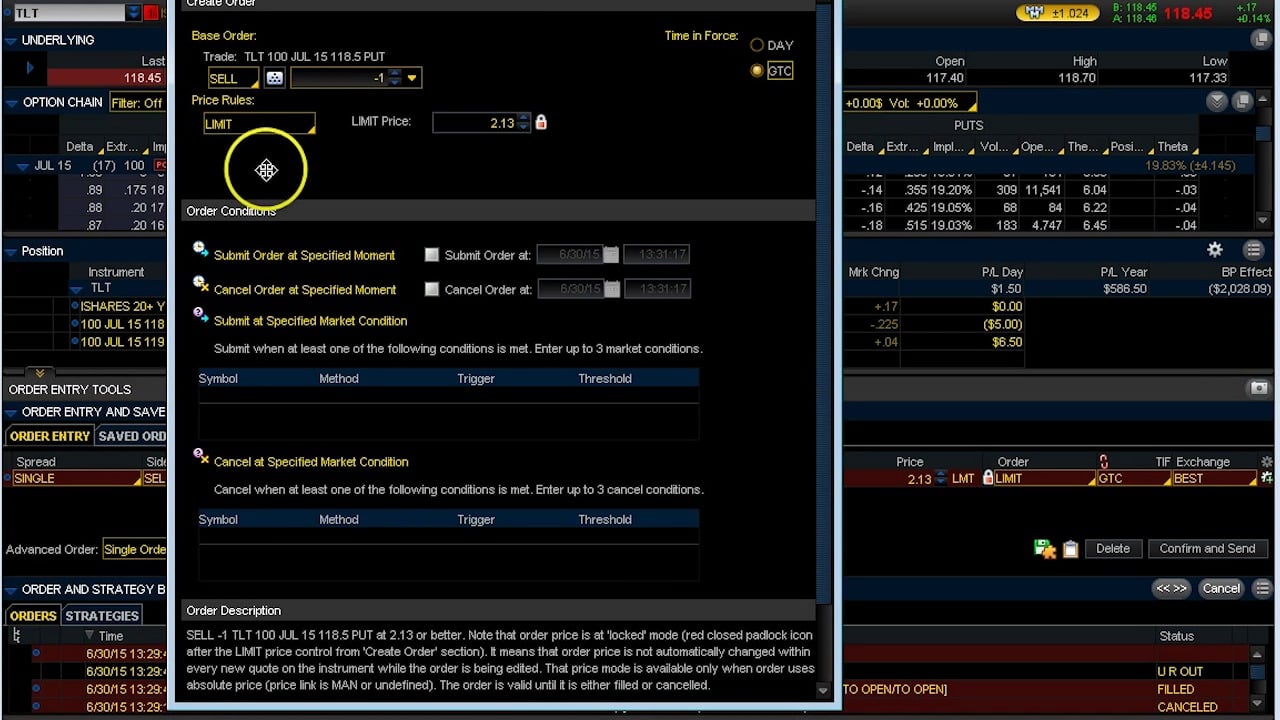

Trading TLT Using Conditional Orders: Insights from SMBU’s Daily Video

In our SMBU Daily Video, learn more about conditional orders.

In this video from Andrew Falde, you will learn:

How to set up conditional orders to control your risk when you aren’t at your screen

How to plan your trades for different scenarios and automate for each

Learn what qualities to look for in a stock, ETF, or Index that make sense for conditional order placement

We hope this video improves your trading.

SMBU Team

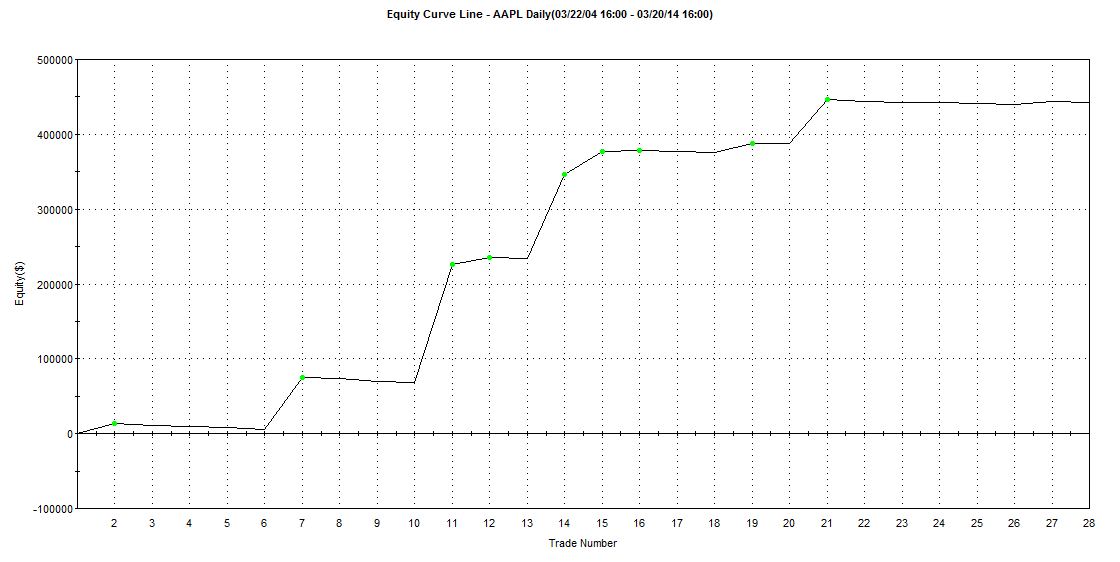

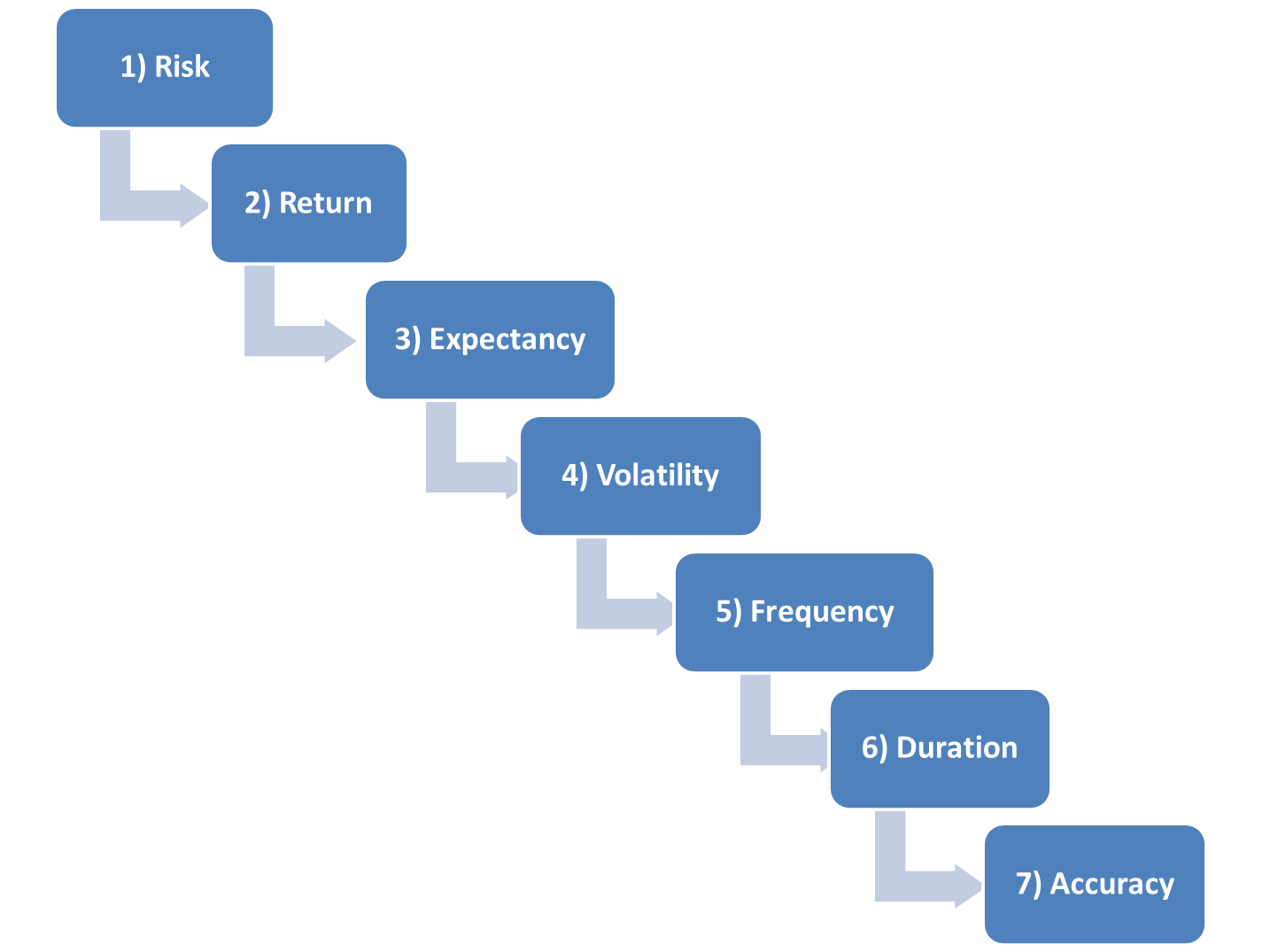

The Final Step for Systems Success: Accuracy

Accuracy is simply defined as the percentage of trades that end profitably. It is the final of our seven steps to systems success. To phrase it better, accuracy is the last thing we look at in building a system. Accuracy—almost without fail—is the first question asked about a system. However, it has the least impact on the success of a system. … Read More

The First Step to Systems Success

Risk. This is the first and most important metric for a systems trader to track and improve. When learning about a system or strategy, most people first ask about the returns. Imagine you had one program that generated 21% per year on average and second was doing 35%. For some, the analysis is over because they just want higher returns. … Read More

Turn Your Ideas Into Statistics

The trading world is littered with anecdotal evidence of cause and effect from various technical indicators and signals. I cringe when I hear something like the following: “As you can see, last time the 19-week moving average crossed the 52-week moving average, this stock moved 18.5%.” This statement has absolutely nothing to do with anything. It’s an observation of a … Read More