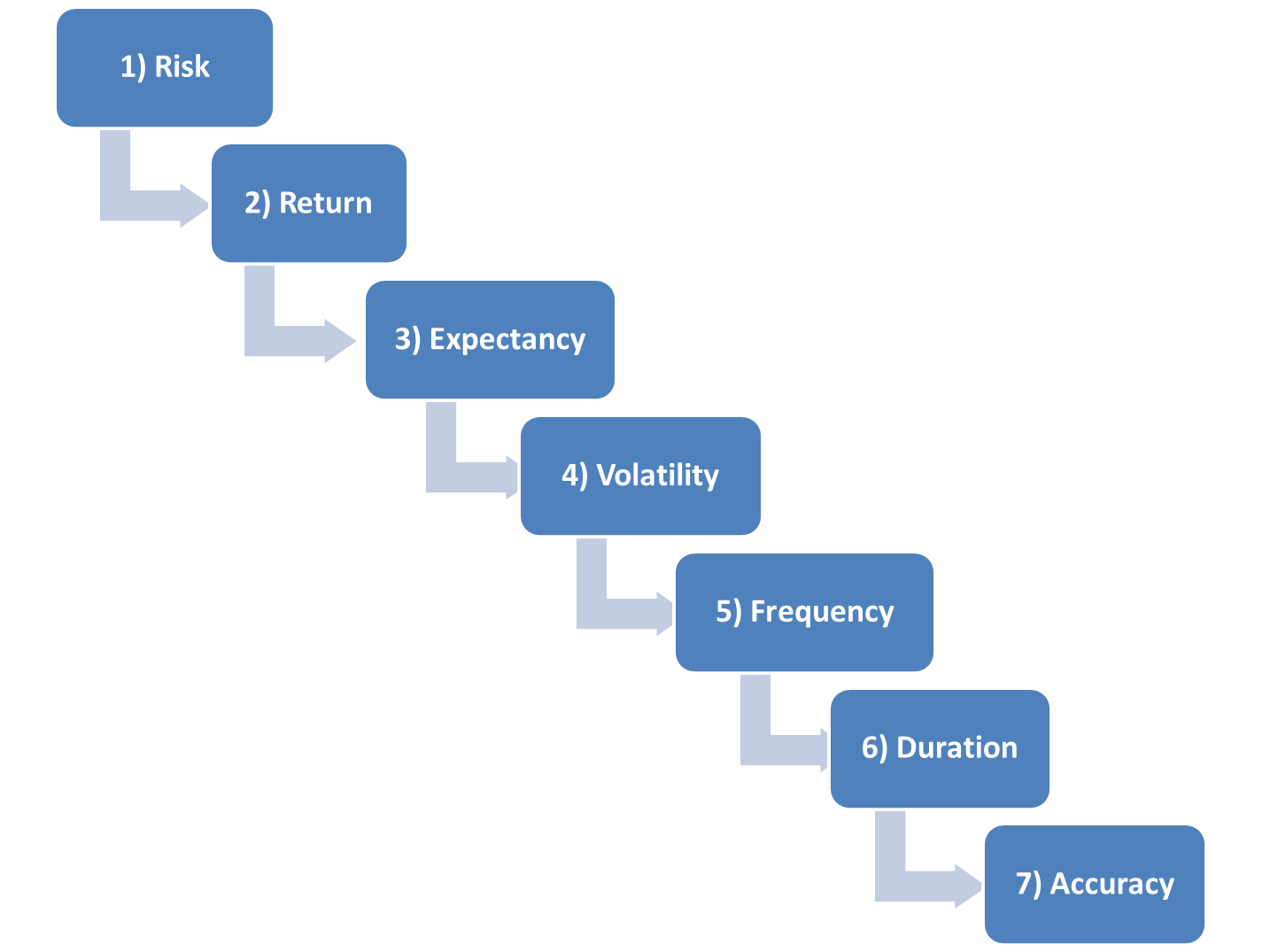

Our fifth of seven steps for building, testing, and following a system is to understand the frequency of the system. Higher frequency increases profit potential, but it also reduces reliability. The two primary downsides of higher frequency are 1) transaction costs and 2) execution assumptions. In back testing you can assume buying every bid and selling every offer. But this … Read More

The wind of change is blowing…

Yesterday’s AXA settlement could represent a new direction in SEC regulation and oversight.

Why I am Getting Stopped Out More? (Part II)

Yesterday we explained a trading algorithim on more desks that may explain why swing traders, retail traders, long-term investors/traders are getting stopped out more on their positions. Today we will explain another part to the algorithm that eliminates one possible adjustment. So as we discussed, say we are long at 30 with a stop at 29.84. One way to combat the algorithm that is … Read More