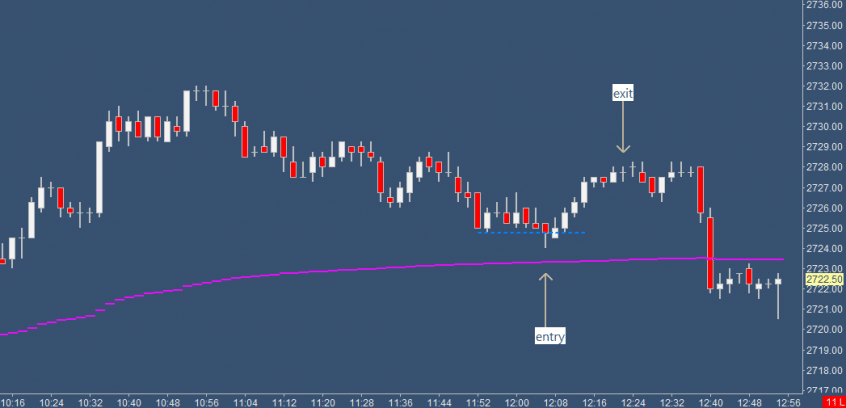

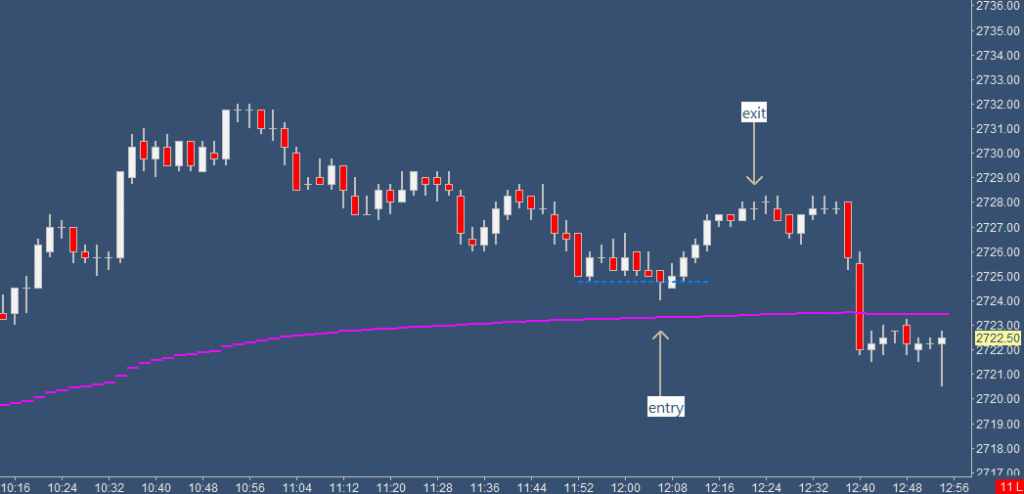

It’s time for the Futures Desk Trade of The Day! Here’s a link to yesterday’s trade as well.

This trade combines a classic “spring” pattern, with the use of vwap, and time of day factors.

Key variables:

- ES in an uptrend defined by method

- Pullbacks mid-day during slow trade can be more complex (multiple legs)

- Watch for pull back into vwap, and if buyers respond there

- Spring pattern (very short term support level drops, but is quickly rebid)

- Simple exit on waning momentum, nothing fancy

Nice little 3:1 R/R by combining a few simple chart features and overall understanding.

Here’s the trade below.

ES Futures. 2min chart.

The spring pattern is such a thing of beauty. It embodies several concepts I love as an intraday trader:

- It traps shorts who are taking the “breakdown” short (they provide future bullish orderflow when they stop out)

- It runs the stops of traders who are already long (they provide more bullish orderflow when they get back in)

A spring pattern is simply a place on the chart where there is short term support, that level breaks down, but then there is no energy behind the move and it fails quickly and re-mounts the support level. They are easy to identify in real time.

Understanding the nature of price movement as it relates to time of day is a big deal for intraday trading. Study your market(s) of choice to gain an intimate understanding of it’s typical behaviors across various time slices.

VWAP is a great intraday trading reference, but it’s not something to be looked at in pure isolation. Adding patterns (like the spring), other contextual features, as well as orderflow… all of it takes VWAP trading to a whole new level.

We use VWAP, patterns, and orderflow every single day in our live trading webcast in our Futures Slack Room.

Trade well,

Merritt

*No Relevant Positions