(Please note the following is based on hypothetical trades using historic data.)

The SPY Detector signal has a 20 year history of successfully navigating the underlying price change of the S&P 500. The signal is made up of 5 sub-systems that follow trend and momentum using proprietary indicators.

Each of the 5 underlying systems makes up 20% of the total signal. For example: If the signal is 20% long, then one of the systems is confirming the bullish trend and the other four are not. There are two basic facts about the SPY Detector signal.

- The market cannot make a significant correction without all five systems being flat.

- The market cannot resume the trend unless at least one system confirms.

More than detecting trend and momentum; there is one major benefit that SPY Detector has over any traditional system I’ve tested. In the past, I’ve written on the SMB U blog about the 7 Steps to Systems Success. In that series I repeated multiple times that the #1 step to systems success is to reduce Risk.

The sizing aspect of SPY Detector makes it unique from any traditional indicator. Most indicators have an all-or-none characteristic. SPY Detector weights the signal in five increments. Quite often the first move in the market can be false. To avoid false signals, most indicators have to slow down; which creates late entries, lower probabilities, and bigger give backs before exiting.

Also, traditional indicators often look their strongest when they are most overbought or oversold. SPY Detector has its strongest signal in the middle; because this is the sweet spot for the variety of systems that detect turns and hold momentum. As the market slows its move, SPY Detector reduces size BEFORE the turn starts. It really is a beautiful thing to watch.

So what do we do with this signal?

There are many possible applications; but first we will start with SPX options trades. Options trades offer benefits because many of the small winning signals or even small losing signals can be big wins when you include premium decay.

A group of options traders tested several different years using a simple credit spread. The best results came from selling one fifth of allowable risk for each level of the indicator. The results were good; averaging about 25% per year with a max draw down of 12%.

Two major observations were made from all this work

1) The signal rarely gets to full size; so we often don’t have a lot of theta coming in

2) Trading frequency was a little higher than most of the team preferred

In order to solve these issues, I decided to test a combination of trades. One is very similar to a “Jeep” trade and the other is a ratio condor. The Jeep trade is used when the signal is 20% to 40% long; and the ratio condor is used when the signal is 60% or higher.

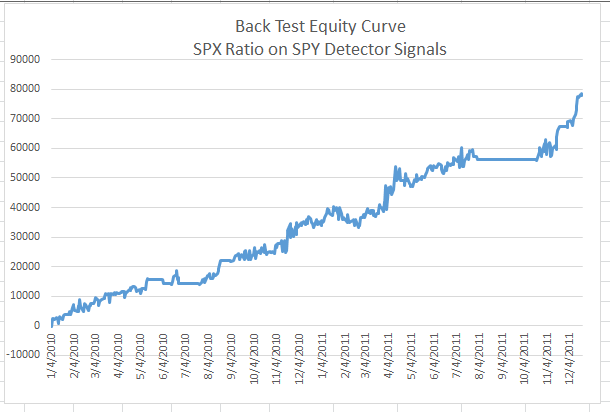

I recently finished retesting the worst two years of the credit spread version using the combo Jeep/Ratio spreads. The combo trade had 75% less draw down (just 3%) and more than double the returns (39% annualized).

So we have a signal that avoids major corrections and uses variable sizing to control risk… combined with an options trade that controls risk while offering the flexibility to follow the different levels of signal strength.

So is this the “Holy Grail”??? No, it’s not. But if you are looking for something that trades no more than once per day, offers the opportunity to take advantage of market trends, and benefits from premium decay of options… then SPY Detector for SPX Options may be something for you to consider.

I’ve posted the Back Test Results: SPX Ratio on SPY Detector; which covers the two year back test I just finished along with the trade rules.

I look forward to any questions or comments you have! If you are interested in learning more about SPY Detector, please email me anytime and I’ll answer your questions and put you on a list to receive future updates on SPY Detector back tests and training opportunities.

Andrew Falde

[email protected]

No Relevant Positions.