Volatility has ticked up in recent weeks. It’s about time. The major U.S. equity indices and currency markets have presented some sizable intraday movements. Uncertainty is beginning to re enter the markets. This is the time when traders shine the most. This is when the average traders improve and the good traders become great. Investors and uninformed watch their accounts shrink. Ever wonder why this transfer of wealth is so likely in such an increasingly uncertain trading environment? Overreactions.

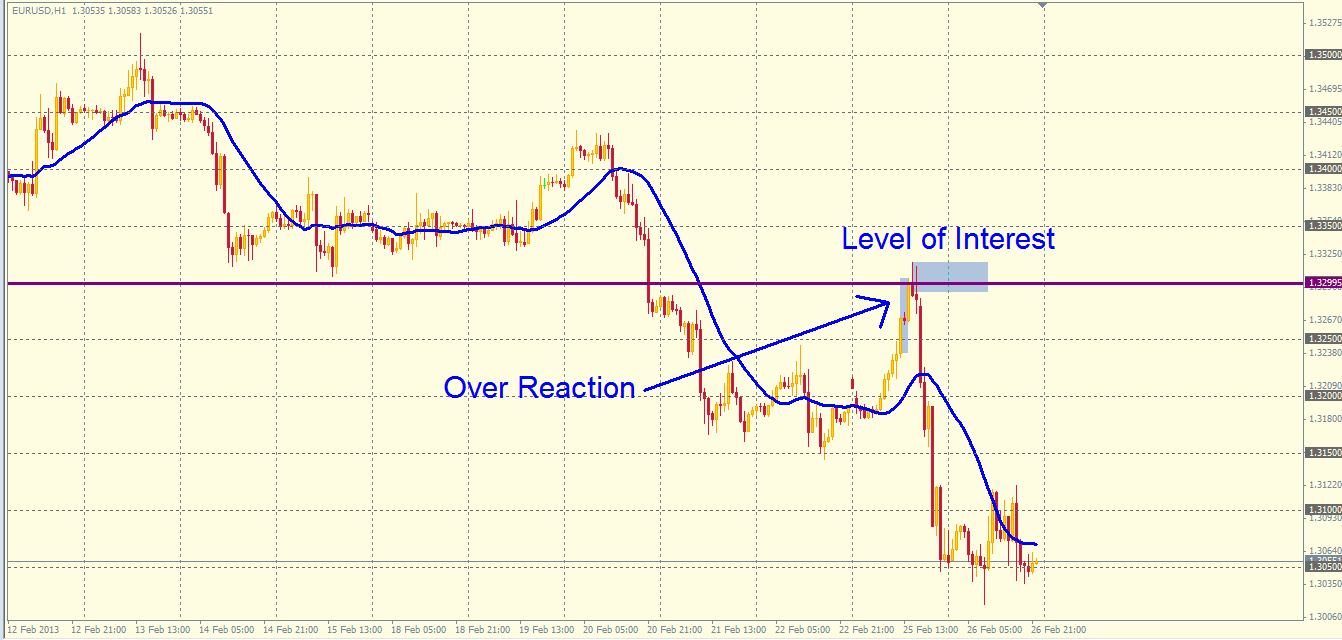

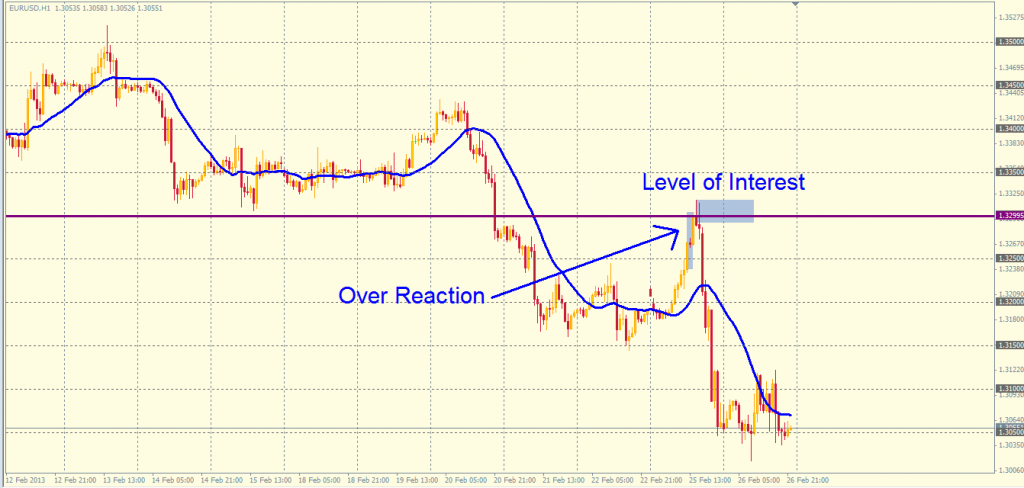

Market participants initiate trades for an infinite number of reasons. They also tend to place potential market orders (aka stops) in similar price areas. When new information enters the market and the initial crowd reacts, it can set off a cascading effect that is further amplified by leverage and the speed of information. When we look at this on a chart, we see a “parabolic” price move or what appears to be a vertical candle that seems to want to go forever. As this cascade probes further, it encounters clusters of stop orders that continue to add fuel to the momentum until it finally runs out of steam.

These sharp movements in the market are typically “over reactions”. Price moves in an exaggerated way at a rate that cannot be sustained for very long. While this is happening, usually the amateur or uninformed trader will be distracted. They want to join in the fun and give in to the fear of missing any more of the opportunity. On the other side of that trade, you have the professional. The one with a clearly defined strategy who, like a sniper, has been waiting for particular prices to be reached before taking action.

You may have heard of “mean reversion” strategies or “fading” the market. If done right, these strategies can be rewarding for short term day traders like the ones we train at SMB. The concept is simple, but the execution requires particular information. If you don’t know what to look for or how to validate this type of strategy then you will not be able to identify a high quality trade from signal noise.

Traders who aspire to make this a profession need to remember that the crowd is usually wrong at turning points in the market. These turning points are full of opportunity for those who can recognize them and take action. Market tops and bottoms, although not a single isolated event, offer multiple opportunities that are based on the crowd’s over reactions.

Learning what to look for in order to take advantage of these unique situations is not something easily achieved through trial and error. Consider becoming more familiar with market perspectives such as the Elliott Wave Principle or Harmonic Patterns. These are good references that offer ways to forecast potential turning points in any market. If a shorter learning curve is what you are looking for then be prepared to pay for a quality education. There are many providers, take some time to compare.

*No Relevant Positions