So my friend JC Parets tweeted recently that he is miffed by traders and investors complaining about market manipulation and not formulating a plan to profit from said manipulation. His point is, I think, as market participants our job is to find ways to extract profit from the market and if we recognize patterns/manipulations then we should have a plan to exploit them.

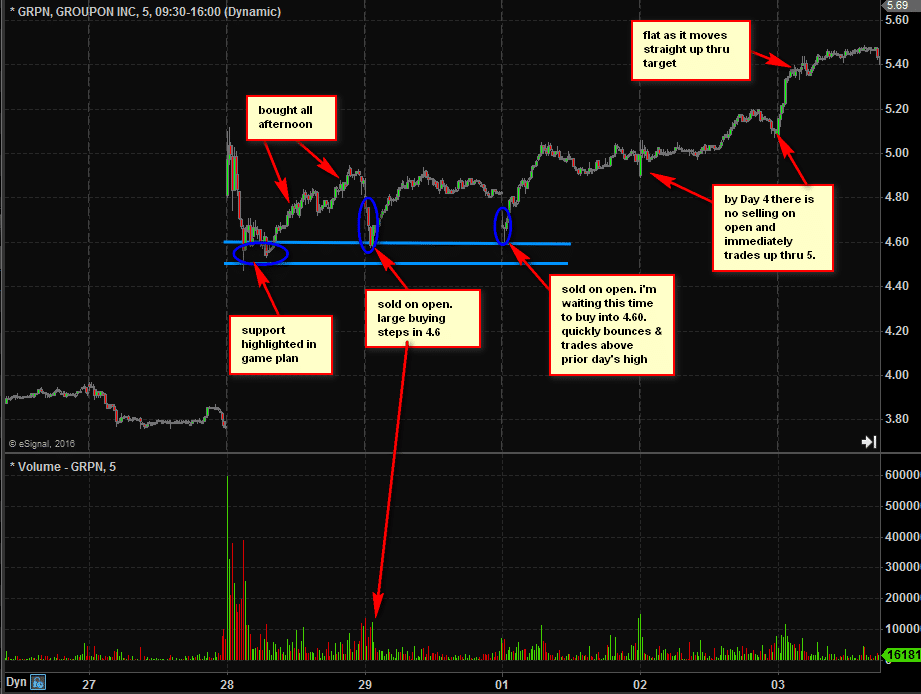

Here is my contribution to the effort. This is a type of manipulation that I have seen as long as I can remember and it works pretty damn well. This week it occurred in GRPN and I was able to take advantage of it. The setup was GRPN had reported solid earnings and was gapping above recent resistance. We identified potential support in our AM Meeting and the plan was to buy there after market Open if it dropped that area.

I bought at the support area and GRPN traded higher. But never pushed up to 5.20s which was my target area.

HERE IS THE MANIPULATION PART: The next morning, Day II, GRPN quickly dropped out on the Open then was bought up. I had two days of post earnings trading data that showed the stock being accumulated at higher pricess. On Day III I was ready for the quick drop on the Open to beat the manipulators at their own game. Why do I say the stock was being manipulated? Because despite being bought for two entire days there were no bids to support it each morning as the market opened.

I don’t know if large buyers were putting in sell orders right on the Open, attempting to accumulate at lower prices or traders who were trapped short after earnings were attempting to reverse the upward momentum. And frankly I couldn’t care less. The only thing that mattered to me was identifying the time and price where the stock was being accumulating and getting shares at those prices.

By Day 4 the drop out game was over. Probably too many had caught on at that point. So Day 4 and 5 you can see first move was up and eventually traded to 5.40 where I sold my remaining shares. These ideas are shared every morning in our AM Meeting. Get info Here.

Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, and options. He has traded professionally for 20 years. His email address is: [email protected].

No relevant positions