In working with retail traders I get to see where people have holes in their trading plans, and where they need the most help. One of the most common areas I see a major need for improvement is in using the higher timeframe.

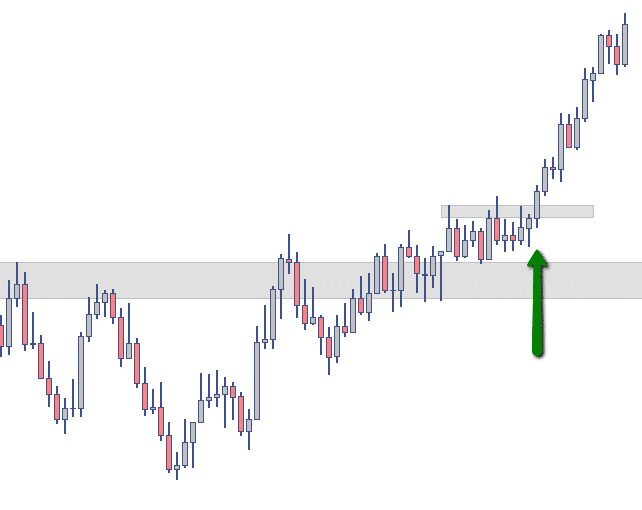

Why do we use the higher timeframe? Let’s say, for example, we’re in intraday trader that likes to get long consolidation breakouts. Well, I would go so far as to say that taking every consolidation breakout on the intraday chart actually has zero edge. That’s right. Where I think this trader will find a positive expectancy is from an acute awareness of the higher timeframe to help filter when to take the pattern entry (in this case a consolidation breakout), and when to pass on the trade.

That’s right… not all consolidation breakouts are created equal!

In my opinion, an intraday pattern is a tool to help you clearly define risk and provide a “trigger” to get you into a trade – both are good things to have in a trade plan. The real edge comes from identifying what the risk:reward landscape looks like on the higher timeframe, and then using that context to your advantage.

Two very common examples of entries without a proper context:

- Are you entering late in an extended leg on the higher timeframe?

- Are you entering a consolidation breakout long on the intraday chart, but failing to see you’re headed right into resistance?

Take some time to determine exactly how you’re framing higher timeframe context for your intraday setups, and how good of a job you’re doing. Make it a real part of your process. It just might make all the difference for your own trading.

Trade smart,

-Merritt

*No relevant positions.