This post is another in a series tracking the hypothetical performance of broken wing butterfly trades selected by Greg Loehr of Optionsbuzz.com.

The hypothetical butterfly on the SPXPM is progressing nicely. You’ll recall that this was instituted as a “longer-term” trade compared to the weekly broken wing butterflies that I had been tracking on AAPL and SPX. So for now there’s nothing to do but kick back and wait for the time decay to set in.

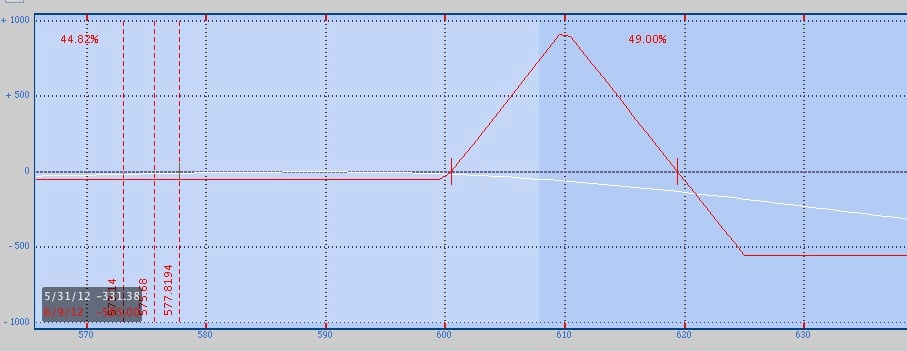

Sometimes watching the time decay trickle in is a bit like watching grass grow, so to keep things interesting I’m tracking another AAPL broken wing butterfly, on the weekly options again, but this hypothetical trade is being entered into for a debit – which is different from the other six or so trades that I’ve been tracking in this blog. The trade is the June 8 expiration 600-610-625 call broken wing fly for a debit of $0.55.

Now, this trade risks the 55-cent debit in addition to the $5.00 risk that comes from the width of the strikes, but this trade also has a max theoretical profit of $9.45. All in all, a little bit of a different animal than what I’ve been tracking, so this should be fun.

And while there are ways of potentially overcoming the risk of the debit, I’ll keep things simpler for now and just stick with this one position. Stay tuned for continued updates now on both SPXPM and the new AAPL fly.

Trade safe!

Greg Loehr

Optionsbuzz.com

Please note: Hypothetical computer simulated performance results are believed to be accurately presented. However, they are not guaranteed as to accuracy or completeness and are subject to change without any notice. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Since, also, the trades have not actually been executed; the results may have been under or over compensated for the impact, if any, of certain market factors such as liquidity, slippage and commissions. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any portfolio will, or is likely to achieve profits or losses similar to those shown. All investments and trades carry risks.

No relevant positions.