BHP was gapping lower and trading very actively in the pre-market. This message was to highlight it would be one of the best stocks to trade on the Open and my bias would be informed on which side of 78.50 it started the day. I initiated a short right on the Open against a 78.36 seller.

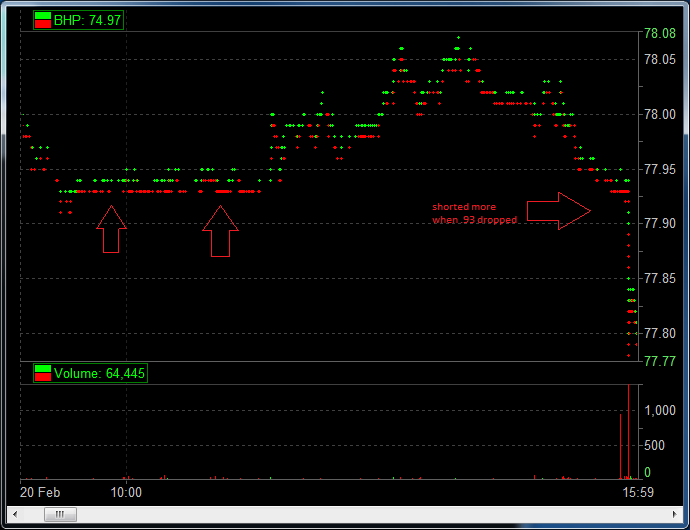

This was the first interesting thing I noticed on the tape since shorting it on the Open. From a big picture perspective it was below my 78.50 level and consolidating near the Open low so it was clearly a short. I was looking for a catalyst for the next down leg and I found it with the 77.93 buyer.

I loaded up when the buyer dropped. The great thing about this level is since it was “irregular” no-one was focused on shorting more when it dropped and I got executions at .92 cents. Normally traders would look for a buyer at 98 and not 7 cents below the whole number.

I was risking about 50 cents on the overnight position in my view and was satisfied with the additional upside of $1.60 from the prior day’s close. I was looking for some type of spike and failure on the Open and then a re-entry. The stock is so liquid and has such a tight spread getting back involved is never difficult.

Here is a picture of the tick chart that illustrates rather nicely the buyer at 77.93.

Steven Spencer is the co-founder of SMB Capital and SMB University and has traded professionally for 16 years. His email is [email protected].

No relevant positions