Friday presented an excellent risk/reward long setup in Apple. It had been sold aggressively for three straight days after having reported another record breaking quarter. The magnitude of the sell off was similar in size to what we saw in late February but the speed with which it occurred was far more dramatic.

Thursday’s low about $11.50 from the after hours and pre-market highs matched almost exactly the dollar amount as the pull back from 2/24 to 3/12. Maybe that is just my human brain looking for a pattern where none exists but that is what I was thinking during its meltdown through 125 on Thursday.

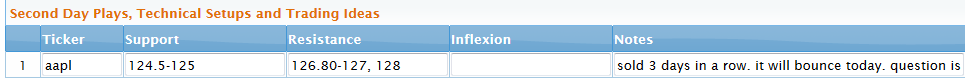

On Friday with the market gapping higher I still was hoping for a flush into the Thursday’s support area but understood market conditions weren’t ideal for that sort of price action. Here is what I wrote in our pre-market game plan in which AAPL was our #1 idea for Second Day Plays and Technical Setups.

It is very rare for me to use the word “will” when describing a potential move in a stock. Like most traders I will hedge a bit with words such as “may” or “likely” but I made a conscious decision to say it would bounce in the hope that more confidence would be instilled in traders looking for a bounce. It was also a reminder for myself to be very aggressively long if my thesis began to play out.

This chart highlights three potential spots to play the AAPL bounce from most aggressive to most conservative. How one attacks this trade will depend on your individual preference but I think all three areas are valid long entry areas from an intra-day perspective.

I managed the trade in several different ways: long stock; short puts; and long calls. When evaluating how I performed in a position that works I divide my max position size by 2 and multiply by the size of the intra-day move. Its a little trickier when you are buying out of the money calls on the day of expiration that potentially can move over 1000 percent, which in fact the AAPL 127 calls did. They traded at 10 cents late morning and closed at $2. In that respect I severely under capitalized on the opportunity.

I log the trade in my journal and write this post so that next time a similar opportunity arises I may better capitalize.

Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, options, forex and futures. He has traded professionally for 19 years. His email address is: [email protected].

Steven Spencer is currently long AAPL, DDD, FB, FEYE, OHRP, P, PAYX, TASR, TWTR and short BA, SBUX